Protection from volatile markets

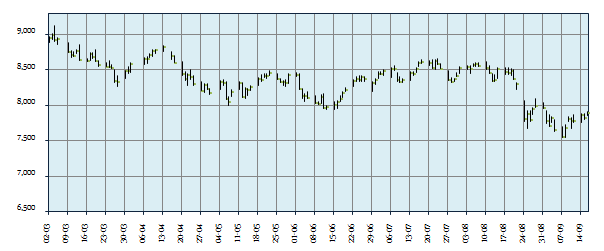

The equity market has been volatile for the last 6 months. From its all time of 9120, made on an intraday basis on March 3, the Nifty fell to 7,558 on September 8, a drop of 17%. Daily swings of more than 1% were seen quite often. Out of the 137 trading sessions from March 1 to September 16, Nifty saw a swing of more than 1%, both on the upside and the downside, in 45 trading sessions. On August 24, which many traders called Black Monday, the Nifty fell by almost 6% in a single session. The chart below shows the daily price movement of Nifty over the last 6 months.

When will the volatility end? Due to various global macro factors, we can expect the volatility to continue in the coming months. In this blog we will discuss, how retail investors can protect themselves against volatile markets.

Is volatility a good thing or a bad thing?

Volatility is associated with uncertainty and it causes stress. In volatile markets, three questions confront investors, which we will try to answer in this blog.

- Should I redeem my equity investments?

- Should I stop investing or continue to invest?

- How should I invest in volatile markets?

Should I redeem my equity investments?

There is no denying that volatility causes risk aversion, because nobody knows for sure how much lower the market can go from this level. But we should take a step back and think about our investment objectives. If you are investing for long term goals, then does volatility over the next three to four months, or even the next six months really matter, if you are convinced that the market is eventually headed higher? Over the last 10 years Nifty has grown nearly 3 times, at a compounded annual growth rate of over 12%. Over the same period, top performing diversified equity mutual funds have given 17 – 18% compounded annual returns. In our article, making sense of volatility in the equity market: A Historical perspective, we had seen that volatility lasts for a fairly short period. Also over the last 20 years, we have seen the market rebounded sharply after every bear market and scaled new all time highs. If you are a long term investor, you should stay invested and you will make money in the long term.

Should I stop investing or continue to invest?

The first reaction of investors in volatile market conditions is stopping to invest. When they see marked to market losses on their investments, they stop fresh investments and shift to risk free assets. Many market experts advise investors to stay in cash during volatile markets. The logic underlying the strategy of staying in cash in volatile market conditions is that, in volatile markets one does not know what the market bottom is. Therefore these experts advocate staying in cash till a bottom is confirmed. On the other hand, if you invest in volatile markets you can take advantage of attractive valuations and get excellent long term returns

How should I invest in volatile markets?

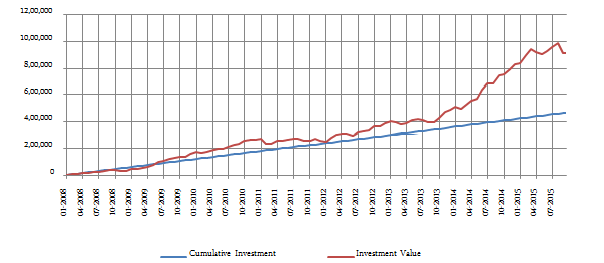

In volatile market conditions you should make volatility work in your favour, through a principle called rupee cost averaging. By investing a fixed amount of money on a regular basis (weekly, monthly etc) across time in mutual funds, you can average out your cost of purchase. Basically, you buy more units when the price is less and less units when the price is more. Rupee cost averaging works for you by reducing your average cost of acquisition thereby enabling you to earn higher returns. You can achieve this through two modes of investment in mutual funds. The first is Systematic Investment Plan (SIP). In a systematic investment plan, you invest a fixed amount of money on a regular basis (e.g. weekly, monthly etc) in a mutual fund scheme. SIPs work very well in volatile market conditions through rupee cost averaging. SIPs also help the investors stay disciplined. By investing a fixed amount out of regular your savings, you will be able to build a corpus for your long term financial needs. Money not invested often gets spent on consumption and compromises the long term goals of the investors.

They key to investment success irrespective of the market conditions is to have a robust financial plan and to stick to it. SIP is a terrific investment option to help you meet your financial plan goals. Therefore, if you are investing towards your long term goals through a systematic investment plan, you should continue with it.

What if you have a lump sum amount that you to invest, but you are not sure when to invest because of volatile market conditions? You have two options. The first option is to keep your money in a savings bank account and invest it through an SIP in a mutual fund scheme of your choice till the entire lump sum amount is invested. A fixed amount will be auto-debited from your bank account and get invested in the mutual scheme. However, there is a better option, which we had alluded to in the earlier example. You can park your lump sum amount in a low risk debt mutual fund, also known as liquid fund and transfer a fixed amount on a regular basis through a Systematic Transfer Plan (STP). An STP works exactly like an SIP, except the money towards your investment is debited from another mutual fund scheme (e.g. liquid fund) instead of your bank account.

The behavioral aspect of investing

We can discuss any number of investment strategies but investment success depends on how we react to different situations. A senior leader of a large multinational corporation once told me that, it is not the situation which impacts us, as much as how we react to it. It is imperative that you should be in control of your emotions in volatile markets. It is easier said than done, but if you have a financial plan, it will definitely help you stay focused and disciplined. A good defence mechanism in volatile market conditions is your ability to filter out signal from noise. What do we mean by this? Your colleagues, friends and relatives will have their view on the market, optimistic or pessimistic. You should remember that their views, more often than not, are manifestation of their own emotions. In volatile market conditions, you will also be confused with conflicting views from market experts on TV channels. You have separate out facts from opinions and stay focused on your investment objectives. Again, your biggest friend will be your financial plan.

Conclusion

In this blog we have discussed how retail investors can protect themselves in volatile market conditions. Volatility is an intrinsic attribute of equity markets. Highly volatile markets which we have seen in the recent past and may continue to see in the coming months are indeed stressful for most retail investors. However, as discussed in this blog, if you are a long term investor, volatility may not necessarily be your enemy. In fact, if you have a systematic approach towards investing, you can actually make volatility your friend. The critical success factors of investing in volatile market are clarity about investment objectives, an actionable financial plan and rigorous investment discipline.

Disclaimer:

Any information contained in this article is only for informational purpose and does not constitute advice or offer to sell/purchase units of the schemes of SBI Mutual Fund. Information and content developed in this article has been provided by Advisorkhoj.com and is to be read from an investment awareness and education perspective only. SBI Mutual Fund’s participation in this article is as an advertiser only and the views / content expressed herein do not constitute the opinions of SBI Mutual Fund or recommendation of any course of action to be followed by the reader

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY