A smart mutual fund option for regular cash flows needs: Systematic Withdrawal Plan

An analysis of traffic to different sections (articles and different mutual fund research tools) of our website, advisorkhoj.com, provides us several interesting insights on investor preferences. Over a last couple of years we have seen a lot of interest in dividend paying mutual funds, particularly hybrid funds (formerly also known as balanced funds). With bank deposit interest rates declining, interest in mutual fund dividends is understandable.

However, investors should know that mutual fund dividends are not guaranteed. Both the amount of dividend per unit and the frequency of payment are at the discretion of the fund house, depending on the accumulated profits of a mutual fund scheme. Further, a 10% Dividend Distribution Tax (DDT) was introduced for equity oriented schemes (including hybrid funds) in this year’s budget and has been effective from April 1, 2018. Though dividends are tax free in the hands of investors, the asset management company (fund house) has to pay DDT before distributing dividends to investors. DDT in equity oriented schemes will reduce the dividend yield for investors for the same payout rate.

Systematic Withdrawal Plan or SWP

Systematic Withdrawal Plans (SWP) is a smart investment option for such investors because it gives fixed cash-flows to investors, irrespective of scheme net asset values (NAVs) or market levels. In a mutual fund Systematic Withdrawal Plan (SWP), you can draw a fixed amount from your mutual fund investment every month or at any other frequency (specified by the investor); you can specify the amount to be drawn and the day of the month when the withdrawal should be made and the amount will be credited directly to your bank account on the specified day. You can continue your SWP as long as there are balance units in your mutual fund scheme account.

How Systematic Withdrawal Plan works?

In a Systematic Withdrawal Plan (SWP) you have to first make an investment in a mutual fund scheme; the investment can be made either in lump sum or through Systematic Investment Plan (SIP). The investor chooses a start date for SWP. Once the SWP in a certain account (scheme) is initiated, it generates cash-flows for investors by redeeming units of mutual fund scheme at specified intervals. The number of units redeemed to generate cash-flows in an SWP depends on the SWP amount and the scheme Net Asset Values (NAV) on the withdrawal dates. Let us understand how SWP generates cash-flows for investors with the help of an example.

Example of a SWP

Let us assume you invested Rs 10 lakhs in a mutual fund scheme. The purchase NAV was Rs 20; so 50,000 units will be allotted to you. Let us assume you start a monthly SWP of Rs 6,000 after one year from the date of investment to avoid exit loads. In the first month of the SWP, the scheme NAV is 25 (illustrative). In order to generate Rs 6,000 for you, the fund house will redeem 240 units (Rs 6,000 divided by 25). Your balance units will be 49,760 (50,000 minus 240). In the second month, if the NAV is 27, the AMC will redeem 222.22 units (Rs 6,000 divided by 25) for the SWP and your unit balance will be 49,537.78 (49,760 minus 222.22). In the third month if the scheme NAV is 28, the AMC will redeem 214.28 units and your unit balance will be 49,323.49.

In an SWP, your unit balance will diminish over time, but if the NAV keeps at a faster rate than your withdrawal rate, then your investment value will be higher. In the above example, after your third SWP instalment, your investment value will be Rs 13.81 Lakhs. You can see that, your investment value has gone up even after making monthly withdrawals. However, if the scheme NAV keeps falling instead of rising, like in a bear market, then effect on your investment value will be opposite, because withdrawals in a falling NAV scenario will require redemption of a higher number of units.

SWP works best for moderate withdrawals over long tenors

Let us assume that you invested Rs 70 Lakhs in BSE Sensex at the beginning of 2010 and you initiated your SWP with withdrawal amount is Rs 40,000 per month at the same time. For the sake of simplicity, let us ignore exit loads and short term capital gains tax. A monthly withdrawal of Rs 40,000 amounts to an annual withdrawal of Rs 4.8 Lakhs, which is around 7% of the investment amount (around the same rate of return as fixed income).

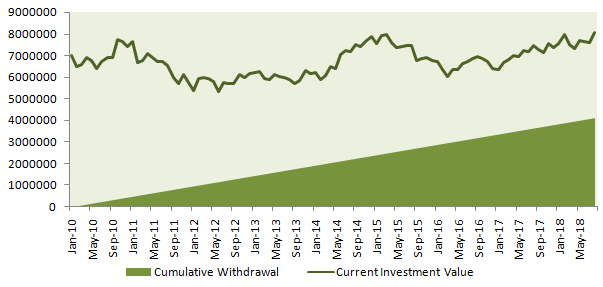

Equity is the best performing asset class in the long term, but it is volatile in the short or intermediate term. If your SWP withdrawal rate is similar to fixed income returns, then you give your equity investment an opportunity to grow and beat inflation in the long term. A moderate withdrawal rate also helps your investment to tide over short term volatility, while generating cash-flows for you. The chart below shows the SWP performance of Rs 70 Lakhs invested in Sensex at the beginning 2010 till October 1, 2018.

BSE Sensex was at around 17,500 at the time of investment. Every month you drew Rs 40,000 by redeeming units of Sensex at prevailing values and over the last 8+ years, you would have drawn more Rs 40 Lakhs on a cumulative basis. However, over this period, the Sensex appreciated from 17,500 to over 37,500 before correcting by 1,000 in September 2018 to around 36,500. The value of your 419 units at current Sensex (October 1, 2018) value will be around than Rs 78 Lakhs, Rs 8 Lakhs higher than your initial investment amount. Despite drawing Rs 40 Lakhs on a cumulative basis, your investment appreciated from Rs 70 Lakhs to Rs 78 Lakhs. This demonstrates the power of SWP over a sufficiently long tenor, provided your withdrawal rate is moderate. Over longer tenors, SWP can give even better results and you can increase your withdrawal rate in Rupee terms (while keeping it at the same level in percentage terms).

Be mindful of exit loads and short term capital gains tax while planning SWP

In the above example, we ignored exit loads and the short term capitals gains taxations for the sake of simplicity. Since SWP works on the basis of redemptions to meet your cash-flow needs, you may have to incur these costs unless you plan carefully. For every SWP withdrawal during your exit load period, the exit load specified for the scheme will be deducted and this will lower your long term returns. This can be avoided by planning your SWP in such a way that your withdrawals begin after the exit load period.

Similarly, short term capital gains tax can be avoided if you plan your withdrawals after the short term capital gains tax period which is 12 months for equity oriented funds (schemes which have 65% or more invested in equity) or 36 months for non equity oriented funds (schemes which have less than 65% invested in equity). Long term capital gains taxation is hugely advantageous both for equity oriented and non-equity oriented schemes.

Long term capital gains in equity oriented schemes are tax exempt up to profit of Rs 1 Lakh; profit in excess of Rs 1 Lakh is taxed at 10%. Long term capital gains in non equity oriented schemes are taxed at 20% after allowing for indexation benefits; indexation benefits can reduce your tax obligation substantially.

Conclusion

In this blog post, we discussed about Systematic Withdrawal Plans. SWP is a smart and convenient option for getting predictable cash-flows from your investment; at the same time, there are a multiple considerations that you need to be aware of, to get the desired results from your SWP. If you need regular income from your investments, you should consult with your financial advisors if SWP from mutual fund schemes are suitable for your financial needs.

You can check our Mutual Fund SWP research tool to understand how SWP works?

Disclaimer: The views expressed herein are based on internal data, publicly available information and other sources believed to be reliable. Any calculations made are approximations, meant as guidelines only, which you must confirm before relying on them. The information contained in this document is for general purposes only. The document is given in summary form and does not purport to be complete. The document does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. The information / data herein alone are not sufficient and should not be used for the development or implementation of an investment strategy. The statements contained herein are based on our current views and involve known and unknown risk and uncertainties that could cause actual results, performance or event to differ materially from those expressed or implied in such statements. Past performance may or may not be sustained in the future. LIC Mutual Fund Asset Management Ltd. / LIC Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investment made in the scheme(s). Neither LIC Mutual Fund Asset Management Ltd. and LIC Mutual Fund (the Fund) nor any person connected with them, accepts any liability arising from the use of this document. The recipients(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice and shall alone be fully responsible / liable for any decision taken on the basis of information contained herein.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY