Kotak Multicap Fund: Outstanding track record of outperformance

Market scenario

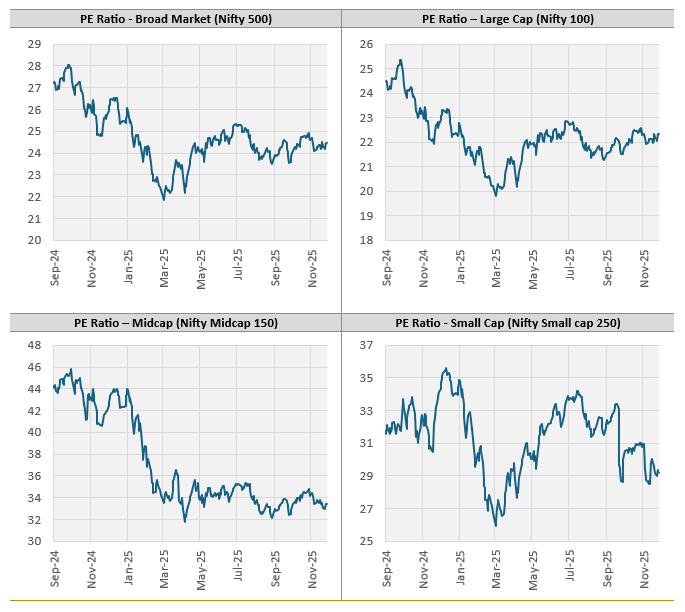

The Nifty 50 index made it to its all time high towards the end of November and has since then retreated for higher levels due to profit booking. The Nifty 50 index clocked gains after RBI cut repo rate by 25 bps but the rally was short-lived. Despite Q2 GDP growth at 8.2% exceeding expectations, the market scenario is facing headwinds due to weakening INR (INR depreciation) and uncertainty about the outcome of Indo US Trade talks. On the macro front, strong GDP growth on the back of consumption recovery, fiscal consolidation and low / stable inflation provides a strong base for Indian equities in the medium to long term. Despite the rally in the market, valuations across different market cap segments are below their peak valuations in 2024 (see the graphic below). In the current market cap scenario, multicap strategy can be suitable for investors with long investment horizons

Source: NSE, as on 30th November 2025

About Kotak Multicap Fund

Kotak Multicap Fund has completed 4 years since its launch. The fund has a strong track record of outperformance against its benchmark index, as well as its peer funds. The fund aims to invest in the right mix of large-cap, mid-cap, and small-cap stocks that work together as a dream team to create winning opportunities. The fund invests in Sectoral leaders, with a special emphasis of investing in companies that are likely to deliver higher earnings growth than the respective industry in the coming years.

Outperformed the benchmark index

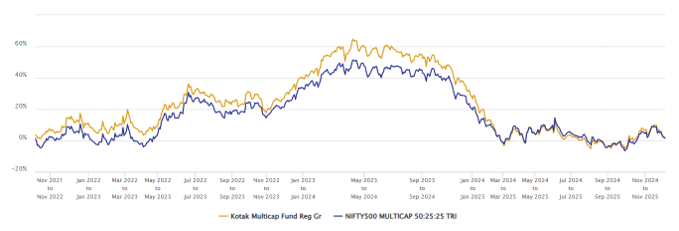

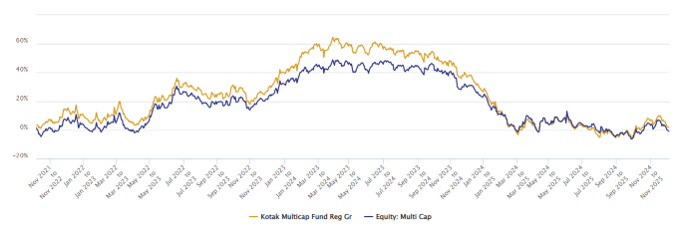

The chart below shows the 1 year rolling returns of Kotak Multicap Fund versus its benchmark index since the inception of the fund. You can see that the fund consistently outperformed the benchmark index

Source: Advisorkhoj Research, as on 8th December 2025

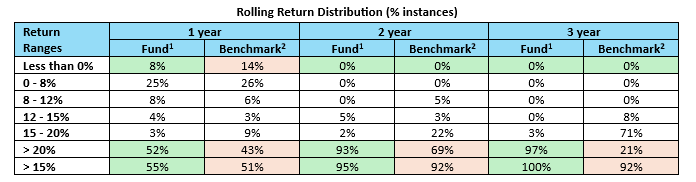

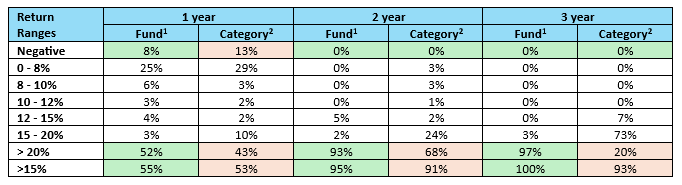

The fund was able to provide better risk / return trade off to investors by having lesser instances of negative returns relative to the benchmark, while delivering to investors more instances of 15%+ and 20%+ CAGR returns respectively compared to the benchmark index (see the table below).

Source: Advisorkhoj Research, as on 8th December 2025. 1) Kotak Multicap Fund 2) Nifty 500 Multicap 50:25:25 TRI

Outperformed the category average

The chart below shows the 1 year rolling returns of Kotak Multicap Fund versus its multicap funds category average since the inception of the fund. You can see that the fund consistently outperformed the category average across different market conditions.

Source: Advisorkhoj Research, as on 8th December 2025

The fund was able to provide better risk / return trade off to investors versus the multicap funds category by having lesser instances of negative returns relative to the category average, while delivering to investors more instances of 15%+ and 20%+ CAGR returns respectively compared to the category average (see the table below).

Source: Advisorkhoj Research, as on 8th December 2025. 1) Kotak Multicap Fund 2) Multicap Funds category average

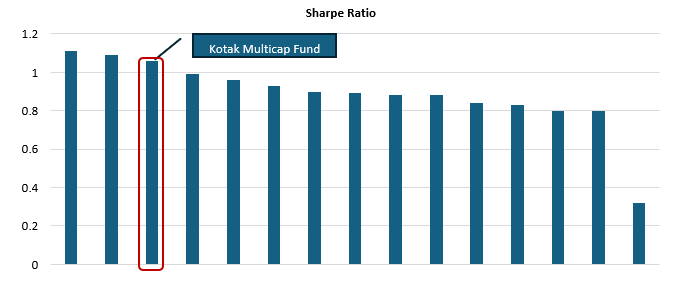

Superior risk adjusted returns

Sharpe ratio is a measure of risk adjusted returns of a mutual fund scheme. We compared the Sharpe ratios of all the multicap funds that have minimum three years of performance track record (see the chart below). Kotak Multicap Fund marked in red, was able to deliver higher Sharpe Ratios compared to most multicap funds.

Source: Advisorkhoj Research, as on 30th November 2025

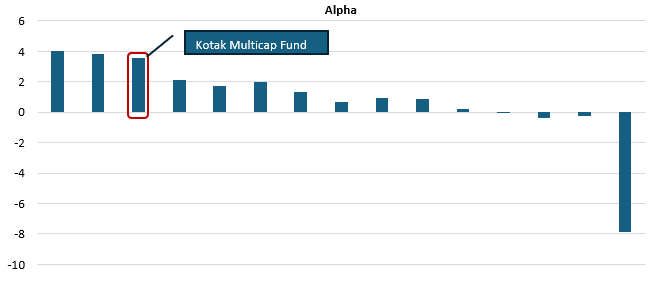

Higher alphas

Alpha is a measure of outperformance of a mutual fund scheme versus its benchmark index, taking into account the systematic risk of the fund versus the benchmark i.e. Beta. Alpha is considered to the gold standard of mutual fund performance. We compared the Alphas of all the multicap funds that have minimum three years of performance track record (see the chart below). Kotak Multicap Fund marked in red, was able to deliver higher alphas compared to most multicap funds.

Source: Advisorkhoj Research, as on 30th November 2025

Consistently ranked in the Top 2 quartiles

Kotak Multicap Fund was ranked in the top 2 quartiles 8 times in the last 12 quarters, including 5 times in the top quartile.

Source: Advisorkhoj Research, as on 30th September 2025

SIP Returns

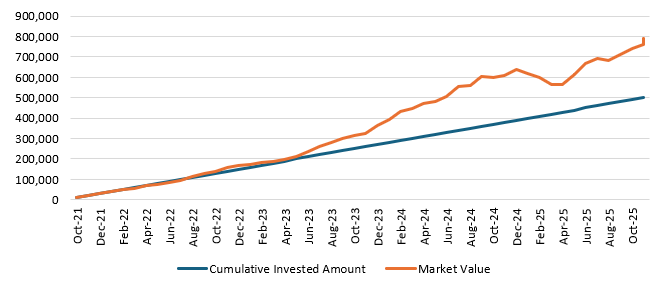

The chart below shows the growth of Rs 10,000 monthly SIP in Kotak Multicap Fund since the inception of the scheme. With the cumulative investment of Rs 5.1 lakhs, you could have accumulated a corpus if Rs 7.9 lakhs (as on 28th November 2025.

Source: Advisorkhoj, as on 28th November 2025

Investment strategy

- The fund managers expect the growth trajectory for domestic-oriented businesses to be more resilient than those with global linkages.

- The investment focus is on stocks with a high earnings visibility going ahead. There are select pockets across industries where the earnings growth is pretty robust, and the market is rewarding those.

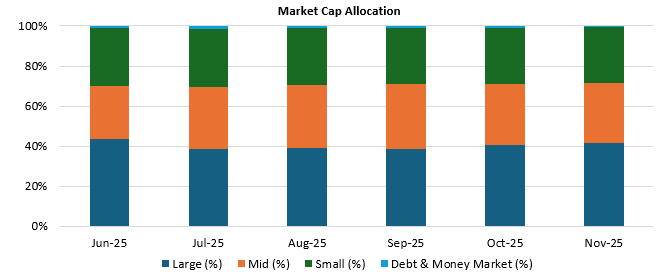

- The fund is maintaining its market cap weights for now with incremental money going more in large caps (see the chart below).

Source: Kotak MF, as on 30th November 2025

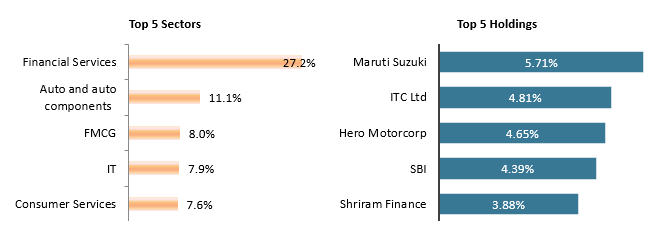

Current portfolio positioning

Source: Kotak MF, as on 30th November 2025

Who can find Kotak Multicap Fund suitable?

- Investors seeking capital appreciation and wealth creation over long investment tenures

- Investors who want diversified exposure in all market cap segments in a single fund

- Investors with very high risk appetites

- Investors with minimum 5 year investment horizon

Investors should consult with their financial advisors or mutual fund distributors if Kotak Multicap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Established in 1985 by Mr. Uday Kotak, it was the first Indian non-banking financial company to be given a banking licence by the Reserve Bank of India in February 2003.The group caters to the financial needs of individuals and institutional investors across the globe. Kotak Mutual Fund is the wholly-owned subsidiary of Kotak Mahindra Bank Limited. Kotak Mutual Fund started its operations in December 1998 and is now the 5th largest AMC based on quarterly Average AUM as of December 2020.

Investor Centre

Follow Kotak MF

More About Kotak MF

POST A QUERY