SBI Equity Hybrid Fund: Outstanding long term SWP returns

In a Systematic Withdrawal Plan (SWP), investor can regularly withdraw a fixed amount of money on a fixed date or dates from a mutual fund scheme. The amount to be withdrawn and the frequency of withdrawals (e.g. weekly, fortnightly, monthly, quarterly or annually) are decided by the investor. SWP withdrawals from an equity fund, after one year from the date of investment, is subject to long term capital gains taxation. Long term capital gain of up to Rs 1 Lakh in a financial year is tax exempt. Long term capital gains in excess of Rs 1 Lakh are taxed at 10%. SWP is an ideal investment option for investors with lumpsum investible surplus and looking for regular income from their investments and capital appreciation at the same time.

Suggested reading – how SWPs are smart option to get regular income from your investment

SWP as a long term income solution

One question which we get from investors, especially senior citizens is, whether SWP is an effective retirement planning solution – can SWP generate steady cash-flows for investors over 20+ years and also beat inflation, keeping in mind the inevitability of market cycles. In our view SWP can be an excellent, tax efficient solution to supplement your post retirement income. However, we also wanted to back test this hypothesis.

For the purpose of back testing, we selected SBI Equity Hybrid Fund, an aggressive equity oriented hybrid fund with at least 20 years track record. Hybrid funds are excellent investment choices for SWP because the debt portion of the schemes provide stability to the investment in volatile markets, while the equity portion generates capital appreciation for investors over long tenors.

SBI Equity Hybrid Fund SWP

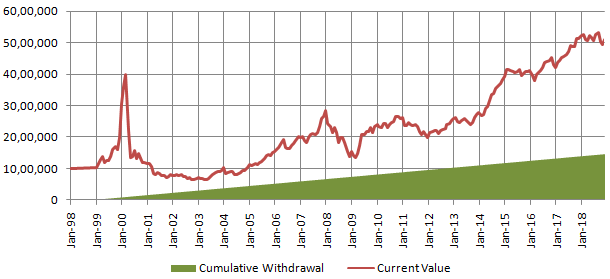

Let us assume that you invested Rs 10 Lakhs in SBI Equity Hybrid Fund on January 1, 1998. You waited for a year to begin your monthly SWP of Rs 6,000. Please note that this is a hypothetical example purely for the purpose of demonstrating how SWP can work over long periods of time. Let us see the results of this hypothetical SWP.

Source: Advisorkhoj SWP Returns Calculator

You can see in the chart above that you would have continued your SWP for 20 years, withdrawing Rs 14.4 Lakhs (more than your initial lump sum investment) through 240 monthly installments. You can also see in the chart above that value of your investment in SBI Equity Hybrid Fund, despite the regular withdrawals would have multiplied more than 5 times to over Rs 50 Lakhs (as on December 3, 2018). This means that you can continue your SWP for many more years with the potential of creating even more wealth. The table below shows the summary of the SWP over the last 20 years.

Source: Advisorkhoj SWP Returns Calculator

Increasing your withdrawal rate over time

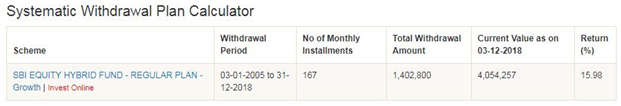

Some investors may want their cash-flows to go up over time to meet inflation. Investors have flexibility of increasing the withdrawals in an SWP. However, in our view, investors should exercise caution and increase the withdrawal rate only if the returns are also higher. The 2000 to 2002 period was challenging for equity markets in India due to number of factors. You can see that, the market value of your investment dipped below the Rs 10 Lakh mark (your initial investment amount) from 2001 to 2004. If you increased your withdrawals during this period, your investment value would have dipped further affecting your long term returns. Therefore, let us assume you waited till January 2005, by which time the bull market was back in full swing, to increase your monthly withdrawal by 40% (factoring in inflation from 1999 to 2005) to Rs 8,400 per month from Rs 6,000 per month. Let us see the results of the SWP from 2005 till date at the higher withdrawal rate.

Source: Advisorkhoj SWP Returns Calculator

You can see that you would have been able to continue to SWP at the higher withdrawal and still create substantial wealth. Your investment would have multiplied around 4 times to Rs 40 Lakhs by December 2018.

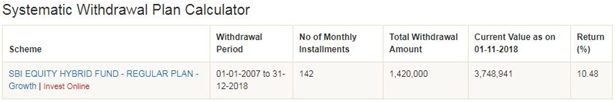

Similarly, in January 2007 you could have increased your withdrawal by another 15% to Rs 9,700; let us go with a round figure of Rs 10,000 monthly withdrawal from January 2007 onwards and see the results (please see the table below). You can see that you would have been able to sustain your SWP and at the same time, grow your investment to Rs 37 Lakhs.

Source: Advisorkhoj SWP Returns Calculator

As you create wealth through capital appreciation of your investment you can draw more money from your SWP to meet your expenses.

Performance across market cycles

In the SWP example that we have been discussing we saw the results of the SWP across a 20 year investment tenor. During this period we experienced different market conditions from bull markets to bear markets, volatile markets and range-bound markets. The last 20 years saw at least 4 bear markets and yet SBI Equity Hybrid Fund was able to create substantial wealth for investors while providing regular cash-flows at the same time through SWP.

SBI Equity Hybrid Fund is an equity oriented hybrid mutual fund scheme – at least 65% asset allocation to equity is maintained at all points of time. The fund manager has the flexibility to increase or decrease the equity and debt allocations (maintaining the minimum 65% limit) depending on market conditions.

Having moderate SWP withdrawal rates is critical to capital appreciation

Having a moderate withdrawal rate is of utmost importance in an SWP from a hybrid fund. Mutual funds are subject to market risks. Point to point returns of your mutual fund scheme will depend on market conditions. If you want to sustain your SWP over long periods of time and also grow your wealth, your withdrawal rate should be lower than long term (covering different market cycles) average asset returns. In our view your withdrawal rate from your SWP should not exceed 8% per annum to start with.

You should understand that SWP generates cash-flows for you by redeeming units of the scheme you invested in at prevailing NAVs on SWP dates. If your withdrawal rate is high, then more units will be redeemed to provide cash-flows. If unfortunately, the market conditions turn bad soon after you started your SWP, then for higher withdrawals a lot more units will have to be redeemed in a bear market. This will affect your long term returns. In the example, we just discussed you would have faced a bear market just a year after you began your SWP. But since your withdrawal rate was moderate, you were not only able to sustain your SWP, but also able to generate substantial wealth in the long term. You should begin with a moderate SWP withdrawal rate and over a period of time, as your investment grows in value, you can increase your withdrawal rate as discussed in our example.

SBI Mutual Fund has introduced an innovative way of opting for SWPs, known as Bandhan SWP which you should read.

About SBI Equity Hybrid Fund

Fund selection is an important aspect of any investment decision. We have discussed how to select funds for your investment needs a number of times in our blog. For the benefit of our new readers, you should select fund categories first, based on your risk appetite and your investment goals. Once you have zeroed in onto the right category, you should select schemes which have a strong long term performance track record.

SBI Equity Hybrid Fund is a great example of fund, with a strong long term performance history. Regular Advisorkhoj readers know that we give a lot more importance to performance consistency versus short term returns. We urge investors to use our tool, Top Consistent Mutual Fund Performers to see the most consistent performers in any particular mutual fund category. SBI Equity Hybrid Fund is one of the most consistent performers in Aggressive Hybrid Funds category. In 3 out of the last 5 years, SBI Equity Hybrid Fund has been a top quartile performer. In 4 out the last 5 years, the scheme has figured in the top 2 performance quartiles.

The scheme was launched in 1995 and has over Rs 28,000 Crores of assets under management (AUM). The expense ratio of the scheme is 2%. The scheme has given 14% CAGR returns since inception. Dinesh Ahuja and R. Srinivasan are the fund managers of this scheme. SBI Equity Hybrid Fund has given one of the highest SIP returns in Aggressive Hybrid Funds category (please see our tool, Top Performing Systematic Investment Plan - Hybrid: Aggressive).

Conclusion

In this blog post, we discussed how our hypothetical SWP from SBI Equity Hybrid Funds generated cash-flows for investors and at same time also created substantial amounts of wealth. We also discussed several aspects of SWP including taxation, withdrawal rates, fund selection etc. SBI Equity Hybrid Fund is a great choice for SWP over a long investment horizon. You should consult with your financial advisor SBI Hybrid Equity Fund is suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Demystifying debt mutual funds

- Why Balanced Funds may be the best investments for new mutual fund investors

- How do you know if you have good funds in your mutual funds portfolio: part 1

- Know your mutual fund tax obligations to manage your investments effectively

- Asset Allocation is much more important than fund selection

LATEST ARTICLES

- SBI Dynamic Asset Allocation Active FOF: A smart asset allocation solution in shifting markets

- Your perfect Gift for your little ones this Childrens Day: SBI Magnum Childrens Benefit Fund Investment Plan One of the best performing funds for your childs future

- Magnum Hybrid Long Short Fund: A smart investment option in challenging conditions

- Delivering Returns with Resilience: SBI Multicap Funds proven multicap strategy

- SBI Equity Hybrid Fund: One of the top performing hybrid funds in current market conditions

Quick Links

Follow SBI MF

More About SBI MF

POST A QUERY