Axis Multi Asset Allocation Fund: Track record of stability and consistency

The market has made a decisive recovery since the previous lows immediately following Trump's trade tariffs. Fiscal consolidation, cooling inflation and growth oriented fiscal policies (e.g., GST rate rationalization) have boosted investor sentiments. While overall market sentiment remains positive, valuations in certain pockets remain a concern. From a long-term perspective, favourable macros driven by strong / resilient GDP growth, rising per capita income, expected surge in private sector capex spending on the back of Government spending on infrastructure, foreign investment flows in India etc. make the outlook for Indian equities positive. At the same time, precious metals continues to be best performing asset class in 2025. Gold prices show no signs of slowing down with central banks continuing to purchase gold and with further interest rate cuts expected. Multi Asset Allocation funds which invest in multiple asset classes can provide investors to three or more asset classes e.g. equity, debt, commodities etc in a single scheme.

Why Multi Asset Allocation Fund?

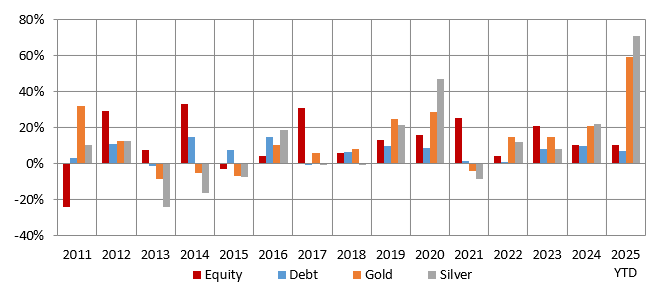

- Winners rotate through asset classes: Different asset classes perform differently every year. Multi asset allocation can capture those opportunities.

Source: NSE, MCX, as on 31st October 2025. Equity is represented by Nifty 50 TRI, Debt by Nifty 10 year Benchmark G-Sec Index, Gold and Silver by MCX spot prices

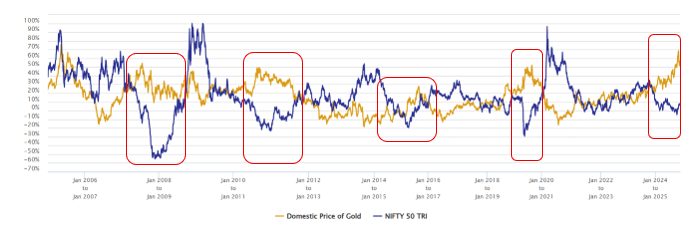

- Equity and Gold are counter cyclical: The chart below shows the 1-year rolling returns of Nifty 50 TRI (representing equity) and gold over the last 20 years. You can see that gold outperformed in the periods where equity returns were low / negative. Multi asset allocation funds can protect downside risks due to gold allocation.

Source: NSE, MCX, Advisorkhoj Research, as on 31st October 2025.

About Axis Multi Asset Allocation Fund

The Axis Multi Asset Allocation Fund (Formerly known as Axis Triple Advantage Fund) was launched in August 2010 and has Rs 1,710.48 crores of AUM (as on 21st November 2025). As per SEBI's requirement these funds should have a minimum 10% in at least 3 assets: these could be equity, debt and gold. The Scheme seeks to generate long term capital appreciation by investing in a diversified portfolio of equity and equity related instruments, debt and money market instruments, Exchange Traded Commodity Derivatives / Units of Gold ETFs, Silver ETF & units of REITs/InvITs.

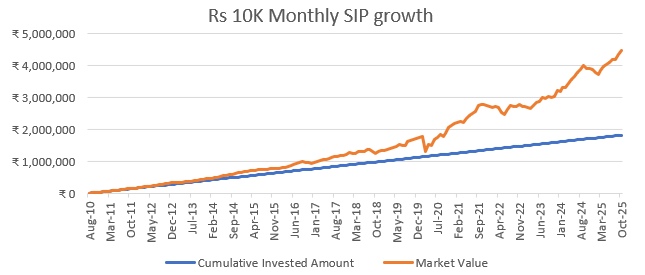

Axis Multi Asset Allocation Fund – Wealth creation story

A monthly SIP of Rs 10,000/- started at the inception of the fund would have grown to Rs 44.75 lakhs as on (21st Nov 2025) against a cumulative investment of 18.30 lakhs.

Source: Advisorkhoj Research as on 21st November 2025

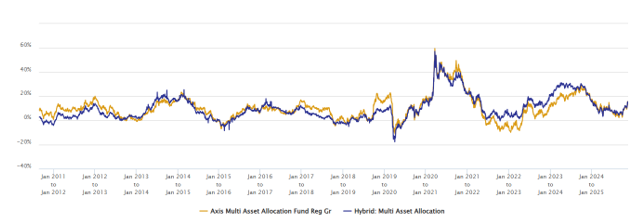

Fund Performance Vs Category: Rolling returns

The chart below shows the 1 year rolling returns of the fund compared to the category average since the inception of the fund. The fund has outperformed the category average in most times across different market conditions.

Source: Advisorkhoj Research as on 21st November 2025

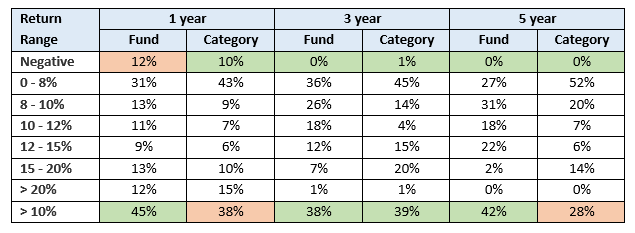

The table below shows the returns distribution of the Axis Multi Asset Allocation Fund for different investment tenures since inception versus the Multi Asset Allocation category average. You can see that the fund was able to provide double digit returns more consistently than category average.

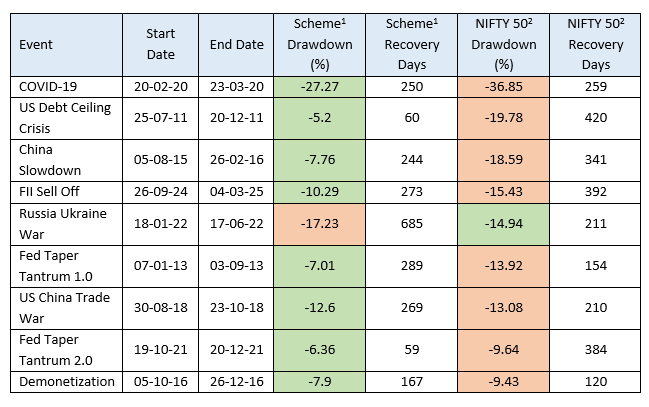

Limited downside risk for investors

The table below shows some of the biggest market corrections since the inception of the fund and how the fund performed versus the broad equity market index, Nifty 50 TRI. You can see that the fund

Source: Advisorkhoj Research as on 31st Oct 2025 1. Axis Multi Asset Allocation Fund 2. Total Return Index

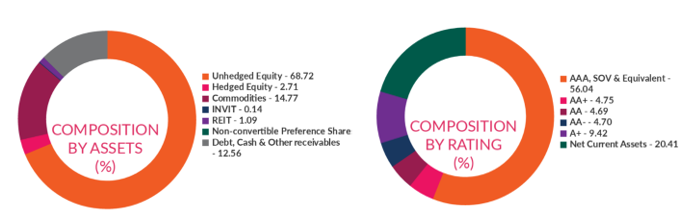

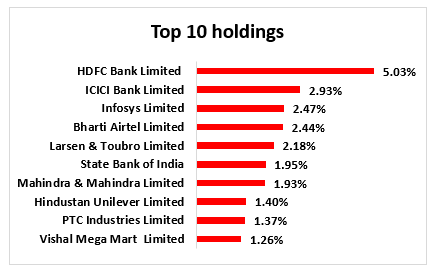

Current Portfolio Construct

Source: Fund Factsheet as on 31st October 2025

Source: Fund Factsheet as on 31st October 2025

Who should invest in the Axis Multi Asset Allocation Fund NFO?

The fund may be suitable for investors who:

- Seek stability in volatile markets.

- Aim for better than debt returns while keeping volatility in check.

- Want to diversify across various asset classes.

- Look for investment for midterm to long term goals of goals 3-5+ years

Contact your financial advisor or Mutual Fund distributor to understand if the Axis Multi Asset Allocation Fund is suitable for you.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Axis Mutual Fund launched its first scheme in October 2009 Since then Axis Mutual fund has grown strongly. We attribute our success thus far to our 3 founding principles - Long term wealth creation, Outside in (Customer) view and Long term relationship. Come join our growing family of investors and give shape to your desires.

Quick Links

Other Links

Follow Axis MF

POST A QUERY