Why debt mutual funds are great options for short term investments

Debt mutual funds are ideal investment options for investors for short term investments. Their risks are much lower than equity or equity oriented funds, they have the potential to generate superior returns compared to traditional fixed income products and they enjoy a significant tax advantage of bank savings and FD.

What are debt funds?

Debt mutual funds invest in debt and money market securities. Money market securities include commercial papers, certificate of deposits, treasury bills etc., while debt securities include Government and corporate bonds. Investors should note that unlike bank FDs or Government Small Savings Schemes, debt mutual funds are subject to risks. There are two main risk factors in fixed income investments are:-

- Interest rate risk, which refers to change in price of the instrument with changes in interest rates. As far as interest rate risk is concerned, it is directly related to the maturity profiles of the underlying securities. Maturity is the time period at the end of which the issuer (borrower) will pay back the face value (principal amount) to the investor. Duration is the price sensitivity of a debt instrument to change in interest rate. If the duration of a debt instrument is 3 years, then for every 1% change in interest rate, the price will change by 3%. Investors should note that in the fixed income universe price has an inverse relationship with interest rates; if interest rate falls, price rises and vice versa.

- Credit risk, which refers to the risk of the issuers of the instruments (the borrower) not meeting their debt (interest and principal payment) obligations. Credit ratings assigned to debt instruments by credit rating agencies are a measure of credit risk.

It is important for investors to note that if a debt instrument is held till maturity, then price change will have no effect on returns. That is whyin the current debt market cycle, some of the debt funds one should consider investing in are accrual based short term debt funds.

What are the debt funds one should consider and why?

Short and very short duration debt funds employ accrual strategy to reduce interest rate risk and earn returns, by holding securities in their portfolios till maturity. We will now discuss different types of short or very short term debt funds.

Liquid Funds:

Liquid funds are money market mutual funds, where the residual maturities of portfolio securities do not exceed 91 days. Redemption requests are processed within 1 day and money credited to the investors’ bank account on the next business day. These funds do not have any exit load, which means that investors can redeem their investments partially or fully at any time without paying penalty.Liquid funds are comparable to your savings bank account from liquidity perspective. In the last one 1 year, average liquid fund category return was 6.5%, much higher than savings bank interest rate (Source: Advisorkhoj Research).Ultra short duration Funds:

Ultra-short duration funds are money market mutual funds, which invest in money market instruments of a certain maturity / duration profile, such that the duration of the fund portfolio is between 3 to 6 months. Longer dated papers give higher yields compared to shorter dated papers. Hence ultra-short duration funds usually give higher returns compared to liquid funds.In the last one 1 year, average ultra-short duration fund category return was 6.1%, much higher than savings bank interest rate (Source: Advisorkhoj Research).Low duration Funds:

These funds invest in debt & money market instruments such that duration of the portfolio is between 6 months- 12 months. While the interest rate risk is slightly higher compared to liquid and ultra-short duration funds, these funds give higher yields. These funds are suitable for parking your money for up to 1 year. In the last one 1 year, the fund category return was 6.3%, much higher than savings bank interest rate. Average category returns over the last 5 years, covering several interest rate cycles was 7.7%, higher than average FD rates over the same period (Source: Advisorkhoj Research).Short duration Funds:

Investment in debt & money market instruments such that the duration of the portfolio is between 1 year – 3 years. While the interest rate risk in these funds is higher compared to lower duration funds, these funds usually give higher returns in the longer term. Historically, short duration funds have given higher returns than FDs over similar terms. Average category returns over the last 5 years, covering several interest rate cycles was 7.8%, higher than average FD rates over the same period (Source: Advisorkhoj Research).Tax Advantage of debt funds

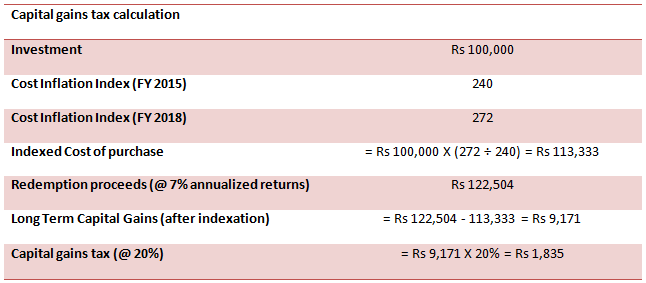

Debt mutual funds, held over 3 years or longer enjoy a considerable tax advantage over FDs. Long term capital gains in debt mutual funds are taxed at 20%, after allowing for indexation benefits. Let us assume you invested Rs 1 Lakh for 3 years and 1 day in a short duration fund in FY 2014 – 15 and redeemed in FY 2017 – 18. Your annualized pre-tax return was 7%.

Therefore, your effective tax rate on actual cash profit is only 8.1%.

Conclusion

- Short or very short term debt mutual funds are suitable for investors who want stable income from their investments and limited interest rate volatility.

- We discussed different types of short or very short term debt mutual funds like liquid funds, ultra-short duration funds and short durations which investors can select based on their investment needs.

- Debt mutual funds enjoy considerable tax advantage over traditional fixed income schemes, when invested over long tenors (3 years plus). Long term capital gains tax reduces the tax burden considerably for investors.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

#Wise With Edelweiss – An Investor Education Initiative by Edelweiss Mutual Fund.

EAML is amongst the fastest growing asset management companies, being an asset management subsidiary of Edelweiss Financial Services Ltd., one of Indias leading financial services group since last 21 years with a proven track record of quality and innovation. Edelweiss AML is present across 11 locations across the country. EAML offers a suite of differentiated asset management products and the unique knowledge proposition focusing on building a strong connect with Distributors and customers. At Edelweiss AMC, the aim is to come up with truly innovative ideas that doesnt exist today and bridge the gap between what investors want and what the industry has to offer.

Quick Links

Contact Us

- Toll Free : 1800 425 0090

- Non Toll Free : +91-40-23001181

- EMFHelp@edelweissfin.com

- distributor.amc@edelweissfin.com

POST A QUERY