Outstanding wealth creation track record of SBI Focused Equity Fund

We have stated many times in our blog that the real wealth creation power of equity mutual funds can be seen over very long investment tenors. The return since inception of SBI Focused Equity Fund (erstwhile SBI Emerging Business Fund) is a testimony of its wealth creation potential in the long term. If you had invested Rs 1 lakh in SBI Focused Equity Fund at the times of its NFO subscription your wealth would have multiplied nearly 14 times in the last 14 years.

SBI Emerging Business Fund was launched in 2004 and has Rs 2,964 Crores of Assets under Management (AUM). In compliance with SEBI’s mutual fund scheme rationalization and re-classification circular, SBI Mutual Fund renamed the scheme as SBI Focused Equity Fund. The fundamental characteristic of the scheme was changed from being a diversified equity fund to focused equity fund that will invest in maximum 30 stocks in the multi-cap space.

Focused versus diversified funds

Past performance of focused funds provides ample evidence that these funds can deliver excellent returns in the long term. Focused equity funds can deliver higher alphas through superior stock selection. Diversified equity funds achieve superior risk diversification, but diversification for the sake of reducing concentration risk also leads to the possibility of having average or below par performers in the portfolio. Focused funds on the other hand, can deliver higher alphas, by packing the portfolio with high conviction stocks through superior stock selection. For the same reason however, intermittently, these funds can go through a period of underperformance versus diversified (multi-cap) funds. Therefore, investors need to have patience. Historical performance of SBI Focused Equity Fund is still relevant because the fund manager has not changed. The stock selection universe also has not changed for the scheme.

Performance Track Record of SBI Focused Equity Fund - Consistency

Performance consistency is a hallmark of good fund managers. In Advisorkhoj, we have built research tools which help investors identify the most consistent performers in any mutual fund category. SBI Focused Equity Fund is one of the most consistent performers in its product category (please see our tool, Top 10 mutual funds in India - Equity: Focused). SBI Focused Equity Fund’s performance ranked in top two quartiles in 3 out of last 4 years.

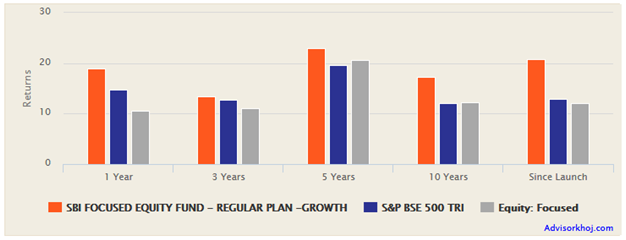

Track Record versus Benchmark and Category

The chart below shows the trailing returns of SBI Focused Equity Fund versus benchmark, BSE – 500 TRI and Focused Equity Fund category over various time-scales. You can see that the fund outperformed its benchmark and category across all time-scales.

Source: Advisorkhoj Research

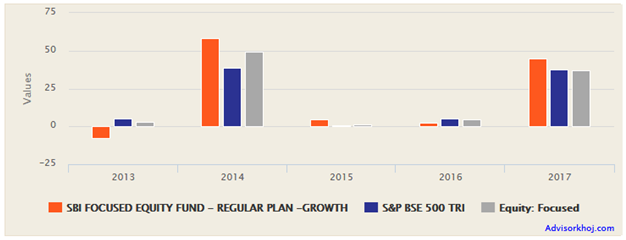

The chart below shows the annual returns of SBI Focused Equity Fund versus its benchmark and category over the last 5 years. You can see that the fund outperformed in most years.

Source: Advisorkhoj Research

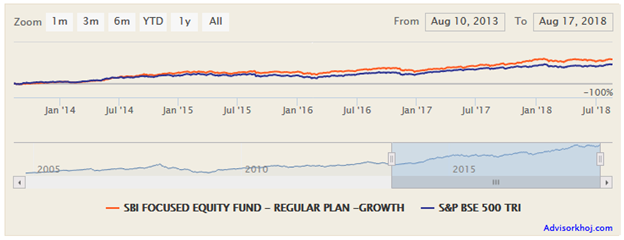

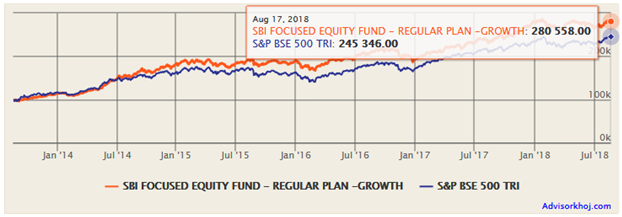

R.Srinivasan is the fund manager of this scheme. The chart below shows the NAV growth of the fund versus its benchmark over the last 5 years.

Source: Advisorkhoj Research

Rolling Returns versus Benchmark

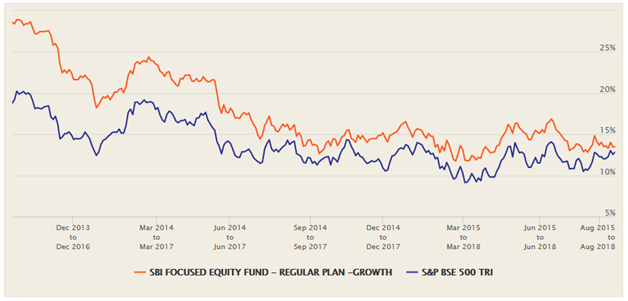

Rolling returns is one of the best measures of performance consistency. It is not biased by market conditions vis a vis fund manager’s strategy because it measures fund performance over the investor’s holding period in all conditions. The chart below shows the 3 year rolling returns of SBI Focused Equity Fund versus its benchmark, BSE – 500 TRI over the last 5 years. You can see that the fund consistently outperformed the benchmark (100% of times) in all periods.

Source: Advisorkhoj Research

Rolling Returns versus Category

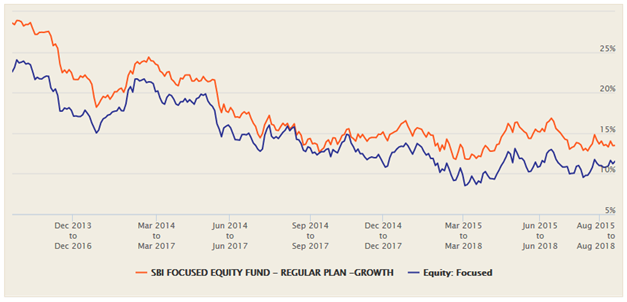

The chart below shows the 3 year rolling returns of SBI Focused Equity Fund versus the category over the last 5 years. Again you can see that the fund outperformed the category returns consistently over the last 5 years.

The average 3 year rolling return of the fund was 17.65% and the median was 15.58%. The maximum 3 year rolling return of the fund was 28.88%, while the minimum was 11.77%. The fund gave more than 12% returns, 98% of the times. These are excellent statistics from a performance consistency standpoint.

Source: Advisorkhoj Research

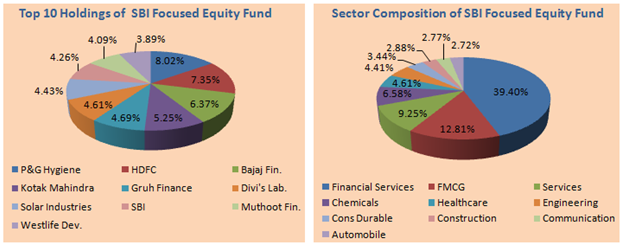

Portfolio Construction

As discussed earlier, the fund has a concentrated portfolio of 30 stocks. Concentrated portfolio has advantages and disadvantages versus diversified portfolios. The impact of few stocks underperforming is much more severe in a concentrated (focused) portfolio compared to a well-diversified portfolio. Therefore, the long term performance track record of the fund manager is that much more important in focused funds. SBI Focused Equity Fund has about 40% of its portfolio in large cap stocks and 60% in mid and small cap stocks. The fund is well diversified across sectors.

Source: Advisorkhoj Research

Lump Sum and SIP Returns

The chart below shows the growth of Rs 1 lakh lump sum investment in the scheme’s growth option over the last 5 years. The investment would have multiplied 2.8 times during this period at a CAGR of 23.3%.

Source: Advisorkhoj Research

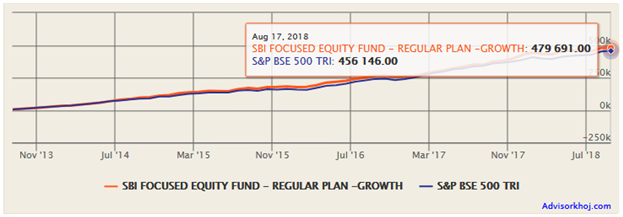

The chart below shows the returns of Rs 5,000 monthly SIP in the scheme’s growth option over the last 5 years. With a cumulative investment of Rs 3 lakhs, your investment value would be around Rs 4.8 lakhs, a profit of Rs 1.8 lakhs in the last 5 years. The SIP XIRR was 18.5%.

Source: Advisorkhoj Research

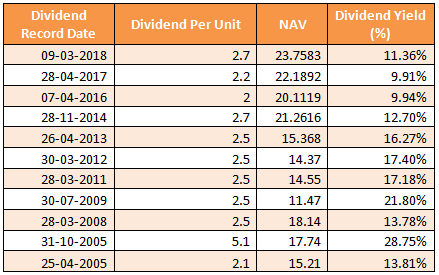

Dividend Payout Track Record

SBI Focused Equity Fund - dividend option has an outstanding payout track record. The fund has paid regular dividends annually in the last 7 years (since 2011). The dividend yield is also fairly good. We must caution investors that mutual fund dividends are paid from the accumulated profits of the scheme. There is no assurance of a certain dividend rate per unit or for that matter, even the guarantee that dividends will be paid at all. Investors should further note that, with effect from this fiscal year, the fund house (AMC) will have to pay 10% dividend distribution tax (DDT) in equity funds, before distributing dividends to investors.

Conclusion

In this post, we reviewed SBI Focused Equity Fund. The scheme has nearly 14 years of outstanding track record. The fund characteristics have recently undergone changes – we will continue to watch the performance of the fund to see if the changed characteristics impact future performance. However, the strong performance track record of the fund manager can give the investors confidence with regards to performance potential of the scheme. As alluded to earlier in this post, investors need to have a long investment horizon and patience to get the best results in terms of wealth creation from this fund. Investors should consult with their financial advisors if SBI Focused Equity Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

- SBI Balanced Advantage Fund: One of the top performing consistent balanced advantage funds

- SBI Magnum Midcap Fund: 22X times growth since inception

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY