360 ONE Flexicap Fund Review

360 ONE MF launched their flexicap fund in June 2023 after IIFL MF became 360 ONE MF earlier during the year. Though 3 months is too short a timeframe to review the performance of equity funds, the investment strategy of 360 ONE Flexicap Fund is unique and has the potential of consistently generating alphas for investors over long investment horizons.

About Flexicap Cap Funds

Flexicap funds are diversified equity mutual fund schemes which can invest across market cap segments. There are no upper or lower limits with respect to allocations to any market cap segment. The fund managers of these schemes can invest any percentage of their assets in any market cap segment viz. large cap, midcap and small cap according to their market outlook. Flexicap funds category is one of the most popular equity mutual fund categories in India.

Why Flexicap?

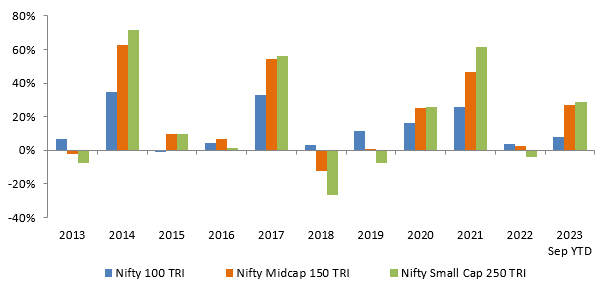

- Winners rotate across market cap segments: One market cap segment cannot keep outperforming or underperforming across all market conditions or investment cycles. Historical data shows that winners rotate across different market cap segments – see the chart below. Flexicap fund managers can generate more consistent returns by rotating allocations to different market cap segments based on their outlook.

Source: National Stock Exchange, Advisorkhoj Research (as on 30th September 2023). Nifty 100 TRI represents large cap, Nifty Midcap 150 TRI represents midcap and Nifty Small Cap 250 TRI represents small cap stocks. Disclaimer: Past performance may or may be sustained in the future.

- Winners rotate across industry sectors: Like market cap segments, winners also keep rotating across industry sectors. Some sectors may outperform in some quarters or years, and others may outperform in other quarters or years. Flexicap funds diversify across industry sectors and can change sector allocations based on top down or bottoms up approach depending on the strategy of the fund manager

Source: 360 ONE Mutual Fund. Disclaimer: Past performance may or may be sustained in the future.

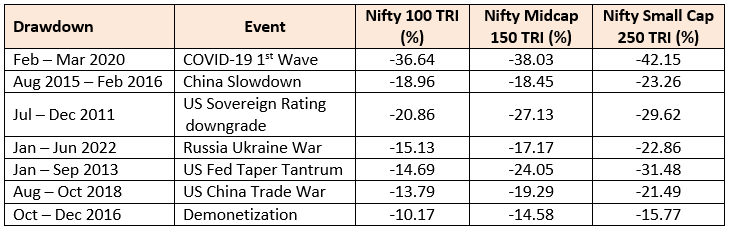

- Manage downside risks: The table below shows the 5 biggest drawdowns in the market in the last 10 years or so and the impact on various market capitalization segments. You can see that large caps are considerably less volatile than midcap and small cap stocks. The manager of a Flexicap Fund can prudently manage risks by shifting allocations between market cap segments based on his / her outlook.

Source: National Stock Exchange, Advisorkhoj Research (as on 31st December 2022). Nifty 100 TRI represents large cap, Nifty Midcap 150 TRI represents midcap and Nifty Small Cap 250 TRI represents small cap stocks. Disclaimer: Past performance may or may be sustained in the future.

- Potential of generating alphas: Large cap stocks have high percentage of institutional ownership, are more researched and therefore have better price discovery. Opportunities of alpha creation are higher in midcaps and small caps, which are less researched compared to large cap stocks. The universe of midcap and small cap stocks is also much larger than large cap stocks. Flexicap fund managers may be able to find quality mid and small cap stocks at attractive valuations, thereby creating alphas for investors over long investment horizons.

- Higher liquidity than small / midcap funds: Since midcap and small cap companies usually have high percentage of promoter ownership, the percentage of free floating shares in these companies is much lesser than large caps. In extreme market conditions, liquidity may be an issue with midcap and small cap stocks. Large cap stocks, on the other hand, are traded in large volumes. The large cap allocation of flexicap funds ensures sufficient liquidity to meet redemption pressures in any market condition.

- Ideal for retail investors: Diversification across different market cap segments can reduce unsystematic risks and generate more consistent returns. Flexicap Funds are ideal for investors who are not able to decide how much allocations they should have towards each market cap segments and want the fund managers to decide on market cap allocations.

Investment Strategy of 360 ONE Flexicap Fund

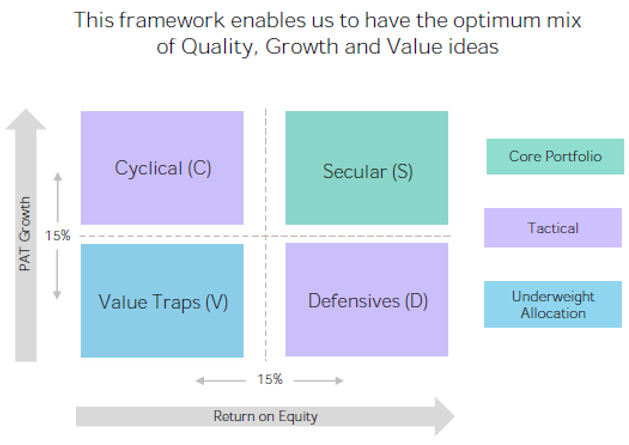

360 ONE Flexicap Fund is sector agnostic and does not have any market cap bias. The fund manager employs bottom up stock picking approach. The fund manager follows SCDV Framework along with internal (financial analysis, corporate governance checks, risk reward evaluation, etc) and external analysis (conferences, investor presentations, management interaction, primary visits across supply chain, etc) for stock selection.

SCDV Framework

In the SCDV Stocks are classified into 4 categories based on their PAT (Profit after Tax) growth and ROE (Return on Equity).

- Secular: Companies delivering high PAT and ROE growth rates, playing out India’s secular upward growth shift.

- Cyclicals: High growth companies which typically have high capital expenditures and hence a lower ROE. These have relatively higher sensitivity to business and economic cycles

- Defensive: Companies that have high ROE and lower growth rates, low capital expenditures and sensitivity to business cycles, but that provide a cushion to returns during downturns.

- Value Traps: Companies that register low growth rates and ROE, which are typically avoided across public equity strategies

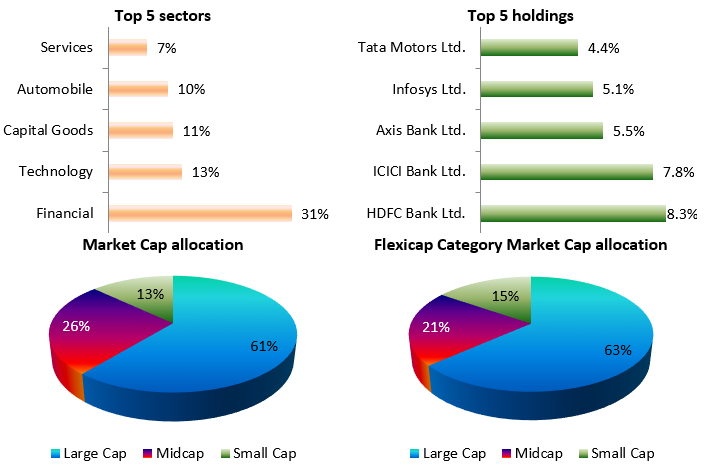

Current Portfolio Construct

Source: Advisorkhoj Research

Who should invest in 360 ONE Flexicap Funds?

- Investors with long term investment horizon i.e., 5-7 year or more.

- Investors with a high-risk appetite who can tolerate theshort term volatility associated with equity investments.

- They are suitable for investors who want to invest from their monthly savings through SIP for their long term financial goals like children’s higher education, marriage, retirement planning, wealth creation etc.

- Investors who wish to avoid the complexities of determining allocation among large, mid, and small-cap stocksindependently. You should consult with your financial advisor, if 360 ONE Flexicap is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- NFO Review: Mutual Fund Industrys First Hybrid Balanced Fund

- 360 ONE Multicap PMS: Long Term Capital Appreciation in Volatile Markets

- 360 ONE Multicap PMS: 8X returns in 10 point 5 years

- 360 ONE Multi Asset Allocation Fund NFO: Power of asset allocation in volatile times

- 360 ONE Multicap PMS: Wealth creation track record

LATEST ARTICLES

- 360 ONE ELSS Tax Saver Nifty 50 Index Fund: Wealth creation with tax benefits

- 360 ONE Multi Asset Allocation Fund NFO: Multi asset allocation solution in volatile times

- 360 ONE Phoenix PMS: Long Term Equity Growth

- 360 ONE Quant Fund: One of top performing quant funds for current market conditions

- 360 ONE Multi Asset Allocation Fund NFO: Power of asset allocation in volatile times

360 ONE Asset offers uniquely structured products to cover diverse investment requirements of investors. Our mutual fund portfolio is concentrated on a few, high-quality, high-conviction stocks. This allows our fund managers to maintain focus and generate improved risk-adjusted returns.

Having pioneered the concept of benchmark-agnostic funds in India, our fund managers function in an unconstrained but research-oriented manner. While traditional asset management companies are constrained by benchmarks, our benchmark-agnostic approach enables us to pick stocks with flexibility and tap into unique multi-baggers of the future.

Investor Centre

Follow 360 One MF

More About 360 One MF

POST A QUERY