How Systematic Withdrawal Plan from Balanced Advantage Fund can be a good idea

What is Systematic Withdrawal Plan?

Systematic Withdrawal Plan (SWP) is a mutual funds facility using which you can draw fixed amounts from your mutual fund investment at regular intervals (e.g. monthly, any other interval as specified by the AMC). SWP works by redeeming the required number of units at prevailing NAVs to meet your SWP cash-flows. The SWP will continue as long as you have sufficient unit balance to meet your cash-flows.

How does SWP work?

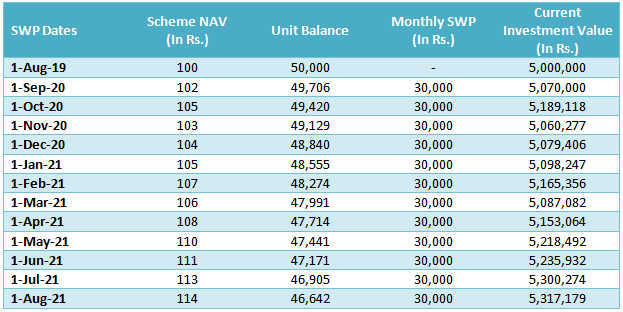

Suppose, you invested Rs 50 Lakhs in a mutual fund scheme at a NAV of Rs 100 per unit on 1st August 2019. You started a SWP of Rs 30,000 per month starting 1st September 2020. We are starting the SWP after a year so that the gain in each SWP is treated as long term capital gains (LTCG).

The table below shows the cash-flows for the purely illustrative NAV movement and the change in value of your investment. You can see that your unit balance will diminish over time because your SWP cash-flows are being generated by redeeming units of your scheme. However, if the scheme return over the SWP period is higher than the withdrawal rate, the value of your investment can grow over time.

Disclaimer: The table above is purely illustrative. Mutual fund NAVs are subject to market movements. You should consult with your financial advisor before planning your SWP

You may try this Systematic Withdrawal Plan Calculator

SWP versus Dividends

- In SWP you get fixed cash-flows at regular intervals as long as you have sufficient unit balance in your account. It is easier to plan your expenses, if you know how much cash-flows you will receive every month.

- Mutual fund dividends are paid at the discretion of the fund manager / Asset Management Company. They are not guaranteed. A scheme may change its dividend payout rate or may stop paying dividends altogether for a period of time.

- Profits arising out of SWP cash-flows are subject to capital gains tax. Short term capital gains (investment holding period of less than 12 months) in equity or equity oriented funds are taxed at 15% (plus applicable surcharge and cess). Long term capital gains (investment holding period of more than 12 months) of up to Rs 1 lakh in equity oriented funds are tax free and taxed at 10% (plus applicable surcharge and cess) thereafter. Since SWPs are usually planned for long tenures, investors can avail the advantage of long term capital gains taxation.

- Dividends paid by mutual fund schemes (both equity and debt funds) are added to the investor’s gross taxable income and are taxed as per the income tax slab rate of the investor. For investors in the higher tax brackets, SWP is more tax efficient than dividends.

Balanced Advantage Funds can be good investment options for SWP

- Balanced Advantage Funds invest in debt and equity dynamically according to market conditions. Balanced Advantage Funds usually reduce equity allocations when valuations are high (bull markets) and increase equity allocations when valuations are low (bear markets). By buying low and selling high balanced advantage funds can create wealth for investors in the long term

- Balanced Advantage Funds have lesser allocations to equity at market peaks. As a result, they see smaller drawdowns in market corrections. Smaller drawdown is an advantage in SWP. If a scheme suffers a large drawdown, more units have to be redeemed for SWP.

- Balanced Advantage Funds usually enjoy equity taxation. Equity taxation, especially long term capital gains taxation makes SWP from Balanced Advantage Funds very tax efficient.

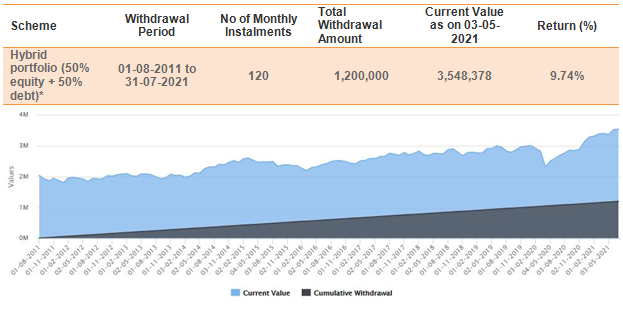

Example of long term SWP in balanced portfolio

For this example, we have constructed a hypothetical balanced portfolio comprising of 50% Nifty 50 TRI (for equity as an asset class) and 50% Nifty 10 year benchmark G-Sec Index (for debt as an asset class). Let us assume that you invested Rs 20 lakhs in this hypothetical balanced portfolio on 1st August 2010. You began a SWP of Rs 10,000 per month from 1st August 2011 and continued till date. We are starting our SWP a year after our investment to avoid exit load and short term capital gains tax. The results of the SWP are shown below. You can see that, despite substantial withdrawal, you were able to see significant capital appreciation.

Source: National Stock Exchange, Advisorkhoj Research (Period: 01.08.2010 to 31.07.2021). * comprises of 50% Nifty 50 TRI + 50% Nifty 10 year benchmark G-Sec Index. Disclaimer: Past performance may or may not be sustained in the future

You should note here we have not rebalanced our hypothetical balanced portfolio in this example throughout the tenure of the SWP. Balanced Advantage Funds rebalanced their portfolio dynamically according to market conditions. In certain market conditions they can have high allocations to equity and in different market conditions they can have allocations to debt. By rebalancing their portfolio dynamically, Balanced Advantage Funds can generate superior risk adjusted returns.

SBI Balanced Advantage Fund – SWP (A)

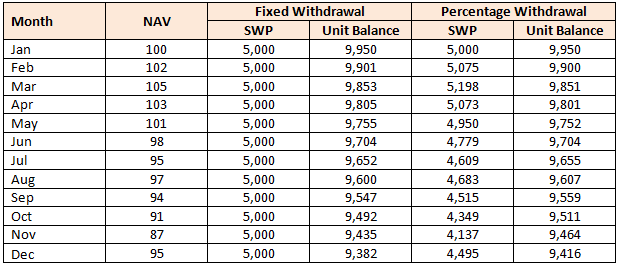

SBI MF is launching a dynamic asset allocation fund, SBI Balanced Advantage Fund. The scheme offers aunique withdrawal option - SWP (Automated) or SWP (A) - under which the investor can assign a percentage withdrawal from the scheme per month, per quarter or per year. Most SWPs offer fixed withdrawals. One of the drawbacks of fixed withdrawal is that it does not take into account the scheme’s Net Asset Values (NAVs) in market swings. As result, more units have to be redeemed to generate SWP cash-flows in volatile or bear markets. The percentage withdrawal feature will ensure lesser number of units is redeemed in bear markets. Let us illustrate with the help of two examples. Let us assume you invested Rs 10,00,000 and are drawing Rs 5,000 per month through fixed withdrawal SWP and 0.5% per month through percentage withdrawal SWP. You can see that you have higher unit balance in the percentage withdrawal SWP option.

Disclaimer: The table above is purely illustrative. Mutual fund NAVs are subject to market movements. You should consult with your financial advisor before planning your SWP

In SBI Balanced Advantage Fund SWP (A) you will have two options:-

- Withdraw fixed % of the Folio balance: 0.5% (monthly), 1.5% (quarterly), 3% (half yearly) and 6% (annual)

- Any specified amount>INR 500 (Monthly/ Quarterly/ Half Yearly/ Yearly)

Investors should consult with their financial advisors about which SWP withdrawal option will be suited for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY