What to do with windfall gains?

There are times when you get unexpected wealth. It can come from sale of your ancestral property, settlement of some legal dispute, getting a large signing bonus on joining a new company, a much larger than expected annual bonus or stock options etc. A large unexpected cash-flow is known in financial parlance as windfall gains. What should you do with such gains?

Avoid splurging it on luxury items

Windfall gains will cause an overload of income and sudden adrenaline rush. There may be an urge to spend your windfalls gains on some luxuries you desire e.g. a new vehicle, diamonds, gold jewellery, expensive watch etc. It is fine to celebrate your windfall gains with your family and close friends, but resist the urge of spending a large part of your windfalls on discretionary spends such as entertainment and luxury goods. While entertainment and luxury spending makes you feel good for some time, it could be a wasteful expenditure in the long term in case if you already have debt or do not have sufficient savings or if you have not planned for adequate savings for future. Think about your short term, medium term and long term financial priorities and plan accordingly.

Repay your loans and become debt free

If you have outstanding loans then use your windfall gains to repay the loan partly or fully. By repaying your loan you will be reducing your interest burden. You may have multiple loans e.g. credit card, personal loans, EMI for purchase of consumer durables (e.g.household appliances, mobile phones etc.), vehicle loans, home loan etc. Which loan should you repay first?

Start with the loan where you are paying the highest rate of interest. Pay your credit card outstanding balance; usually the interest rate is highest on credit cards. If you have a personal loan, try to repay that in part or full. Since personal loans are unsecured loans, you pay a high interest rate on these loans. If you are paying EMIs on purchase of consumer durables, check with the seller if you can reduce your cost by pre-paying the outstanding.

Between vehicle loans and home loans, you should prioritize vehicle loans because interest rates on vehicle loans are usually higher. Your vehicle is a depreciating asset, while your home is an appreciating asset. Furthermore, you get tax benefits on home loan EMI payments, whereas there are no tax benefits on vehicle loan EMIs.

Should you pre-pay your home loan or invest in mutual funds?

This is not a straightforward decision. There are several factors that you should consider and make informed decision on whether to invest your windfalls gains or pre-pay your home loans.

- What is interest rate on your home loan? Can you get your loan refinanced at lower rates?

- How much annualized returns you can get from your investments?

- How much tax savings under Section 24 are you getting on interest payments in your EMIs?

- What is balance tenure of your home loan?

- What are your financial goals and their timelines?

You should consider all these factors and discuss with your tax consultant and financial advisor, to make informed investment decisions.

Save and invest your windfall gains judiciously

You should try to save a portion of your windfall gain to build a corpus in the long term. Try to save as much as you can because the more you can save, the bigger will be your corpus. Saving your windfalls gain is not enough; you should invest your savings to create wealth. You get returns (profits) when you invest. The returns when re-invested get you even higher returns. This is known as the power of compounding.

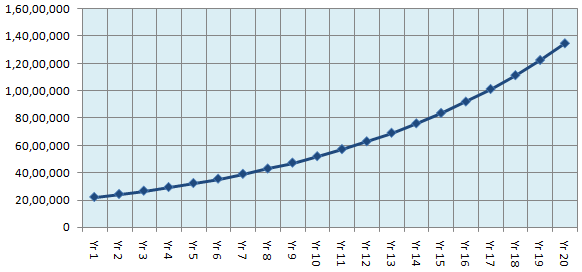

Let us assume you got Rs 25 lakhs as part of your share from the sale of your ancestral property. Out of windfall gain, you spend Rs 5 lakh to repay your high cost debt. The chart below shows, how much wealth you can potentially create over 20 years horizon, by investing your saving of Rs 20 lakh in an equity mutual fund, assuming the fund gives an annualized return of 10%. You can see your wealth growing exponentially over time due to compounding.

The chart above is purely illustrative for investor education purposes. Mutual fund investments are subject to market risks, read all scheme-related documents carefully. Past performance may or may not sustain and doesn’t guarantee the future performance

How to invest windfall gains?

Depending on market conditions, you can invest your windfall gains either in lump sum or through Systematic Transfer Plan (STP) if you expect the market to be volatile and NAVs to correct in the near term. Through STP, you can take the advantage of market volatility through Rupee Cost Averaging of purchase NAVs. You should always invest according to your risk appetite and have long investment horizon; consult with your financial advisor if you need any help.

Invest through SIPs for your long term financial goals

You should remember that windfall gain is just a one-time event. You cannot rely on windfall gains for your financial planning. You should invest from your regular savings through mutual fund systematic investment plans (SIPs) for your long term financial goals e.g. retirement planning, children’s higher education, children’s marriage, wealth creation etc. With SIPs, you can start investing from a young age with relatively small investments and create wealth over long investment tenures through the power of compounding. As your income grows, you should increase your SIP investments by using the SIP Top-up facility to create more wealth or reach your financial goals. Getting windfall gains should have no impact on your regular or top-up SIPs. You should remain disciplined in your investments.

Conclusion

Windfall gains come as a very pleasant surprise, but you should not go overboard and splurge your gains in wasteful expenditure. Instead you should use it judiciously to repay your high cost debt(loans) and save as much as possible to create a corpus for you. At the same time, you should remain disciplined and invest through SIPs for your long term financial goals. You should consult with financial advisor if you need help in investing your windfall gains.

Disclaimer

This document is for information purposes only and should not be construed as i) an offer or recommendation to buy or sell securities, commodities, currencies or other investments referred to herein; or ii) an offer to sell or a solicitation or an offer for purchase of any of the funds; or iii) an investment research or investment advice. It does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. Investors should seek personal and independent advice regarding the appropriateness of investing in any of the funds, securities, other investment or investment strategies that may have been discussed or referred herein and should understand that the views regarding future prospects may or may not be realized. In no event shall the Mutual Fundand / or its affiliates or any of their directors, trustees, officers and employees be liable for any direct, indirect, special, incidental or consequential damages arising out of the use of information / opinion herein.

Issued as an investor education initiative by HSBC Mutual Fund.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

We are a global asset manager with a strong heritage of successfully connecting our clients to global investment opportunities.

Our proven expertise in connecting the developed and developing world allows us to unlock sustainable investment opportunities for investors in all regions. Through a long-term commitment to our clients and a structured and disciplined investment approach, we deliver solutions to support their financial ambitions.

Other Links

POST A QUERY