SIP or Lumpsum: Which is a better option?

Introduction

Disciplined investing is essential for building wealth steadily over time. It involves consistently allocating funds toward investments, regardless of market fluctuations, which helps mitigate emotional decision-making. SIPs and lumpsum investments represent two distinct approaches to disciplined investing. SIPs involve regular, smaller contributions, while lumpsum investments are one-time investments in your chosen mutual fund schemes. Understanding these two ways of investing can help you plan better and keep you on track towards your financial goals.

What should investors use for investing?

Choosing between SIP and lumpsum depends on multiple personal and market factors.

- Investment horizon: Investors must consider their financial goals and investment horizon while choosing the lumpsum or SIP mode of investment. You need to have long investment horizon for SIP. On the other hand, if your investment horizon is short, then lump sum can be the choice. However, there is no guarantee on the returns of the scheme.

- Financial situation: To invest in lump sum you need to have sufficient investible funds. On the other hand, you can invest through SIPs at regular investments from your savings.

- Market conditions: SIPs can be suitable across all market conditions. Lump sum investments can be more suitable in certain market conditions e.g. market dips, market bottoms etc. because you can get the advantage of low prices. However, if you have long investment horizons both lump sum and SIP can be suitable across all market conditions.

Why SIP (Systematic Investment Plan)?

SIP involves investing a fixed amount periodically, making it an accessible and disciplined way to build long term wealth. Its popularity stems from its ability to create wealth over long investment horizon by investing in a disciplined way from your regular savings.

Key features of SIP

- Power of compounding: Returns earned are reinvested, accelerating wealth growth over long time. The magic of compounding investment can aim to grow your wealth over the long term with the small contributions.

- Rupee cost averaging: By investing regularly, investors buy more units when prices are low and fewer when prices are high, reducing the impact of market volatility.

- Encourages discipline: Regular contributions foster a savings habit and consistency in investment.

- Suitable for young / first time investors: Suitable for salaried individuals and those with limited investible surplus, as small amounts can be invested.

When should lump sum be considered?

Lumpsum investing is ideal when investors have a significant amount of capital available, such as from bonuses, inheritance, or accumulated savings, etc. It allows for immediate deployment of funds, thereby preventing from unnecessary splurging.

Key advantages of lumpsum

- Windfall deployment: Ideal for investors who have windfall gains like bonus, or inheritance, or availability of large funds.

- Market timing: Allows entry at potentially opportune moments, such as during market corrections, etc.

Risks and limitations

- Higher volatility: Lump sum investments made near market peaks can be likely to be more volatile compared to SIPs.

- Knowledge and experienced required: More suited for experienced investors with higher risk appetite and awareness of market cycles.

How are SIP and lumpsum Inter-related?

SIP and lumpsum are complementary strategies for achieving your financial goals. You can invest in the same mutual fund scheme from your regular monthly savings through SIP, while contributing lumpsum amounts tactically, such as during market dips or after receiving windfall cash flows e.g. bonus, asset sales proceeds, inheritances etc. This blended approach balances the benefits of rupee cost averaging with the potential for long term returns through strategic timing.

Dealing with different market scenarios

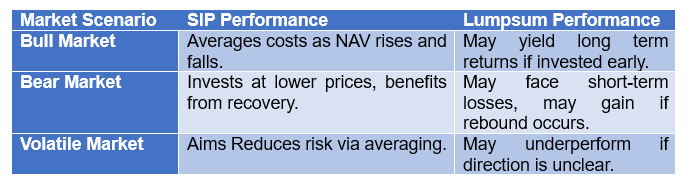

In bull markets, lumpsum investments can capitalize on rising prices, while SIPs help average out costs for investors as prices rise and fall. During bear markets, SIPs benefit from investing at lower prices, positioning investors for future recovery, whereas lumpsum investments may temporarily decline but gain if markets rebound. In volatile markets, SIPs aim to reduce risk through regular investing.

Conclusion

There is no universally accepted superior investment method; or the answer to whether SIP or lumpsum is better. The optimal choice depends on individual circumstances, financial goals, risk tolerance, investment horizon and market outlook. For most investors, a blended approach - combining the regularity of SIP with the strategic deployment of lumpsum funds - cam offer the path to long term wealth creation This blended strategy can balance risk and return potential, promotes disciplined investing, and adapts to market dynamics, ultimately supporting more effective wealth creation over the long term.

An Investor Education and Awareness Initiative by HSBC Mutual Fund

Visit https://www.assetmanagement.hsbc.co.in/en/mutual-funds/investor-resources/information-library/know-your-customer w.r.t. one-time Know Your Customer (KYC) process, complaints redressal process including SEBI SCORES (https://www.scores.gov.in). Investors should only deal with Registered Mutual Funds, to be verified on SEBI website under Intermediaries/Market Infrastructure Institutions (https://www.sebi.gov.in/intermediaries.html). Investors may refer to the section on Investor Education on the website of HSBC Mutual Fund for the details on all Investor Education and Awareness Initiatives undertaken by HSBC Mutual Fund.

Document intended for distribution in Indian jurisdiction only and not for outside India or to NRIs. HSBC MF will not be liable for any breach if accessed by anyone outside India. For more details, Click here / refer website.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

CL 3032

We are a global asset manager with a strong heritage of successfully connecting our clients to global investment opportunities.

Our proven expertise in connecting the developed and developing world allows us to unlock sustainable investment opportunities for investors in all regions. Through a long-term commitment to our clients and a structured and disciplined investment approach, we deliver solutions to support their financial ambitions.

Other Links

POST A QUERY