Kotak Dividend Yield Fund: A promising fund to balance income and growth

Kotak MF has launched a new fund offer (NFO), Kotak Dividend Yield Fund. The scheme will predominantly investing in dividend yielding stocks. The Scheme will consider dividend yielding stocks which have paid dividend (or done a buyback) in at least one of the three preceding financial years. The NFO opened for subscription on 5th January 2026 and will close on 22nd January 2026.

Characteristics of dividend paying companies

- Established Sector Leaders: Long-standing and stable businesses with strong competitive edge and pricing power

- Strong free cash flows: Businesses that can generate regular cash flows from core operations

- Disciplined payouts: Companies that share profits regularly with shareholders instead of reinvesting everything.

- Lower volatility: These companies tend to be more stable during market downturns

Why invest in high dividend yield stocks?

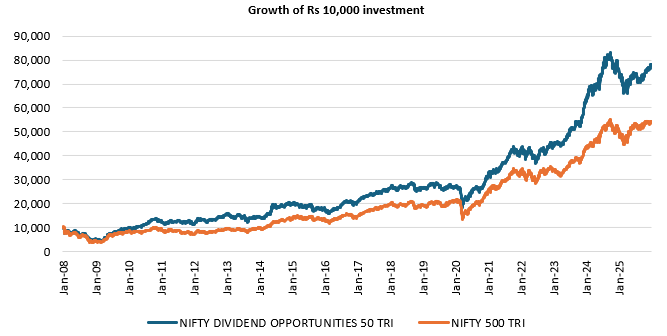

- Wealth creation potential in the long term: The chart below shows the growth of Rs 10,000 investment in Nifty Dividend Opportunities 50 TRI versus the broad market index, Nifty 500 TRI from 31st December 2007. You can see that the dividend opportunities index gave higher capital appreciation compared to the broad market index.

Source: NSE, Advisorkhoj Research, as on 31st December 2025

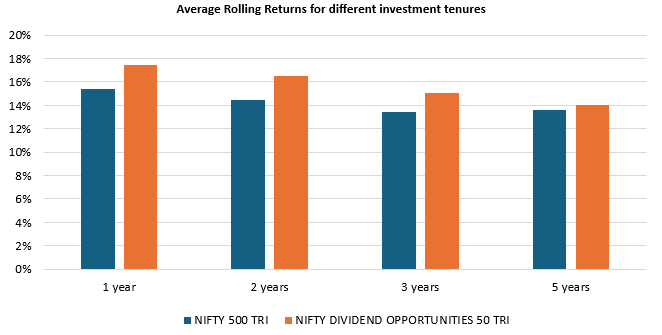

- Higher performance consistency across market conditions: The chart below shows the average rolling returns of Nifty Dividend Opportunities 50 TRI versus the broad market index, Nifty 500 TRI for different investment tenures from 31st December 2007. You can see that the dividend opportunities index gave higher average rolling returns than the broad market index, across different investment tenures.

Source: NSE, Advisorkhoj Research, as on 31st December 2025

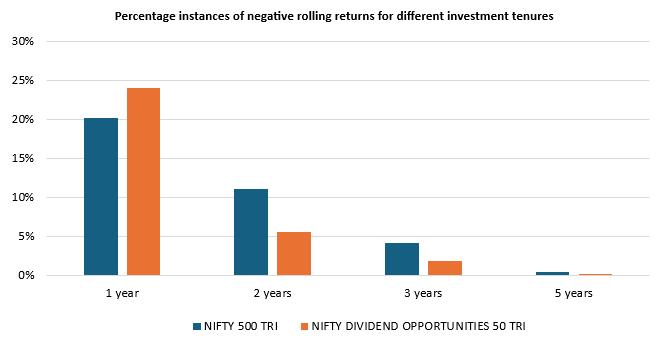

- More stable investment experience: The chart below shows the percentage instances of negative rolling returns of Nifty Dividend Opportunities 50 TRI versus the broad market index, Nifty 500 TRI for different investment tenures from 31st December 2007. You can see that the dividend opportunities index had lesser instances of negative returns compared to the broad market index over 2, 3 and 5 year investment tenures across different market conditions.

Source: NSE, Advisorkhoj Research, as on 31st December 2025

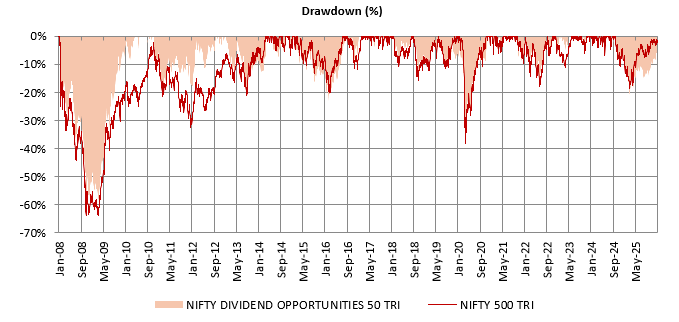

- Smaller drawdowns: The chart below shows drawdowns of Nifty Dividend Opportunities 50 TRI versus the broad market index, Nifty 500 TRI from 31st December 2007. You can see that the dividend opportunities index generally had smaller drawdowns compared to the broad market index.

Source: NSE, Advisorkhoj Research, as on 31st December 2025

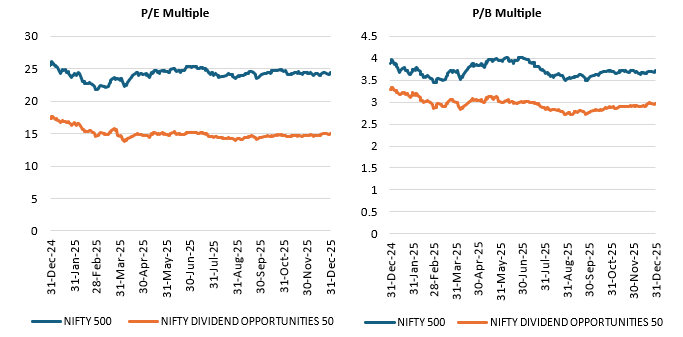

- Valuations are reasonable: Price earnings and price to book multiples of dividend opportunities index are much more reasonable than the broad market index.

Source: NSE, Advisorkhoj Research, as on 31st December 2025

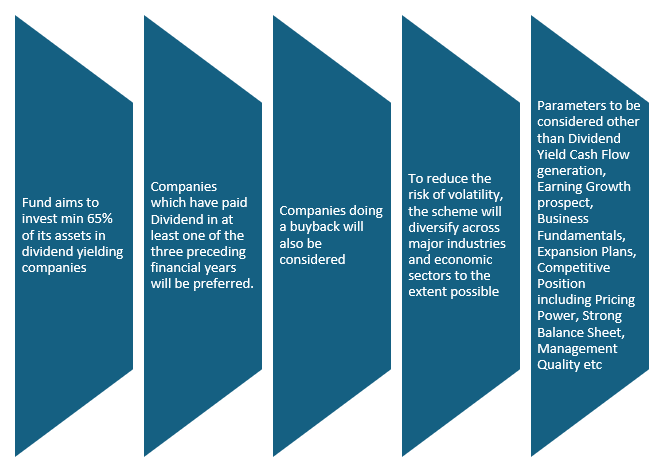

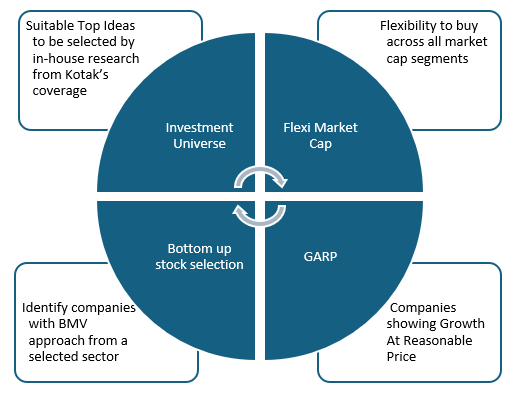

Kotak Dividend Yield Fund investment strategy

Portfolio Construct

Why invest in Kotak Dividend Yield Fund?

- One-Stop Investment Solution combines dividend income, capital appreciation and value investing in a single strategy

- Growth Potential: Exposure to undervalued stocks with upside potential

- Balanced Risk: While lower-valued companies may carry downside risk, the diversified approach helps manage volatility

- Portfolio Diversification: Adds sectoral breadth and style variation to your equity allocation

Who can Invest in Kotak Dividend Yield Fund ?

- Investor seeking professional help in choosing high quality, well-established companies with consistent dividend history

- Investors seeking income from mature businesses along with equity market participation

- Investors looking for a portfolio that invests across diversified sectors to mitigate risk

- Medium- to long-term investors aiming for a balance of income and growth. Investors need to have minimum 5 year investment horizon for this fund

Investors should consult their financial advisors or mutual fund distributors if Kotak Dividend Yield Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Established in 1985 by Mr. Uday Kotak, it was the first Indian non-banking financial company to be given a banking licence by the Reserve Bank of India in February 2003.The group caters to the financial needs of individuals and institutional investors across the globe. Kotak Mutual Fund is the wholly-owned subsidiary of Kotak Mahindra Bank Limited. Kotak Mutual Fund started its operations in December 1998 and is now the 5th largest AMC based on quarterly Average AUM as of December 2020.

Investor Centre

Follow Kotak MF

More About Kotak MF

POST A QUERY