Axis NASDAQ 100 Fund of Funds: Invest in the leading innovators of the world

“Big Tech” refers to the top 5 technology companies in the United States, Microsoft, Apple, Amazon, Alphabet (Google) and Meta (Facebook), collectively also known as the “Big 5”. They are household names all over the world and have become part of our day to day lives. These companies have also been great wealth creators. In the last 5 years an equal weighted portfolio of these companies gave 24% CAGR dollar returns (source: Bloomberg, as on 25th March 2023); in the INR terms, the CAGR return would have been 29%. How can you get cost efficient exposure to these stocks and other leading tech stocks?

In October 2022, Axis Mutual Fund launched Axis NASDAQ 100 Fund of Fund. NASDAQ 100, one of leading stock indices globally, is mainly known for innovation. More than 50% of the index comprises of tech stocks, including the Big Tech companies.

About NASDAQ 100

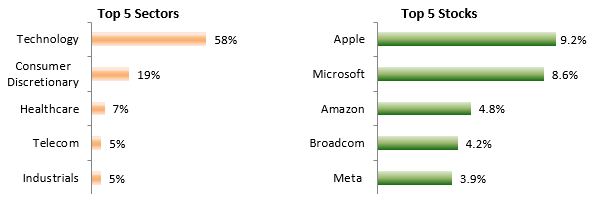

NASDAQ is second largest stock exchange in the US and one of the largest exchanges in the world. It is home to relatively newer companies that are focused on technology and innovation. The NASDAQ 100 comprises of the 100 largest non-financial companies listed on NASDAQ. The chart below shows the top 5 stocks and sectors of the NASDAQ.

Source: NASDAQ, as on 29th December 2023

Why invest in NASDAQ 100?

- Global Exposure: Almost 50% of the revenues of NASDAQ 100 companies come from outside the US*. They provide the benefit of diversification and reducing concentrated geographical risk for investors.

- Exposure to Disruptive Tech: 86% of index weight is engaged in disruptive technologies*. Disruptive technologies drive innovations that significantly alter the way consumer and businesses operate. The big disruptors have historically been the great wealth creators, a trend that is likely to continue or even accelerate in the future.

- Higher R&D spending will drive future innovations: There is strong correlation between Research & Development and innovations. NASDAQ 100 companies spend 3.5 times more on R&D than S&P 500 (index of top 500 large cap companies in the US)*.

*Source: AXIS MF, as on 27th September 2022

Performance of NASDAQ 100

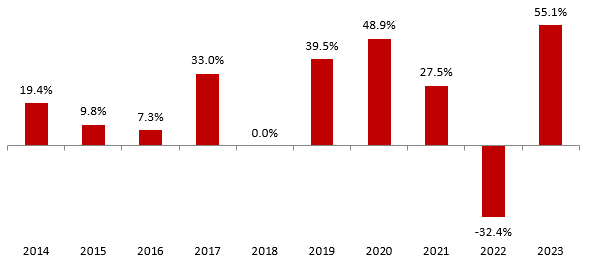

The chart below shows the annual returns of NASDAQ 100 Total Returns Index over the last 10 years. The spectacular performance of NASDAQ 100 stocks during the COVID-19 pandemic raining concerns about frothy valuations, which led to a deep correction in 2022. Since then NASDAQ 100 has recovered, by posting very strong returns in 2023.

Source: NASDAQ, as on 29th December 2023

Why you should include international funds in your portfolio?

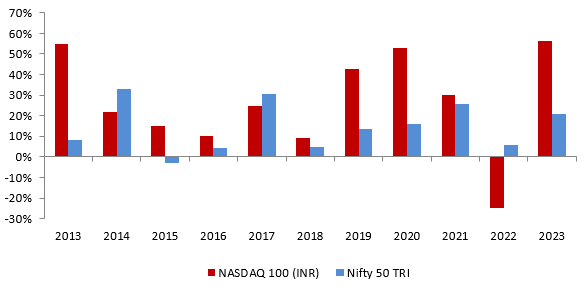

- Portfolio diversification: There is low correlation of returns of different markets. Investing in global equities can diversify risk considerably and bring stability to your portfolio. The chart below shows the returns of NASDAQ 100 TRI (in INR terms) and Nifty 50 TRI over the last 10 years (ending 29th December 2023). A portfolio comprising of both domestic and international equities can add stability to your portfolio.

Source: NASDAQ, NSE, Investing.com (for INR / USD exchange rates) as on 29th December 2023

- Exposure to global mega-trends: The Indian stock market is dominated largely by traditional industry sectors like Banking and Finance, Oil and Gas, Automobiles and Auto Ancillaries, IT Servicing, Metals, Pharmaceuticals, Cement and Construction, Power, FMCG etc. Through NASDAQ 100, you can get exposure to disruptive technologies like E-commerce, Social Media, Gaming, Artificial Intelligence, cloud computing, Robotics, Electric Vehicles etc which have huge growth potential.

- Access to very large markets: You can get exposure to companies which may have global reach and access to very large markets.

- Hedge against INR depreciation: You can benefit if INR depreciates against foreign currency e.g. USD.

About Axis NASDAQ 100 Fund of Funds

Axis NASDAQ 100 FoF invests in top overseas NASDAQ 100 ETFs:-

- Xtrackers Nasdaq 100 UCITS ETF (Xtrackers Plc).

- iShares NASDAQ 100 UCITS ETF (BlackRock Asset Management Ireland Limited).

- Invesco EQQQ NASDAQ-100 UCITS ET (Invesco).

The investment managers have global expertise and superior execution capabilities. These top ETFs have comparatively lower tracking error, which will benefit Axis NASDAQ 100 FoF.

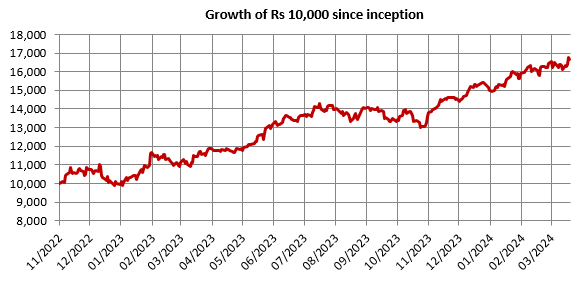

How has Axis NASDAQ 100 FoF performed?

Source: Advisorkhoj Research, as on 29th December 2023

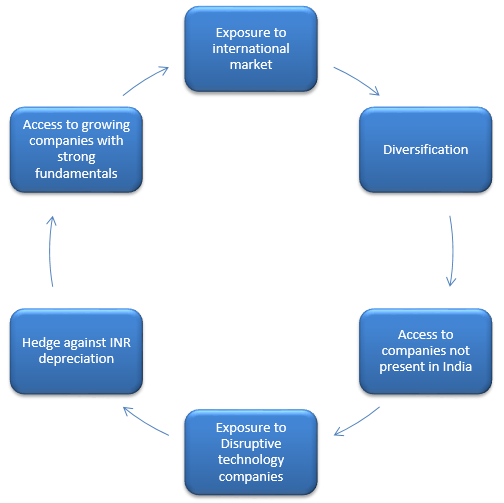

Summing up - Why Invest in Axis NASDAQ 100 FoF?

Please note that the scheme is temporarily closing for subscription from 1st April 2024

Investors should consult their financial advisors or mutual fund distributors if Axis NASDAQ 100 FOF is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

HDFC Mutual Fund launches HDFC Manufacturing Fund

Apr 26, 2024 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Nifty Alpha Low Volatility 30 Index Fund

Apr 26, 2024 by Advisorkhoj Team

-

Kotak Mutual Fund launches Kotak FMP Series 330

Apr 25, 2024 by Advisorkhoj Team

-

Groww receives SEBI approval to launch Indias first Nifty Non-Cyclical Consumer Index Fund

Apr 24, 2024 by Groww Mutual Fund

-

Leveraging the PSU rally to sustain capex growth

Apr 10, 2024 by Axis Mutual Fund