Cricket and Investing: Story of breaking records

Thirty four years back, on a nice winter afternoon in Chennai, Sunil Gavaskar broke Don Bradman’s record of 29 test centuries. My school was closed for the winter break and I remember huddling in front of the radio (we did not have TV in our house back then) with my grandfather, an avid cricket enthusiast, listening to ball by ball commentary in anticipation that one of most hallowed records in cricket will be broken in a few hours. I was very young then, but I still remember jumping with joy when Gavaskar scored his 30th test century against the mighty West Indies squad. Gavaskar would go on to score 34 test centuries by the time he retired in 1987. When Gavaskar retired (I was in my teens then), I told my grandfather that Gavaskar’s record could never be broken. My grandfather chuckled and said that, when he was young, he would discuss with his friends that Bradman’s record could never be broken but history has shown that records are meant to be broken.

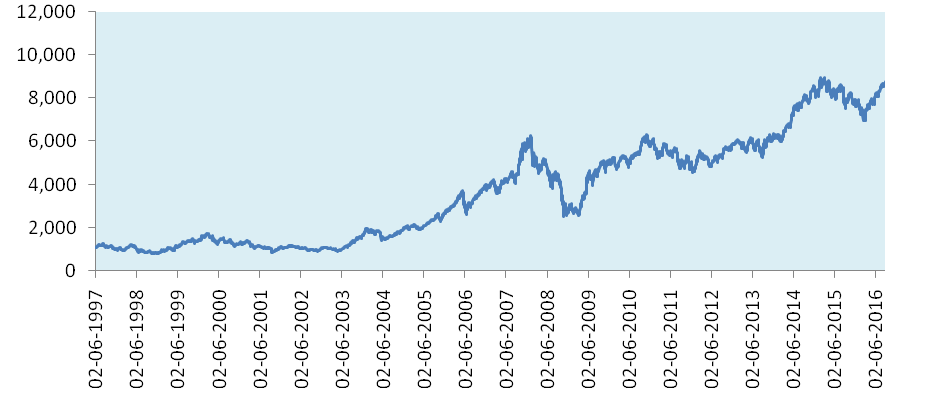

Earlier this year in March, the Nifty broke its previous all time high record (set in early 2015). This was greeted both with cheers and apprehensions by investors. Many experts expressed concerns about stretched valuations. Investors were asked to avoid investing in lumpsum and wait for dips. Many investors were worried that a big correction was imminent. Yet, here we are, in the beginning of June and the Nifty is almost 500 points higher than where it was in March; i.e. almost a 5% growth in just 2 months. Having followed equity market for nearly 17 years now, I have seen the same story play out before also in 2004, 2010 and 2013; each time the market scaled the all time high there were these concerns and yet the market made new highs. The chart below shows Nifty prices from 1997 to 2016.

Let us get back to cricket. Don Bradman’s test centuries’ record stood for around 34 years (from 1948 to 1983) until Gavaskar broke it. When Gavaskar retired, I told my grandfather that Gavaskar’s record will not be broken, because the only person, who I thought could break Gavaskar’s record, was Vivian Richards and Richards only had 3 – 4 years left in cricket at that time.

It was inevitable that I would be proven wrong because just a couple of years after Gavaskar retired, 1989 to be precise, we saw a new phenomenon emerging in the world of cricket. It took some time to break Gavaskar’s record; it stood for around 18 years. In 2005 Sachin Tendulkar broke Gavaskar’s record, when he scored his 35th test century against Bangladesh to become the most successful batsman in the history of cricket.

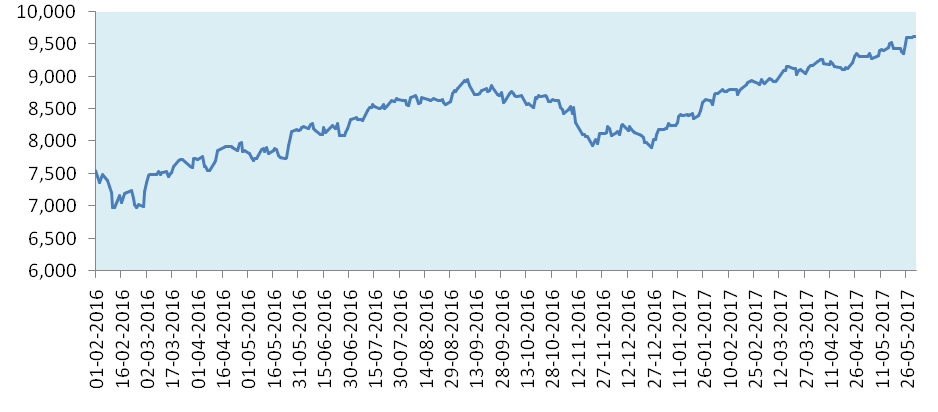

It is foolish to try predicting the future with any degree of certainty. Some of our readers may recall that some prophets of doom were confidently prognosticating a 2008 like financial recession in early 2016 and were advising investors to shift to fixed income. Instead of crashing 50% if a 2008 scenario played out (as these experts were forecasting), the Nifty is up more than 40% in the last 14 months (as you can see in the chart below).

Going back to cricket, in 1987, nobody knew that, in a just a few years, we will have a Sachin Tendulkar. An investment banker friend, another cricket buff like me, said that, Sachin in world cricket was like a Black Swan event. Some of our readers may be familiar with the Black Swan theory propounded by scholar, former stock trader and risk analyst, Nassim Nicholas Taleb.

For readers, who are unfamiliar with the theory, Black Swan is a very high profile, unexpected event that can have a major impact on the market. It may very well be true that, Sachin is a Black Swan, after all we get a cricketer like Sachin comes only once in several generations. In a lighter vein, another friend who was part of this same conversation regarding Sachin whispered the name Virat Kohli in the ears of my investor banker friend who compared Sachin to Black Swan. I am not going to get into a Sachin versus Virat debate here; I like both of them very much. So while, Sachin (and / or Virat) may be Back Swans, we must also recognize that, cricket itself has evolved a lot over the years.

For one, technology in cricket has progressed a lot over the years. Readers of my generation, who started playing cricket (with proper cricket ball, I must add) in the mid eighties, will know that, bats today are far superior compared to what we had when we played cricket; it takes much less effort to clear the ropes with a modern bat compared to what we had back then. Training facilities have improved a lot. When we played cricket our batting practice was limited to the nets; nowadays, you can practice batting even after net sessions with bowling machines. Improved camera and capture technology, along with Decision Review System (DRS) has reduced umpiring errors. Advances in sports health sciences have improved fitness levels remarkably. Better pitch covers, outfield drainage systems have reduced weather (rain) related delays. Whether or not, we have another Sachin Tendulkar in the coming years, technology wise today’s young cricketers are much better equipped to succeed compared to a generation or two before them.

Similarly, the Indian economy has made tremendous progress over the past two and half decades. The GDP growth rate of India was second only to China for many years. Over the last few years, India has been the fastest growing economy in the world. In FY 2016 – 17, India may lose the top position among fastest growing economies in the world to China again, but it is likely to regain the top spot in FY 2017 – 18, as per Niti Ayog. Structurally, our economic growth is largely driven by domestic consumption, unlike China which is largely an export oriented economy. Therefore, India is less likely to be affected by global weakness, as we saw in the last two or three years. Economic reforms implemented by successive Governments has attracted foreign investments, made businesses more efficient and improved our per capita income. The demographic advantage of India (high percentage of young people who form part of the workforce) will pay rich dividends in the coming years as our economic growth gathers further momentum. In the developed economies the ratio of the working population to dependent population (senior citizens) is much lower compared to India. As our productive work-force goes up, our GDP will also grow at a rapid pace.

Less is spoken of the telecom and technological revolution at grass-roots level in our country. Mobile phone penetration in India is one of the highest among the developing economies (India has the second highest number of mobile subscribers in the world). The Aadhar Card is a relatively low profile technological revolution at the grass-root level, the staggering importance of which, we are yet to grasp; however, some academicians in the US are suggesting that, this may lead to the biggest technological transformations the world has ever, particularly in the context of the Modi Government’s initiative of digital economy. India’s digital economy, once more matured, will unleash the potential of our enormous demographic advantage (high percentage of young people) of our country). We do not need a repeat of the dream bull run from 2004 to 2007 to create wealth in equities; India’s economic progress will create wealth for equity investors over a sufficiently long investment horizon, periods of interim volatility notwithstanding.

Let us get back to cricket. The style of cricket has changed considerably but the basics have not changed. When we started to play cricket in the eighties, our coach taught us “the most important shot” in cricket, the forward defensive shot – extend your left foot to the line of the ball and bring your bat down, leaving no gap between bat and pad. We used to play the forward defensive shot for hours in the net. In total there were about 7 or 8 shots that most batsmen would play. Today batsmen has a much wider array of shots thanks to T-20 cricket probably; the upper cut over slip’s head, the switch hit (left handed swing by right handed batsman or vice versa) or reverse sweep, inside out shot over extra cover, scoop over the wicket keeper’s or fine leg’s head, flat batted shot over mid-on, to name a few. These shots have increased run scoring opportunities for batsmen. Batting has become much more aggressive than in the past. In the Indian cricket team of the eighties, we had only two or three attacking batsmen in our line-up, e.g. Srikkanth, Azharuddin and Kapil Dev, the rest were all defensive minded batsmen. In the current Indian test squad, we have only one defensive minded batsman, Cheteshwar Pujara, the rest are all attacking batsmen. But even though batting has become much more aggressive now, the forward defensive is still played today exactly in the same way as my coach taught me 30 years back; the basics of cricket have not changed.

Similarly, in the world of capital markets, the markets have become deeper; there are many more participants, both foreign and domestic investors, than there were, say 20 years back. Regulations have changed and become more effective; stock market scams are a thing of the past. More and more equity market participants are cultivating an investing mentality as opposed to trading mentality of the past. Domestic retail investors have been participating in the market in large numbers over the past few years through mutual funds. Mutual Fund systematic investment plans (SIPs) are ensuring a steady flow of funds into the market to absorb the supply of stocks. Employee Provident Fund (EPF) is investing in equities. These developments have increased the depth of the market and making it increasingly more efficient. However, like cricket, the basics of investing has not changed; investing in good companies, with stable business models, good management teams and competitive advantage in the industry, at reasonable prices is still what good fund managers bet on. You should always get your investment basics right. Obviously, if you are able to invest at market bottoms, you will be able to get extra-ordinary returns, but the fact is that, it is extremely difficult to time the market and catch the bottom. Historical data shows that, investors were able to get good returns from Indian equities over a sufficiently long investment horizon, irrespective of what market level at which investors entered the market.

Conclusion

Sachin Tendulkar retired a few years back as the most successful batsman in the history of test and one day international cricket, having scored over 50 centuries in both the formats. It is a very high benchmark for anyone to beat. But I will never say that his record cannot be broken. Virat Kohli has scored 16 test centuries and 27 ODI centuries. He has at least 10 years of cricket left in him and he is just about reaching the peak of his abilities. I do not want to guess whether Virat will break Sachin’s record, but someday someone surely will; that is evolution and progress.

The Nifty is trading near its all time high (around 9,600) and some investors may be worried about investing at these levels. There may be volatility in the near or medium term, but over a long investment horizon market levels are not relevant. As my grandfather told me, thirty years back, records are meant to be broken and broken they shall be, because nothing can stop human progress. The growth of our capital markets, both in terms of breadth and depth, along with the growth in the Indian economy will ensure that, Indian equity investors can participate in this growth story and create wealth.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Importance of having exposure to commodities in the portfolio

- How to select the right index funds for your portfolio

- Why you need to have large cap mutual funds in your portfolio

- Why invest in Flexicap mutual funds

- Why should one consider Gold as a part of portfolio considering their prices in the current situation

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY