The Importance of Goals in Investing

Guru Dronacharya emphasized the importance of having a target and setting your eyes on the target. This was the crux of his teachings which he imbibed in his training. Despite his efficient training, Arjun was the only disciple who hit the bulls’ eye every time he arched his bow. Did he have a magic bow and arrow? No, he had goals and his eye was always trained on his goals and this made him the best archer. Time and again, great preachers and wise men have always exemplified the importance of having goals. Goals are the only thing which gives our life a purpose and drive our actions. In the words of Mark Pincus, ‘Not having a clear goal leads to death by a thousand compromises’.

When it comes to investments, we always want the best. We want our investments to suit our requirements and provide us the best returns. But can it be done automatically or do we need to plan for our investments based on our goals?

Do I need to answer that question? All of us know the answer to that and yet, when it comes to investments and building up a financial portfolio, many of us go about it the wrong way. How we build our financial portfolio is reflected through the below-mentioned points. You may like to read this – Making better financial decisions

Ad-hoc investments

– the major trap we fall in when planning our financial portfolio is ad-hoc investing. We are so concerned with providing for a specific purpose that other requirements get lost in the way and we end up with a lopsided portfolio. More often than not, our investments are not even aligned to any of our short term or long term investment needs, it caters to the choice or the opinion of the person who happens to advice at that particular point of time.Return-based investing

– yes, though a rational investor should invest in a fund based on the returns, a return-based investing is not the answer when you are building up an all-round financial portfolio. Your portfolio should be diverse to fulfill all your prospective and immediate requirements which is forgotten when we blindly choose funds on their returns. Also past performance never guarantees future performance, it is more like driving while seeing the rear view mirror. So, investment needs to be based on anticipated future performance of the instrument or fund and not just past. Recommended reading – Diversified Equity Funds: Performance and Risk in the last 10 yearsFollowing the herd

– we feel safe when we go the way the others are going. If we find the crowd rooting for a particular investment we plunge into it. Last week my friend informed me that he also invested in the equity mutual fund SIP which I had bought. I was planning with a long-term perspective while he required money after 3 years. The investment was thus made without considering his goals

These are the scenarios of how we invest our hard-earned money and goal setting or sticking to such set goals is given a miss. Is it prudent? Of course not! Though we do take out the time to set our life goals to be fulfilled by our investments, we seldom follow it through. Our investments get lost in the above-mentioned scenarios and goal-based investing is forgotten.

Before we delve into the importance of goal-based investments and understand how to plan a goal-based investment approach, let us first look at the life goals every individual has for which finances are required:

Contingency Fund or Planning for an emergency

– the most important goal which should feature in any individual’s list is planning for an emergency. An emergency fund is a priority and should be embarked upon first. Only after securing an emergency fund can you plan for other goals because in case of an emergency, in the absence of an emergency fund, your savings for other goals would be your only source of funds.Child Education

– the second most important goal is planning for your child’s education, both secondary and higher education. In fact, this is the primary goal in the Indian perspective. With the rising inflation, your child would need a huge corpus a decade and a half later when they embark upon the journey of higher education. Having a fund earmarked for the child’s future is wise and you should make sure that it is not utilized on other expenses.Wealth accumulation

– after you have provided for an emergency fund and secured your child’s future, the next rational goal is wealth accumulation or wealth maximization. Here you are likely to seek such investment avenues which yield the maximum returns. Wealth accumulation is also an important goal because it aids you in building up your assets and also to indulge in your desires. Recommended Reading: Mutual Fund Strategies: To make your investments work hardRetirement planning

– to ensure that your retirement is as financially smooth as your current life is you ought to undertake retirement planning. It is said in the context of retirement planning that the earlier you start the better it is. Start building up your retirement corpus from an earlier period after you have met all your other goals. Your contributions might be limited but ensure to contribute something towards your retirement, no matter how little. Although retirement planning comes to one’s mind after all the other needs are met, this is actually the most important part of your Financial Planning. Recommended Reading: Retirement Planning myths

These are the four broad goals which are universally applicable in every individual’s life. Individuals might also have additional goals according to their unique needs but these goals are rudimentary.

Now when I have enlisted the life goals every one of you out there has, it is time you fix yours and start investing. A goal-based investment should be your approach when you plan your investments and if you are still cynical, let me enumerate the importance of a goal-driven investment approach.

The solution to the three ‘hows’

– when we have surplus funds to invest, three questions usually confront us – How to invest? How much to invest? How long to invest? Having a goal before you answers these three questions and reveals the amount of investments needed for a specified tenure to yield the desired corpus. You may try this Goal Setting Calculator https://www.advisorkhoj.com/tools-and-calculators/goal-setting-calculatorIt helps in choosing the right investment avenues

– when we have deciphered the answer to the three ‘hows’, it becomes easier for us to choose the investment instruments best suited for our requirements. We get to choose the level of insurance needed, the policy term, the contributions to a SIP, contributions to a retirement fund, etc. This helps us in choosing the best-suited instruments for our requirements rather than blindly following the herd. Here, you should also check the right allocation for your investments best suited to your risk profile You may try this https://www.advisorkhoj.com/tools-and-calculators/asset-allocationMakes us disciplined

– Raj invested in a SIP for a 15-year term for his daughter’s higher education. Saving for his daughter’s education was his priority which made him stick to the SIP for a longer tenure even amidst market volatility. With a disciplined investment and the choice of a SIP, the corpus he received was substantial enough to secure his daughter’s future. Having pre-set goals and an investment portfolio meeting such goals helps us in adopting a disciplined investment approach which yields better returns.Ensures good returns through portfolio diversification

– earmarking important goals and investing in each goal separately also helps in availing good returns. With every goal having a different investment, your portfolio becomes diversified and the inherent risk reduces.Financial freedom

– all in all, by getting investment solutions, choosing the right instruments, disciplined investments and portfolio diversification, goal-based investing makes us financially free.

Suppose you are aged 35 years and you have two goals of child education and a retirement corpus. The former would be required after 12 years for your son’s higher education while the latter would be required after 30 years. The cost of an MBA degree today is about Rs.10 lakhs and if we assume an inflation of about 6% you would need about Rs.12 lakhs a decade later. Similarly, if your current monthly expenses are about Rs.20, 000, after retirement, you would face about Rs.287, 000 in expenses and without having a sound investment plan in place, meeting such huge expenses would become impossible. To set your Composite goals and know the future value of each of them, please try this Composite Financial Goal Planner

Conclusion

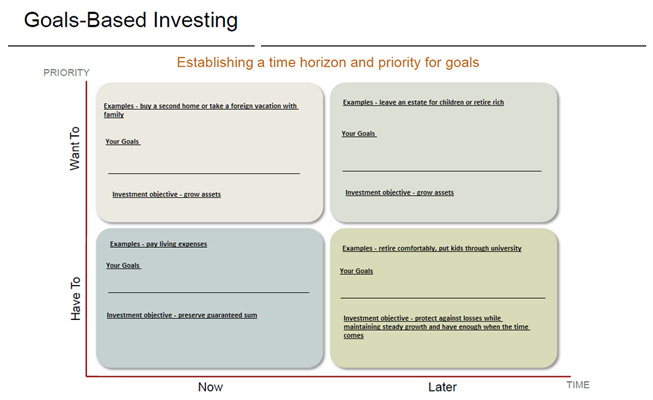

Pablo Picasso remarked, ‘Our goals can only be reached through a vehicle of a plan, in which we must fervently believe, and upon which we must vigorously act. There is no other route to success.’ So, you should also know how to plan your investments so that they become goal-oriented. SEI, a leading global provider of asset and wealth management services, has devised a matrix which would help us identify our goals, their priority and the underlying investment objective.

Source: seic.com

The matrix beautifully helps in making you understand your goals and their priority. While paying living expenses for your family is the foremost responsibility, leaving an estate for your children or retiring rich is an indulgence which should be met if you have additional funds after providing for the basic goals which you have. Just like paying for living expenses, planning for retirement and stabilizing the children’s security are also important which would have to be planned later on once the priority goals have been set.

RECOMMENDED READS

- SWP from Debt Mutual Funds give the most tax efficient income over fixed deposits

- Combination of Home Loan EMI and Mutual Fund SIP can save you lot of money

- Systematic Withdrawal Plans from Debt Mutual Funds give the most tax efficient income

- How to select the right debt mutual funds for your portfolio: Part 1

- How to select the right debt mutual funds for your portfolio: Part 3

LATEST ARTICLES

- Different types of diversified equity mutual funds: Schemes from Principal MF stable

- Principal Equity Savings Fund: For investors who look for regular income and capital appreciation

- Regular Withdrawal Plan: A smart and convenient way of getting regular income

- Mutual Fund ELSS schemes: best way to save tax and create wealth

- What are Balanced Mutual Funds

We understand what you're working for

We are committed towards helping individuals, businesses & institutional clients achieve financial security & success.

Quick Links

Product Brochures

More About Principal MF

POST A QUERY