How does one select a good Mutual Fund

How will you select good mutual fund scheme will give you good returns in the future? Most investors look at short term performance of schemes – top performing schemes in the last one or two years. But this is not the right approach. Short term performance is biased by prevailing market conditions. A particular scheme may outperform in certain market condition but it may underperform in different market conditions.

Why you should not select funds based on short term performance?

- Some mutual fund schemes may beat the market index by adding more risk to the portfolio. For example a high beta scheme may outperform in bull market but will underperform in bear markets.

- Value strategy is highly cyclical. A value stock may keep underperforming for some time and will be able to realize its potential over a full market cycle (bear and bull market).

- If the fund manager of a scheme changes, he / she will need some time to implement his / her ideas. The scheme may underperform in the short term, but it may have good potential over sufficiently long investment horizon.

- Frequent portfolio churning based on short term performance may also have tax implications. Short term capital gains in equity funds are taxed at 15% (plus applicable surcharge and cess). Long term capital gains are tax free up to Rs 1,00,000 and taxed at 10% (plus applicable surcharge and cess) thereafter.

How to select good mutual funds?

While performance is an important factor in fund selection, you should have a methodical and objective approach when comparing performance of different schemes. You should also look at various other factors, when selecting mutual fund schemes for your portfolio. Nippon India Mutual Fund has developed a framework “PoWER”, which can help you select a good mutual fund scheme. We will discuss about this framework in this blog post.

Nippon India Mutual Fund PoWER framework for fund selection:-

We will look at four parameters for selecting mutual fund schemes:-

- Performance over benchmark (Po)

- Wide Investor Base (W)

- Experience of the Asset Management Company (E)

- Right Sized Assets Under Management (R)

Performance over benchmark

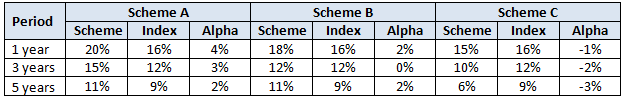

Investors often look at absolute returns when evaluating schemes. Absolute return on its own does not say much. You need to look at relative returns to see how the fund performed versus the market benchmark index and peer funds. You should see how the scheme performed versus the benchmark over different periods. The table below shows an illustration of how different schemes performed versus their benchmark index over different periods.

You should keep the following in mind when evaluating a mutual fund scheme’s performance versus the benchmark

- When comparing a scheme’s performance over its benchmark index always use the relevant benchmark. For example, if you are looking at the performance of a small cap fund, you should not compare it with a large cap index like Nifty 50. You should compare the performance of a small cap fund with a small cap index like Nifty Small Cap 250 etc

- Every mutual fund scheme has a market benchmark index which is specified in the Scheme Information Document (SID) and monthly fund factsheet. You should use the scheme benchmark in performance comparison

- Always use Total Return Index to compare scheme’s performance with the benchmark. Total Return Index is different from price returns in that, they include both price change and dividends. Total Return Indices have the suffix TRI e.g. Nifty 50 TRI, Nifty 100 TRI, Nifty 500 TRI

- You should always compare performance over sufficiently long investment horizons. For equity oriented funds, you should look at minimum three year performance when comparing performance of a scheme versus benchmark

Wide Investor Base

Another parameter you should use to select mutual fund schemes is wide investor base. A wide investor base is an indicator of the scheme’s performance consistency in different conditions. A scheme which has large investor base would have performed well across multiple market cycles and market conditions thereby earning the confidence and faith of investors over time.

A scheme which has a wide investor base is likely to have stability in Assets under Management (AUM) growth. Volatility in AUM may have an impact on scheme performance in extreme market conditions if there is high redemption pressure. This may be important for midcap and small cap schemes which are more affected by market volatility.

How can you know about the investor base of a mutual fund scheme? The number of folios in a scheme can give an indication of the investor base. Though an investor can have multiple folios in a single scheme, if there are large number of folios in a scheme then the scheme is likely to have large diverse investor base. AMCs disclose the number of folios in each scheme in their SIDs. Select schemes with wide investor base.

Experience of the AMC

The experience and track record of the AMC is another important factor that you need to consider when selecting mutual fund schemes. While the fund manager is responsible for performance of individual schemes, they often invest based on a set of investment principles of the AMC. These principles would be been tried and tested over a long period of time.

An advantage of selecting scheme with long history is that you can see the performance of the fund manager and AMC over different investment cycles and market conditions. In case of a new scheme, you can evaluate performance of other schemes managed by the same fund manager with sufficiently track records.

Research is another important factor in mutual fund performance. The AMC provides research analyst support to the fund manager. Research capabilities are very important in bottom up stock selection for a scheme. It is especially important for the midcap and small cap stocks because these stocks have relatively low institutional ownership and therefore get relatively less research coverage. This is where the research capabilities of the AMC come into play.

Right sized AUM

This factor is somewhat related to having a wide investor base, but is an important factor by itself. For mutual funds the performance of the scheme is the biggest selling proposition. A scheme with a sufficiently large AUM base is likely to have a strong track record of past performance. Typically, schemes with large AUM base would have performed over multiple market cycles.

Sufficiently large AUM also helps in extreme markets, especially in the case of small cap funds. Small cap stocks usually trade on relatively thin volumes as the percentage of free float market capitalization is relatively low compared to large and midcap stocks. In extreme conditions, a small cap fund may find it difficult the stocks the fund manager wants to sell to meet redemption needs. The fund manager may be forced to sell more liquid and better performing stocks to meet redemption needs. This may impact the future investment performance of existing investors. A scheme with large AUM base is likely to deal with redemption pressures in extreme market conditions better than scheme with small AUM base, especially in the case of small cap funds.

However, very large AUM can also be constraining factor in delivering alphas to investors, especially for funds which have significant midcap / small cap holdings in their investment mandates. As mentioned earlier, free float market capitalization is relatively lower for mid and small cap stocks. If the AUM of a scheme becomes too large, the fund manager will be forced to add highly liquid large cap stocks or buy more liquid midcap stocks at higher prices in the scheme portfolio. Both will have an impact on scheme performance in terms of delivering alphas to investors. Some AMCs stop receiving lump sum investments in specific schemes for certain periods of time in order to have the right sized AUM which enables them to deliver alphas to investors.

Conclusion

In this article, we have discussed a framework to select mutual fund schemes. Nippon India Mutual Fund’s PoWER framework uses performance over benchmark, wide investor base, experience of the asset management company and right sized AUM to select mutual fund schemes. You should apply this framework after you have identified what type of mutual fund you want to invest based on your investment objectives and risk appetite. You should discuss Nippon India Mutual Fund’s PoWER framework when you discussing about your existing mutual fund investments and new investments with your financial advisor.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Importance of having exposure to commodities in the portfolio

- How to select the right index funds for your portfolio

- Why you need to have large cap mutual funds in your portfolio

- Why invest in Flexicap mutual funds

- Why should one consider Gold as a part of portfolio considering their prices in the current situation

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY