Should you invest in Flexicap mutual Funds?

What are market capitalization segments?

Market capitalization typically tells us how much a company is worth. Market capitalization of a stock is the market price of the stock multiplied by the number of total outstanding shares. Stocks can be classified into different segments based on their market capitalization. According to SEBI, there are three market capitalization segments – large cap (top 100 stocks by market capitalization), midcap (101st to 250th stocks by market capitalization) and small cap (251st and smaller stocks market capitalization). Stocks in different market capitalizations segments have different risk profiles. Equity mutual funds are also categorized on the basis of the market cap segments they primarily invest in e.g. large cap, midcap, small cap fund etc.

What are Flexicap Funds?

Flexicap funds are diversified equity mutual fund schemes which can invest across market cap segments. There are no upper or lower limits with respect to allocations to any market cap segment. The fund managers of these schemes can invest any percentage of their assets in any market cap segment viz. large cap, midcap and small cap according to their market outlook.

Flexicap mutual funds category is one of the most popular equity mutual fund categories in India.

Difference between Flexicap and Multicap Funds

The term Flexicap Funds is relatively new. Equity schemes with flexible market cap mandates were previously known as Multicap Funds. In November 2020, SEBI introduced market segment wise limits for Multicap Funds to make them true to label. At the same time, SEBI introduced a new equity fund category called Flexicap Funds. Multicap Funds must invest at least 25% of their assets in large cap stocks, minimum 25% in midcap and minimum 25% in small cap stocks. Multicap Funds will have minimum 50% allocation to midcap and small caps.

Flexicap Funds, on the other hand, have no market cap limits, and therefore, it can have any percentage allocation to any market cap segment. It is important for you to understand clearly, the difference between these two fund categories and make informed investment decisions.

Why invest in Flexicap Funds?

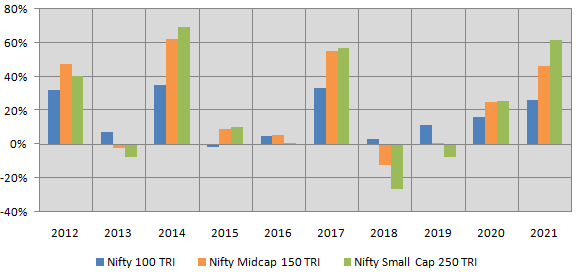

- Winners rotate across market cap segments: One market cap segment cannot keep outperforming or underperforming across all market conditions or investment cycles. Historical data shows that winners rotate across different market cap segments – see the chart below. Flexicap fund managers can generate risk adjusted returns by rotating allocations to different market cap segments based on their outlook.

![Historical data shows that winners rotate across different market cap segments Historical data shows that winners rotate across different market cap segments]()

Source: National Stock Exchange, Advisorkhoj Research (as on 31st December 2021). Nifty 100 TRI represents large cap, Nifty Midcap 150 TRI represents midcap and Nifty Small Cap 250 TRI represents small cap stocks. Disclaimer: Past performance may or may be sustained in the future.

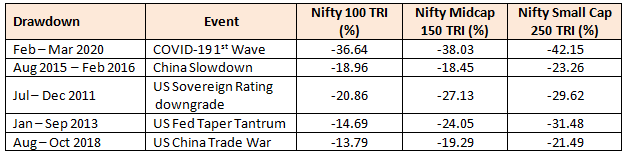

Suggested reading: How to build a resilient portfolio - Manage downside risks: The table below shows the 5 biggest drawdowns in the market in the last 10 years or so and the impact on various market capitalization segments. You can see that large caps are considerably less volatile than midcap and small cap stocks. The manager of a Flexicap Fund can prudently manage risks by shifting allocations between market cap segments based on their outlook.

![5 biggest drawdowns in the market in the last 10 years 5 biggest drawdowns in the market in the last 10 years]()

Source: National Stock Exchange, Advisorkhoj Research (as on 31st December 2021). Nifty 100 TRI represents large cap, Nifty Midcap 150 TRI represents midcap and Nifty Small Cap 250 TRI represents small cap stocks. Disclaimer: Past performance may or may be sustained in the future.

- Potential of generating alphas: Large cap stocks have high percentage of institutional ownership, are more researched and therefore, have better price discovery. Opportunities of alpha creationarehigher in midcaps and small caps, which are less researched compared to large cap stocks. The universe of midcap and small cap stocks is also much larger than large cap stocks. Flexicap fund managers may be able to find quality mid and small cap stocks at attractive valuations, thereby creating alphas for investors over long investment horizons.

- Higher liquidity than small / midcap funds: Since midcap and small cap companies usually have high percentage of promoter ownership, the percentage of free floating shares in these companies is much lesser than large caps. In extreme market conditions, liquidity may be an issue with midcap and small cap stocks. Large cap stocks, on the other hand, are traded in large volumes. The large cap allocation may support flexicap funds ensures reasonable liquidity to meet redemption pressures in difficult market condition.

Please read: Should you invest in midcap mutual funds - Ideal for investors: Diversification across different market cap segments can reduce unsystematic risks and generate risk adjusted returns. Flexicap Funds are ideal for investors who are not able to decide how much allocations they should have towards each market cap segments and want the fund managers to decide on market cap allocations.

You may like to read why is asset class diversification necessary when you invest?

Who should invest in Flexicap Funds?

- Investors who want capital appreciation over long investment horizon.

- Investors with high to very high risk appetites.

- Investors who have at least 5 years plus investment tenures.

- You can invest in these funds either in lump sum or SIP depending on your financial situation and investment needs.

Investors should consult with their financial advisors if Flexicap Funds are suitable for their investment needs.

Issued as an investor education initiative by HSBC Mutual Fund.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

We are a global asset manager with a strong heritage of successfully connecting our clients to global investment opportunities.

Our proven expertise in connecting the developed and developing world allows us to unlock sustainable investment opportunities for investors in all regions. Through a long-term commitment to our clients and a structured and disciplined investment approach, we deliver solutions to support their financial ambitions.

Other Links

POST A QUERY