At Edelweiss AMC the aim is to come up with truly innovative ideas that does not exist today

BFSI Industry Interview

Radhika is an asset management professional with global and India experience across both asset classes, investor segments, and investment management and distribution. She started her career at McKinsey & Company, and then was a hedge fund manager with AQR Capital, one of the world’s most prominent systematic asset managers. She then moved to India to start Forefront Capital Management, an alternative asset management firm in India, which was acquired by Edelweiss in 2014. She built one of India’s most prominent public market alternatives businesses at Edelweiss, and also led Edelweiss’s acquisition of JP Morgan’s Mutual Fund business and Ambit Capital’s AIF business in 2016. From 2017, Radhika has been the CEO of Edelweiss Asset Management.

Radhika is a graduate of the Management and Technology Program at the University of Pennsylvania, with joint degrees in Economics from the Wharton School and Computer Science Engineering from the Moore School. She is the founding President of the University of Pennsylvania Alumni Club, a member of the Global Leadership Council of the Management and Technology Program, and a Board Member of the Association of Mutual Funds of India (AMFI). Radhika is a global citizen who has grown up across 4 continents, a TEDx speaker, and a keen bridge player.

At the outset accept our heartiest Congratulations for coming with this one-of-its kind NFO – Edelweiss Maiden Opportunities Fund – Series 1. Our readers would like to know what is unique about this NFO?

At Edelweiss AMC, the aim is to come up with truly innovative ideas that doesn’t exist today and bridge the gap between what investors want and what the industry has to offer. This fund is first-of-its-kind in the industry that intends to follow a disciplined approach while investing in recent and upcoming listings. The aim is to make investing in such maiden ideas accessible and simpler for retail investors.

We saw huge number of IPOs hit the market in the year 2017. Do you see opportunities still exist in this space? Do you really see some good companies going public this year on or so? Also, how many IPOs are expected this calendar year?

Our analysis suggests that the IPO markets will likely surpass last year’s capital raise in 2018. Our current estimates indicate that we would at least be at 2017 levels in terms of IPO capital raise value and volume.

We expect IPO activity in the range of INR 70,000 – 75,000 crore with an upward bias if the markets continue to be supportive. The trend towards larger IPOs will continue, and there will be broader industry participation than that seen in 2017 as new sectors come to market.

Markets are at all time-high, do not you think the IPO valuations will not be cheap. Will there still be room for retail investors to make profit from these IPOs?

Positive earnings momentum is what drives the companies to IPO market. This positive momentum encompasses better earning visibility, optimism in relation to its prospective products or future prospects. The companies with positive earning momentum over next three years demand premium while getting listed. Such fundamentally strong companies with supportive business environment, will perform well in long term, irrespective of the market cycle we are into.

Currently markets are at new highs but we are still far away from the peak and we expect some healthy returns in coming time. Further, the activity in 2018 could see a rush as companies might look to advance their IPOs in light of the general elections in 2019.

Why the NFO a close ended scheme?

IPO activity remains buoyant during years when equity market and economy is doing well

This theme is cyclical in nature. A close ended fund will be able to capture this theme and time the exit in a better way as compared to an open-ended fund. A closed-ended fund gives better predictability and holding capacity to the fund manager – Best suited for a theme like IPO investing.

A small size close ended fund can participate in IPO efficiently given the higher exposure.

Source: Bloomberg

Will the NFO invest in IPOs of few particular sectors or will it be more like a diversified equity fund?

Since the fund will be investing in recently listed stocks and will be sector agnostic in its approach, the sectoral exposure will be very different from traditional MFs. Some of the features encompass:

- Portfolio will be constructed by analysing companies by using a process driven approach.

- The stock weights will be in the range of 1% to 4% at the time of entry depending upon the quality of business, valuations and cyclicality of the sector.

- The fund will hold on an average 20 to 30 stocks.

- Holding period in such stocks will be in 18 to 24 months range depending on the qualitative aspects.

What is your investment strategy for Edelweiss Maiden Opportunities Fund?

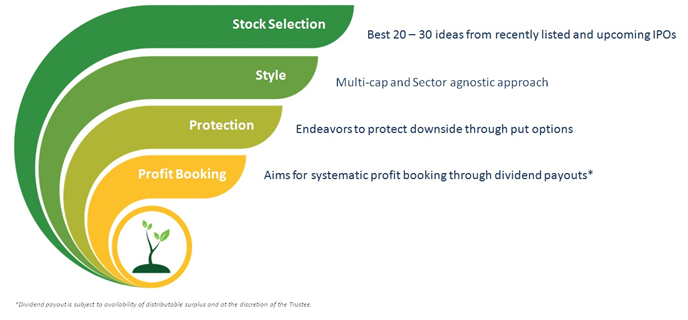

The portfolio will predominantly invest in maiden ideas from recently listed universe and some portion shall be invested in upcoming listings to capture listing and future potential gains. Further, the fund endeavours to protect downside risk by hedging through long dated put options. Further, it follows systematic profit booking through dividend payout.

2017 was a terrific year for equity investors. Do you expect the bull market to continue in 2018? What are some of the factors that will drive the market forward in 2018?

2018 has been off to a dream start and the cycle is expected to remain bullish. Over the next three years, equities are geared to deliver decent returns. Earnings growth will be one of the important catalysts. Earnings were good last two quarters and are expected to remain healthy going into 2018. The bottom of earning is behind us and going forward, there will not be very few earning draggers.

Over the past one year or so, we are seeing quite a few financial advisors and certified financial planners advising asset allocation strategies to their clients. There can be multiple views on this topic. Some think that a goal based asset allocation strategy is simple and most effective, while others recommend a market (P/E, P/BV etc.) based asset allocation strategy. As an investment expert, please share your views on this, for the benefit of retail investors among Advisorkhoj.com readers?

There are two asset allocation strategies: Strategic and Tactical. Strategic asset allocation is often a goal based strategy which encompasses setting target allocations and then periodically rebalancing the portfolio back to those targets. Tactical asset allocation is a dynamic investment strategy that actively adjusts a portfolio's asset allocation as per market dynamics. So out of two, tactical asset allocation is more active investment strategy as it can move to the higher end of the range when stocks are expected to do better and to the lower end when the economic outlook is bleak.

What AMCs offer is tactical asset allocation funds based on market trends and valuation. Such funds warrant some allocation in everyone’s portfolio as it gives stability and better investment experience during volatile markets. Also such funds are good investment option for a conservative investor who wants to participate in equities, but with some caution.

What is your advice for the retail Mutual Fund Investors? What they should do now and how to invest in the current market situation?

We are in the midst of a long-running bull market that is far away from its momentous peak. Investors can go for equity mutual funds to participate in this momentum. One way to do it is rebalancing your allocations. For investors who are over invested in mutual funds can continue with their long orientation to participate in the subsequent growth. For investors who are under-invested in equities can increase their allocation through SIPs and investment in asset allocation funds to participate in India’s growth story.

Disclaimer: Ms. Radhika Gupta is the Chief Executive Officer of Edelweiss Asset Management Limited (EAML) and the views express above are her own.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY

Recent Interviews

-

Partner Connect by Advisorkhoj with Mr Ajay Sehgal from Allegiance Financial

Jan 13, 2026

-

In conversation with Mr Pratik Oswal Chief of Passive Business of Motilal Oswal MF

Jan 6, 2026

-

In conversation with Mr Nilesh Jethani Fund Manager Equity with Bank of India Mutual Fund

Jan 6, 2026

-

Partner Connect by Advisorkhoj with Mr Amit Kalra Glorious Path Pvt Ltd New Delhi

Dec 5, 2025

-

Partner Connect by Advisorkhoj with Mr Alok Dubey PrimeWealth Pune

Dec 1, 2025

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team