What are short term investment options as bank rates at lowest point in many years

In the first part of this blog post, we have discussed that, even though term deposit rates are declining, there are a variety of mutual fund investment options that, can meet a wide spectrum of investor’s risk return needs provided Investors broaden their horizons and empower themselves with knowledge of debt fund investments. In the next post we will discuss how ultra short term debt funds and liquid funds can fulfil your short term investment needs while giving higher returns.

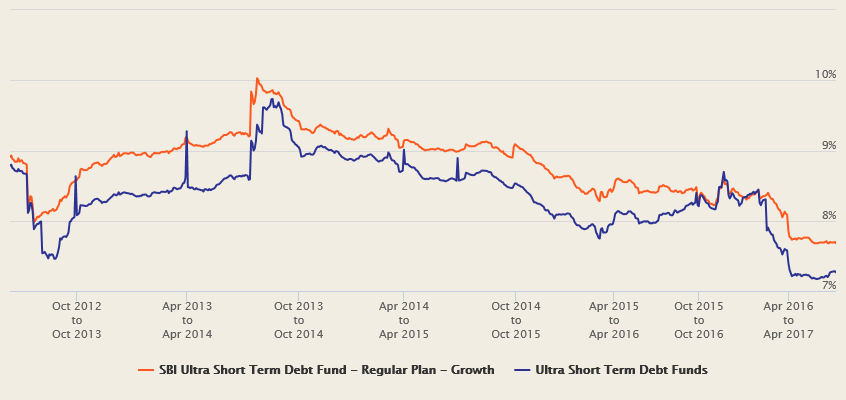

Ultra-short term debt funds: Ultra-short term debt funds are money market mutual funds and invest primarily in money market instruments like treasury bills, certificate of deposits and commercial papers and term deposits, with the objective of providing investors an opportunity to earn returns, without compromising on the liquidity of the investment. These funds are suitable for investment tenures of more than 3 months to about a year. They provide higher returns than savings bank accounts interest (which is usually around 4%) and sufficient liquidity to meet urgent needs. SBI Ultra Short Term Debt Fund has given 7.7% over the last 1 year;compare this with 4% interest from savings bank account or even interest from less than 365 days bank FDs and you will find that ultra short term debt funds are much more attractive. These funds are suitable for 3 months to 1 year investment tenures. The chart below shows 1 year rolling returns of SBI Ultra Short Term Debt Fund.

Source: Advisorkhoj Rolling Returns Calculator

The average 1 year rolling return of this fund over the last 5 years was 8.8%. The maximum 1 year rolling return was 10% while the minimum was 7.7%. The returns of this fund over the last 5 years were more than 8%, more than 90% of the times. While the returns will decline in the future, if interest rates go down, the current returns are still much higher than the less than 12 months FD rates, while offering much more liquidity than FDs because ultra-short term debt funds can be redeemed at any time without any penalty (exit loads).

Liquid Funds:

Liquid funds, like ultra-short term debt funds, invest in money market instruments like treasury bills, certificate of deposits and commercial papers and term deposits. Unlike ultra-short term debt funds, liquid funds invest in money market securities that have a residual maturity of less than or equal to 91 days. As such, they are suitable for parking money for a few days to up to 3 months. Liquid funds usually give much higher returns than savings bank interest rates.

There is no exit load. Withdrawals from liquid funds are processed within 24 hours on business days. However, some liquid funds, like SBI Magnum Insta Cash Fund offer faster withdrawals. Through the Instant Redemption Facility, investors can redeem units of SBI Magnum Insta Cash Fund and get funds credited to their registered bank accounts within a few minutes of transactions through the SBI mutual fund website or SBI mutual fund mobile app, limited to a maximum withdrawal limit of Rs 50,000 or redeemable balance (whichever is lower) per transaction.

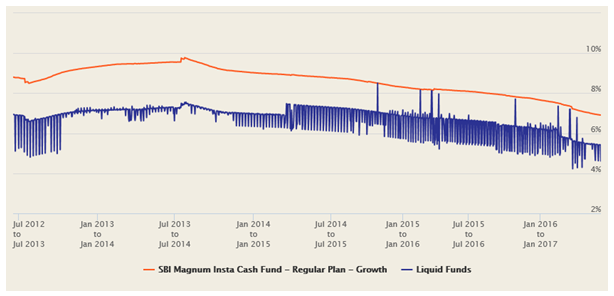

The Instant Redemption Facility provides almost the same convenience as a savings bank account. However, the returns of liquid funds can be substantially higher than savings bank interest. In the last one year, SBI Magnum Insta Cash Fund gave 6.9% returns. These funds are suitable for 3 months to 1 year investment tenures. The chart below shows 1 year the rolling returns of SBI Magnum Insta Cash Fund.

Source: Advisorkhoj Rolling Returns Calculator

The average 1 year rolling return of this fund over the last 5 years was 8.6%. The maximum 1 year rolling return was 9.8% while the minimum was 6.9%. The returns of this fund over the last 5 years were more than 8%, around 75% of the times. While the returns will decline in the future, if interest rates go down, the current returns are still much higher than the savings bank interest rates, almost as high as less than 1 year FD rates, while offering savings bank like convenience.

Conclusion

In this blog post, we have discussed that, even though term deposit rates are declining, there are a variety of mutual fund investment options that, can meet a wide spectrum of investor’s risk return needs. Investors need to broaden their horizons and empower themselves with knowledge of investments; instead of complaining about lower FD interest rates (justifiably so, from their perspectives), they may be able to find more attractive investment options which are aligned to their investment objectives. Investors should discuss with their financial advisors, if various debt mutual fund options are suitable for their short term investment needs.

Disclaimer:

Any information contained in this article is only for informational purpose and does not constitute advice or offer to sell/purchase units of the schemes of SBI Mutual Fund. Information and content developed in this article has been provided by Advisorkhoj.com and is to be read from an investment awareness and education perspective only. SBI Mutual Fund’s participation in this article is as an advertiser only and the views / content expressed herein do not constitute the opinions of SBI Mutual Fund or recommendation of any course of action to be followed by the reader

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY