Groww Nifty 50 Index Fund Regular Growth

Fund House: Groww Mutual Fund| Category: Index Fund |

| Launch Date: 02-07-2025 |

| Asset Class: Equity |

| Benchmark: NIFTY 50 TRI |

| TER: 1.0% As on (28-11-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 500.0 |

| Minimum Topup: 500.0 |

| Total Assets: 17.72 Cr As on 28-11-2025(Source:AMFI) |

| Turn over: - | Exit Load: Nil |

10.2861

-0.1 (-1.0208%)

3.03%

Benchmark: 13.81%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

NIFTY 50 TRI

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

There is no value for 2x

There is no value for 4x

There is no value for 5x

There is no value for 10x

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

Current Asset Allocation (%)

Indicators

| Standard Deviation | - |

| Sharpe Ratio | - |

| Alpha | - |

| Beta | - |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| Groww Nifty 50 Index Fund Regular Growth | 02-07-2025 | - | - | - | - | - |

| Motilal Oswal Nifty MidSmall Financial Services Index Fund-Regular Plan-Growth | 29-10-2024 | 32.0 | - | - | - | - |

| ICICI Prudential NASDAQ 100 Index Fund - Growth | 01-10-2021 | 26.26 | 29.77 | 35.59 | - | - |

| Kotak Nifty Financial Services Ex-Bank Index Fund - Regular Plan - Growth option | 14-08-2023 | 24.68 | 18.11 | - | - | - |

| Motilal Oswal Nifty India Defence Index Fund Regular Plan Growth | 03-07-2024 | 23.4 | - | - | - | - |

| Aditya Birla Sun Life Nifty India Defence Index Fund-Regular-Growth | 30-08-2024 | 22.94 | - | - | - | - |

| Motilal Oswal S&P 500 Index Fund - Regular Plan Growth | 05-04-2020 | 22.32 | 25.61 | 25.16 | 17.42 | - |

| Nippon India Nifty Auto Index Fund - Regular Plan- Growth Option | 14-11-2024 | 21.44 | - | - | - | - |

| ICICI Prudential Nifty Auto Index Fund - Growth | 05-10-2022 | 21.4 | 24.11 | 30.48 | - | - |

| Tata Nifty Auto Index Fund - Regular Plan - Growth | 26-04-2024 | 21.09 | - | - | - | - |

Scheme Characteristics

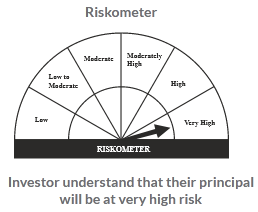

Riskometer

PORTFOLIO

Market Cap Distribution

Others

0.35%

Large Cap

99.67%

Scheme Documents

There are no scheme documents available