SBI PSU Fund - Regular Plan -Growth

Fund House: SBI Mutual Fund| Category: Equity: Thematic-PSU |

| Launch Date: 07-07-2010 |

| Asset Class: Equity |

| Benchmark: BSE PSU TRI |

| TER: 1.86% As on (31-12-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 5000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 5,816.55 Cr As on 31-12-2025(Source:AMFI) |

| Turn over: 39% |

34.8997

0.75 (2.1384%)

8.35%

Benchmark: 15.39%

PERFORMANCE

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Investment Objective

The objective of the scheme would be toprovide investors with opportunities forlong-term growth in capital along with theliquidity of an open-ended scheme throughan active management of investments in adiversified basket of equity stocks ofdomestic Public Sector Under takings and indebt and money market instruments issuedby PSUs and others.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 21.65 |

| Sharpe Ratio | 1.01 |

| Alpha | -2.45 |

| Beta | 0.93 |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| SBI PSU Fund - Regular Plan -Growth | 07-07-2010 | 22.49 | 10.15 | 32.14 | 28.74 | 15.86 |

| Invesco India PSU Equity Fund - Growth | 18-11-2009 | 23.0 | 12.25 | 31.74 | 27.22 | 18.33 |

| Aditya Birla Sun Life PSU Equity Fund-Regular Plan-Growth | 05-12-2019 | 20.74 | 5.71 | 29.49 | 27.86 | - |

| ICICI Prudential PSU Equity Fund - Growth | 09-09-2022 | 16.84 | 9.45 | 29.03 | - | - |

| Quant PSU Fund - Growth Option - Regular Plan | 20-02-2024 | 2.9 | - | - | - | - |

Scheme Characteristics

Minimum investment in equity & equity related instruments of a particular sector/ particular theme - 80% of total assets.

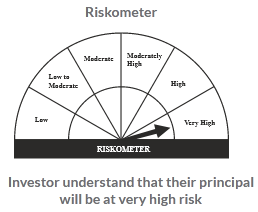

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

6.11%

Others

2.88%

Large Cap

68.95%

Mid Cap

22.06%

Scheme Documents

There are no scheme documents available