Kotak Healthcare Fund NFO

Kotak MF will shortly be launching Kotak Healthcare Fund NFO later this month. Kotak Healthcare Fund is an open ended thematic equity scheme which will invest in Pharmaceuticals, Healthcare and allied sectors. The NFO will open from subscription on November 20th 2023 and close on December 4th 2023. In this article, we will review this NFO.

India’s Healthcare Industry - Strengths

- The Indian pharmaceutical industry is the third largest in the World in terms of volume. India exports pharmaceutical supplies to 200+ countries, producing 60% of the world’s vaccine supplies and 20% of the world’s generic drugs supply (source: Kotak MF).

- India is the largest exporter of generic drugs in the world accounting for 40% of US needs and 50% of Africa’s needs (source: Kotak MF).

- India is the 3rd largest Active Pharmaceuticals Ingredients (APIs) producer in the world accounting for 8% share of the global API industry. There is huge growth potential in the API segment as the pharma industry looks to lessen its China dependence for APIs (source: Kotak MF).

- The healthcare ecosystem in India is growing at a faster rate than developed economies. From 2014 to 2023, the number of medical colleges from 387 to 689 and the number of MBBS seats doubled to more than 1 lakh. India has the highest number of doctors working abroad (source: Kotak MF).

- Medical tourism is growing in India due to low cost of medical services. Medical tourists visiting India have grown from around 1 lakh in 2009 to 6.5 lakhs in 2023 (source: Kotak MF).

- The Government has been working towards providing a favourable investment environment through FDI policy reforms, PLIs and other policies including PMJAY, the world’s largest healthcare scheme (source: National Health Authority, Government of India)

India’s Healthcare Industry –Opportunities

- World’s population is ageing. By 2030, more than 15% of the world’s population will be in the 65+ age-group. The average per capita healthcare spending in the 65 – 84 age-group is 70% higher than the healthcare spending in the 45 – 64 age-group (source: Kotak MF).

- Global R&D spend in pharmaceuticals will increase from $262B to $302B. Higher R&D spending can lead to outsourcing opportunities for Indian pharma companies (source: Kotak MF).

- Medical tourists to India can grow to 30 lakhs by 2030 (up from 6.5 lakhs in 2023) primarily due to affordability and quality of treatment (source: Kotak MF).

- The domestic pharma market size currently at around $55B is expected to grow to $132B by 2032 (source: IMARC)

- India ranks low in healthcare spending as a percentage of GDP and hospital penetration to developed economies and even some emerging markets. There is immense scope of improving healthcare infrastructure in India (source: Kotak MF).

- The Diagnostic services industry in India is highly fragmented. Nearly half of the diagnostic services in India comprises of standalone centres. Shift from standalone centres to chain will lead to industry consolidation, growth and higher shareholder value (source: Kotak MF).

- The per capita healthcare spending increases exponentially as GDP per capita increases. India’s per capita spending on healthcare is currently low compared to developed markets. But it can see a significant jump in the medium to long term as our per capita income increases (source: Kotak MF).

- Government’s policies are likely to boost the healthcare sector in the medium to long term. The budgetary allocation to the health sector for FY 2023-24 was Rs 89,155 crore, a hike of around 13% as against Rs 79,145 crore allocated in FY 2022-23 (source: Union Budget 2023-24). Pradhan Mantri Jan Arogya Yojana (PMJAY) is a big step towards universal health coverage in India.

Healthcare is much more than just Pharma

Investors usually think of the just the Pharma sector as part of Healthcare investments. While Pharma is an important component of the healthcare theme, the theme itself is much broader covering hospitals, diagnostic centres, biotechnology, medical equipment and health insurance.

Healthcare as an investment theme

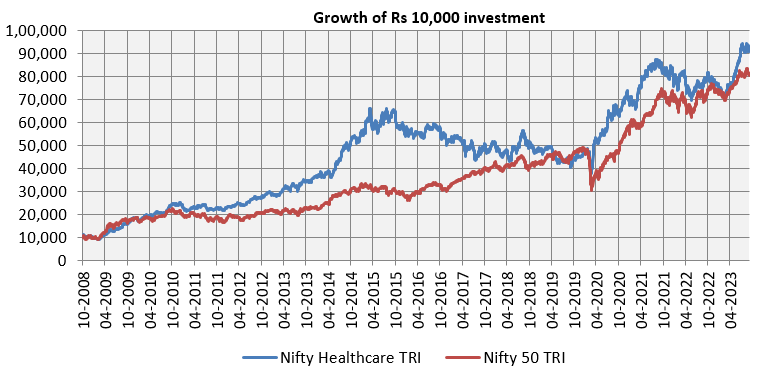

Nifty Healthcare TRI has outperformed the broad market index Nifty 50 TRI over the last 15 years (see the chart below). You can see that the Healthcare index underperformed from 2015 to 2019 due the US price erosions, but outperformed in the aftermath of the COVID-19 pandemic. In the last 15 years Nifty Healthcare TRI gave 15.7% CAGR return versus 14.8% CAGR for the Nifty.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st October 2023

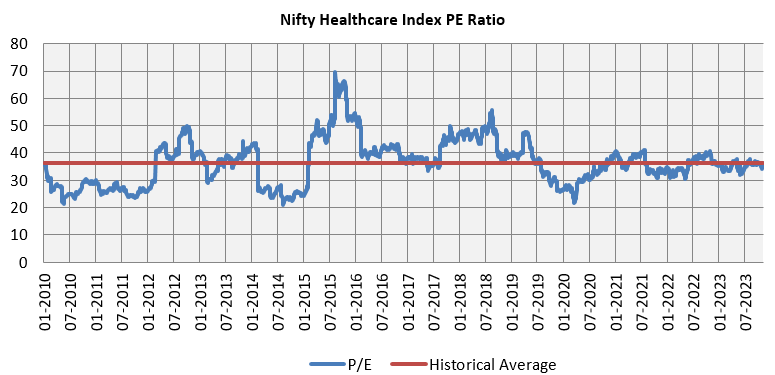

We have shown the PE ratios of the Nifty Healthcare Index from 1st January 2010 to 31st October 2023. You can see that the Healthcare Index is currently trading slightly below (34.2) the long term historical average PE (36.4).

Source: National Stock Exchange, Advisorkhoj Research, as on 31st October 2023

Investment strategy of Kotak Healthcare Fund

Why invest in Kotak Healthcare Fund?

Who should invest in Kotak Healthcare Fund?

- Investors willing to have Tactical Allocation to overall equity portfolio

- Investors looking for capital appreciation over long investment tenures from Healthcare theme

- Investors with high to very high risk appetites

- Investors with minimum 5 year investment tenures

- You can invest either in lump sum and SIP depending on your investment needs.

Investors should consult with their financial advisors or mutual fund distributors if Kotak Healthcare Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Established in 1985 by Mr. Uday Kotak, it was the first Indian non-banking financial company to be given a banking licence by the Reserve Bank of India in February 2003.The group caters to the financial needs of individuals and institutional investors across the globe. Kotak Mutual Fund is the wholly-owned subsidiary of Kotak Mahindra Bank Limited. Kotak Mutual Fund started its operations in December 1998 and is now the 5th largest AMC based on quarterly Average AUM as of December 2020.

Investor Centre

Follow Kotak MF

More About Kotak MF

POST A QUERY