Index Funds: Edelweiss MSCI Domestic and World Healthcare 45 Index Fund NFO

Passive Investing – ETFs and Index Funds

Exchange traded funds (ETFs) and index funds are passive schemes, which aim to track a particular market index like Sensex, Nifty 50 etc. ETFs and Index funds both invests in a basket of stocks which replicate the underlying index. ETFs are listed on stock exchanges and can be bought or sold through stock exchanges. For transactions of certain lot sizes (as specified by the AMC) ETFs can be purchased or sold directly with the AMC. You need to have Demat and trading accounts to invest in ETFs. Index funds, on the other hand, are like any open ended equity fund. You do not need to have a demat account to invest in Index funds. Like other mutual fund schemes, you can invest or redeem Index funds with the AMC.

What are the advantages of Index Funds?

- The biggest advantage of Index Funds is low cost. The expense ratios of Index Funds are much lower than actively managed equity funds

- There is no unsystematic risk in Index Funds because they invest in the entire basket of stocks in the Index they are tracking

- For certain investment themes, which are dominated by a limited number of stocks, it can be difficult for actively managed funds to beat the Benchmark Index. Index funds with its cost benefits can be advantageous in such themes

- The major advantage of Index funds for retail investors is that you do not need to have a demat account to invest in Index funds

- Since ETFs can be sold only in stock exchanges (unless you are redeeming in lot sizes), you need to find a buyer and liquidity can sometimes be an issue with some ETFs. Liquidity is not an issue in Index funds because you can redeem Index funds with AMCs at prevailing NAVs

- Unlike ETFs, you can invest in Index Funds through SIP, STP and switches from other schemes

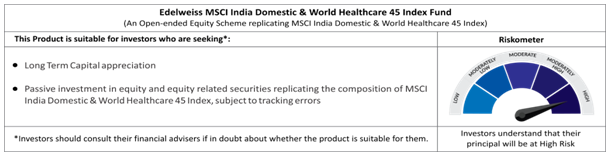

Edelweiss MSCI Domestic and World Healthcare 45 Index Fund

The fund will invest in a basket of stocks underlying MSCI India Domestic and World Healthcare Index, which comprises of 45 stocks in healthcare sector listed across India and USmarkets. Here are some salient features of the index: -

- MSCI India Healthcare Component (70% weight in the fund): Comprises of top 25 stocks based on free float market cap. The stocks are spread across sectors like Pharmaceuticals, Hospitals, Diagnostics, Life Science tools and services, Biotechnology and other healthcare services

- MSCI World Healthcare Component (30% weight in the fund): Comprising of top 5 stocks based on full market cap from each of the 4 sub-sectors – Pharma, Healthcare Equipment, Biotechnology and Life Science tools & services; total of 20 stocks. All the 20 stocks are listed in the US.

- Single stock exposure in the Index / fund is capped at 20%

- Index will be rebalanced at calendar quarter end.

Why invest in domestic healthcare theme?

- The Indian pharmaceutical industry is the third largest in the World in terms of volume i.e. 10% of global industry and over 60,000 generic brands (source: Edelweiss MF)

- Indian healthcare sector is expected to grow at CAGR of 22% during 2016 – 2022 reaching a size of $372 billion by 2022 from $110 billion in 2016 (source: IBEF report)

- India ranks low (145/195) in terms of quality and accessibility of healthcare. There is an immense scope of improving healthcare in India and development of the healthcare industry (source: IBEF report)

- Rising income levels, ageing population, growing health awareness and changing attitude towards preventive healthcare is expected to boost demand for healthcare services

- Medical tourism is growing in India due to low cost of medical services. Cost advantage is also helping India to emerge as a global R&D hub

- The Pharma sector is stabilizing from the US FDA issues over the last year or so. Pricing pressure on Indian exports to US generics market (a big export market) has also abated

- The Government has been working towards providing a favourable investment environment through FDI policy reforms, tax benefits and other policies including PMJAY, the world’s largest healthcare scheme

Why invest in US healthcare theme?

- US is the largest healthcare market in the work with the highest healthcare spend as % of GDP (source: WHO, 2019)

- US has 42% share in global Pharma market (source: WHO, 2019)

- US lead the world in bio-pharmaceutical innovation and research. The US leads by a large margin in termson patent counts held by US Pharma Companies. In 2018 US Pharma companies spent $80 billion on R&D (source: WHO, 2019)

- US is home for fast growingBiologics and medical devicecompanies

Why invest in MSCI Domestic and World Healthcare 45 Index now?

- The healthcare theme has seen underperformance in last 5 years and has potential to generatereasonably good performance in coming years.

- Valuations are reasonable at present

- MSCI is the largest Index provider in the world. It has robust processes to create innovative Indexes including thematic Indexes.

Summary

In this article, we have discussed about passive investing through Index Funds and its benefits. We also discussed the big growth opportunity for healthcare in India. Through MSCI Domestic and World Healthcare 45 Index Fund you also get exposure to the US healthcare sector in addition to India. The US exposure will reduce portfolio volatility and bring stability. Investing in the healthcare theme through an Index fund not only provides cost advantage, it also removes unsystematic risks which can be significant for some sectors. You should consult with your financial advisor if Edelweiss MSCI Domestic and World Healthcare 45 Index Fund is suitable for your investment needs.

Disclaimer -

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

#Wise With Edelweiss – An Investor Education Initiative by Edelweiss Mutual Fund.

Disclaimer: This document has been prepared by Edelweiss Asset Management Limited (Edelweiss AMC) based on internal data, publicly available information and other sources believed to be reliable. Any calculations made are approximations, meant as guidelines only, which you must confirm before relying on them. The information contained in this document is for general purposes only. The document is given in summary form and does not purport to be complete. The document does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Sector(s) / Stock(s) / Issuer(s) mentioned above are for the purpose of explanation and should not be construed as recommendation. The fund manager(s) may or may not choose to hold the stock mentioned, from time to time. Investors are requested to consult their financial, tax and other advisors before taking any investment decision(s). The information/ data herein alone are not sufficient and should not be used for the development or implementation of an investment strategy. The same should not be construed as investment advice to any party. The statements contained herein are based on our current views and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. Neither Edelweiss Asset Management Limited (Edelweiss AMC) and Edelweiss Mutual Fund (the Fund) nor any person connected with them, accepts any liability arising from the use of this document. Edelweiss Mutual Fund/AMC is not guaranteeing returns on investments made in this scheme. The recipient(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice and shall alone be fully responsible / liable for any decision taken on the basis of information contained herein. Past performance may not be sustained in the future.

Source: MSCI. The MSCI data is comprised of a custom index calculated by MSCI for, and as requested by, Edelweiss Asset Management. The MSCI data is for internal use only and may not be redistributed or used in connection with creating or offering any securities, financial products or indices. Neither MSCI nor any other third party involved in or related to compiling, computing or creating the MSCI data (the “MSCI parties”) makes any express or implied warranties or representations with respect to such data (or the results to be obtained by the use thereof), and the MSCI Parties hereby expressly disclaim all warranties of originality, accuracy, completeness, merchantability or fitness for a particular purpose with respect to such data. Without limiting any of the foregoing, in no event shall any of the MSCI Parties have any liability for any direct, indirect, special, punitive, consequential or any other damages (including lost profits) even if notified of the possibility of such damages.

EAML is amongst the fastest growing asset management companies, being an asset management subsidiary of Edelweiss Financial Services Ltd., one of Indias leading financial services group since last 21 years with a proven track record of quality and innovation. Edelweiss AML is present across 11 locations across the country. EAML offers a suite of differentiated asset management products and the unique knowledge proposition focusing on building a strong connect with Distributors and customers. At Edelweiss AMC, the aim is to come up with truly innovative ideas that doesnt exist today and bridge the gap between what investors want and what the industry has to offer.

Quick Links

Contact Us

- Toll Free : 1800 425 0090

- Non Toll Free : +91-40-23001181

- EMFHelp@edelweissfin.com

- distributor.amc@edelweissfin.com

POST A QUERY