360 ONE Multicap PMS

360 ONE Multicap PMS is multicap scheme which invests across market cap segments. This PMS was launched in 2013. Minimum investment in this scheme is Rs 50 lakhs. 360 ONE is one of the leading Portfolio Management Services (PMS) providers in India. Their unique SCDV investment framework for stock selection (more on SCDV framework later in this article) has proven track record of alpha creation. In this article, we will review 360 ONE Multicap PMS.

Why invest PMS?

Portfolio Management Services are specialized investment vehicles suited for investment needs of High Net worth Investors (HNIs). PMS Managers have much greater flexibility than mutual fund managers because they are not bounded by some of the restrictions which mutual fund managers have. For example, PMS Managers have greater ability to time the market by taking cash calls, which mutual fund managers may be unable to take. As such, PMS may be better are more suited for investment needs of experienced investors who desire higher alphas (outperformance versus market benchmark).

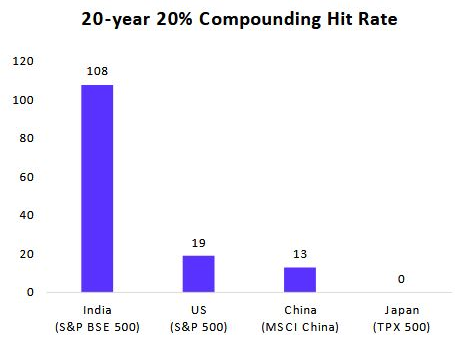

The case for Indian equities – Compounding machine

The chart below shows the number of stocks (among Top 500) that delivered more than 20% CAGR returns in the last 20 years for different markets. Just to put this context from a wealth creation perspective, if you invest Rs 10 lakhs in a stock, with 20% compounding in 20 years, the market value of your stock will be Rs 3.8 crores. You can see that 108 companies in BSE 500 delivered more than 20% CAGR returns; significantly higher than US, Japan and China (MSCI China index has 637 stocks). 31% of BSE 500 stocks delivered more than 20% CAGR returns in the last 10 years.

Source: Bloomberg, as on 30th September 2023

Why is this a good time to invest in 360 ONE Multicap PMS?

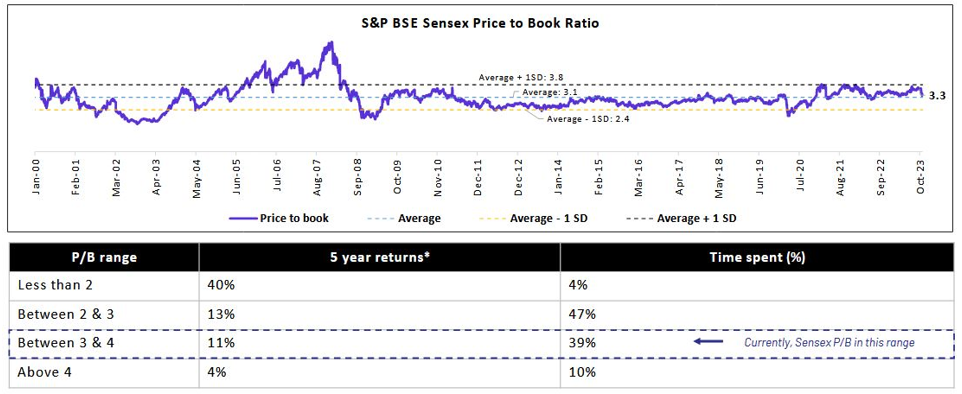

- Valuations are near long term average (see the chart below). The Sensex Price to Book at 3.3X is close to the 23 average of 3.1. The market may be in the P/B range of 3 and 4 for a considerable period of time, and can strong 5 years returns from the current levels

Source: Bloomberg, as on 30th September 2023

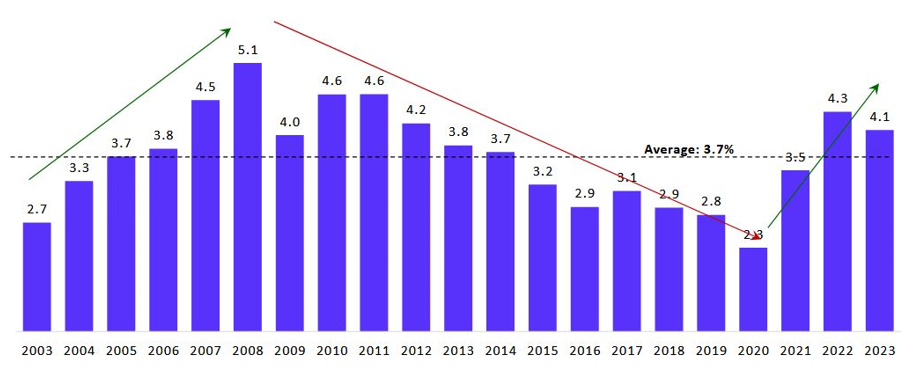

- Corporate profits to GDP ratio has been improving for its low in 2020 (COVID-19) after a long period (more than 10 years) of decline. Historical data suggests that improving corporate profits to GDP ratio heralds strong bull market.

Source: Motilal Oswal, corporate profits refers to earnings of Nifty 500 companies

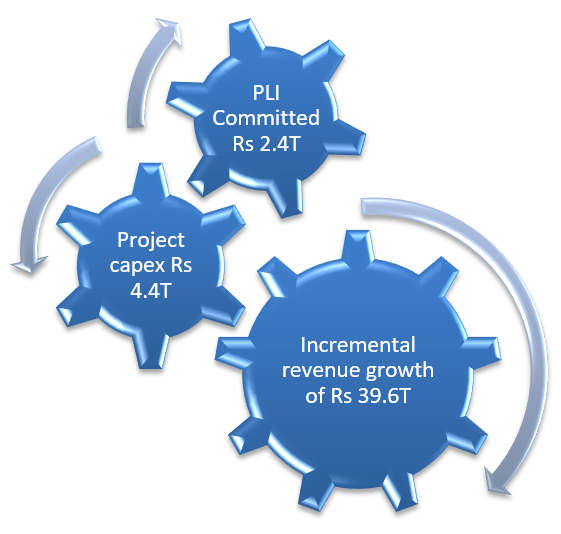

- The production linked incentive scheme (PLI) of the Government is incentivizing private sector capex spending (Rs 4.4 Trillion of committed or likely capex investments), which can lead to significant revenue and earnings growth in the coming years.

Why Multicap strategy?

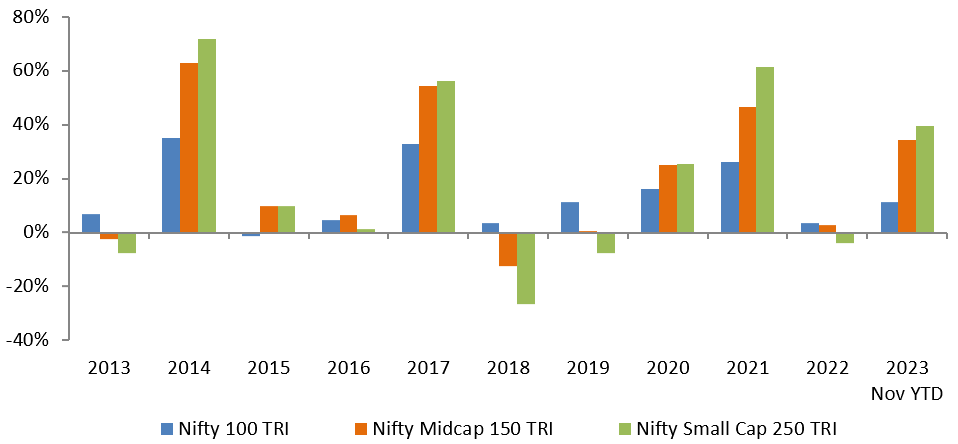

Historical data shows that winners rotate across different market cap segments – see the chart below. In periods of market volatility, large caps outperform mid and small caps. Midcaps and small caps outperform in early to mid-stages of economic recovery. Flexible and prudent allocations to market cap segments can improve portfolio stability and a create alphas.

Source: National Stock Exchange, Advisorkhoj Research, as on 30th November 2023. Disclaimer: Past performance may or may not be sustained in the future

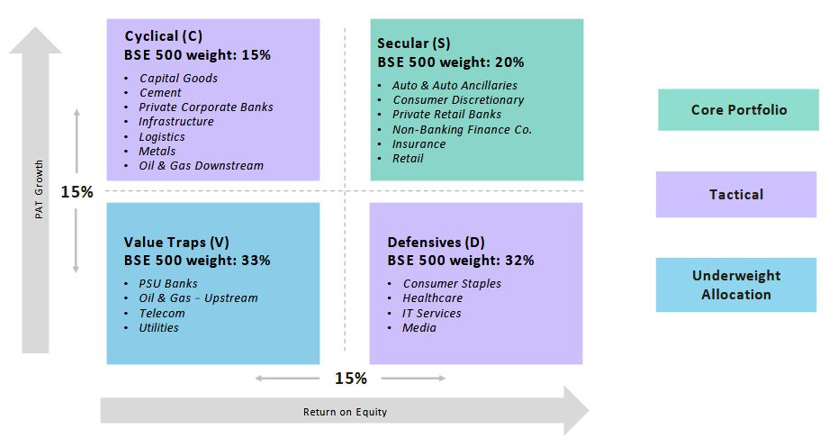

SCDV Investment framework of 361 Multicap PMS

Source: 360 ONE, as on 31st October 2023.

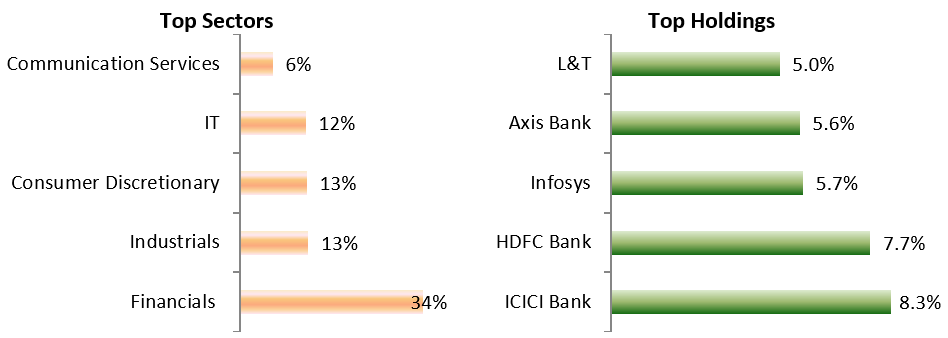

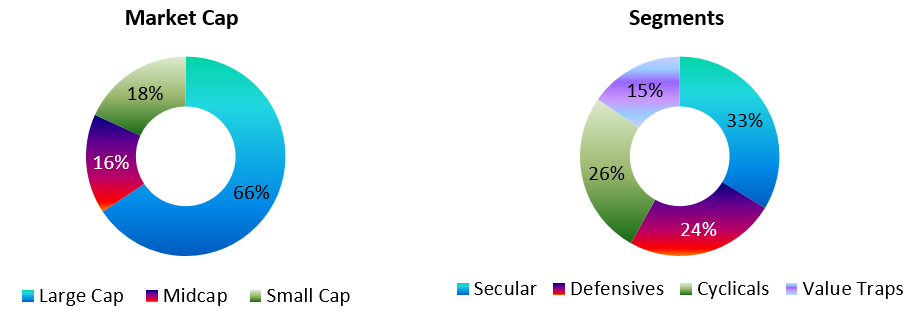

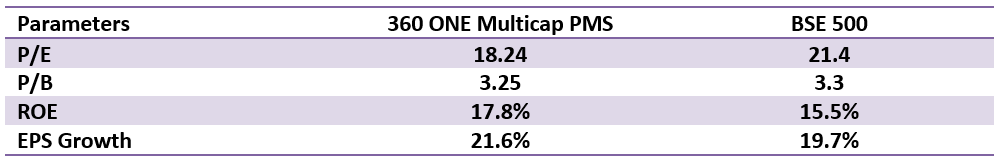

Current portfolio positioning

Source: 360 ONE, as on 31st October 2023.

Source: 360 ONE, as on 31st October 2023.

Source: 360 ONE, as on 31st October 2023.

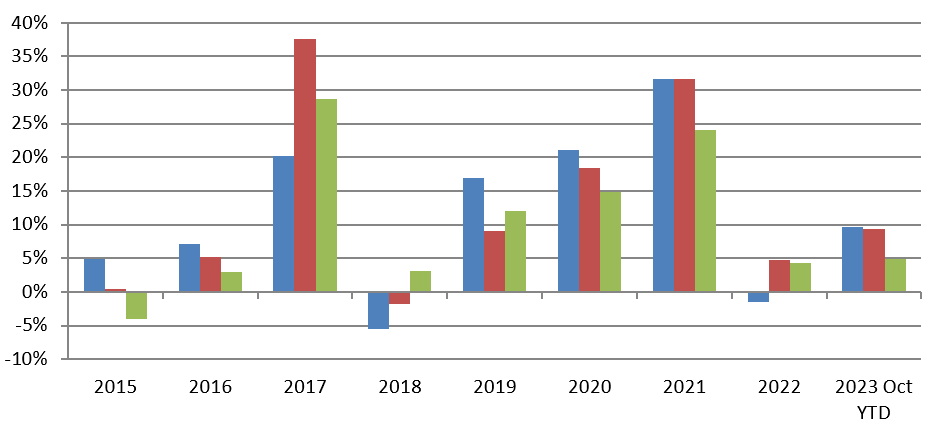

Performance

You can see that 360 ONE Multicap PMS was able to outperform its benchmark and the Nifty in most years since inception.

Source: 360 ONE, as on 31st October 2023.

Our take

- Global equities have rallied after the Fed signalled that the current interest rate cycle is coming to its end

- India continues to be the bright spot among the emerging economies and is likely to see higher allocations from FIIs in the coming year

- Markets are expecting political stability and we may see pre poll rally to the run up of Lok Sabha elections in 2024

- In the current market context and economic outlook for 2024, we expect stock selection to be significant driver in portfolio returns.

- 360 ONE Multicap PMS with its track record of alpha creation is strongly positioned to deliver alphas for investors in the medium to long term.

Consult with your financial advisor or PMS distributor if you want to know more about 360 ONE Multicap PMS

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- NFO Review: Mutual Fund Industrys First Hybrid Balanced Fund

- 360 ONE Multi Asset Allocation Fund NFO: Power of asset allocation in volatile times

- 360 ONE Balanced Hybrid Fund: A true to label balanced fund

- 360 ONE Focused Equity Fund: Consistent performing top fund

- 360 ONE Flexicap Fund: Strategic Allocations in Volatile Markets

LATEST ARTICLES

- 360 ONE ELSS Tax Saver Nifty 50 Index Fund: Wealth creation with tax benefits

- 360 ONE Multi Asset Allocation Fund NFO: Multi asset allocation solution in volatile times

- 360 ONE Phoenix PMS: Long Term Equity Growth

- 360 ONE Quant Fund: One of top performing quant funds for current market conditions

- 360 ONE Multi Asset Allocation Fund NFO: Power of asset allocation in volatile times

360 ONE Asset offers uniquely structured products to cover diverse investment requirements of investors. Our mutual fund portfolio is concentrated on a few, high-quality, high-conviction stocks. This allows our fund managers to maintain focus and generate improved risk-adjusted returns.

Having pioneered the concept of benchmark-agnostic funds in India, our fund managers function in an unconstrained but research-oriented manner. While traditional asset management companies are constrained by benchmarks, our benchmark-agnostic approach enables us to pick stocks with flexibility and tap into unique multi-baggers of the future.

Investor Centre

Follow 360 One MF

More About 360 One MF

POST A QUERY