Canara Robeco Consumer Trends Fund: One of the best performing consumption funds

India is primarily a domestic consumption driven economy and consumption growth is likely to a central theme in the India Growth Story. It is not surprising that consumption is one of the most popular investment themes in mutual funds. There are 22 thematic consumption funds (as on 20th November 2025). While most thematic consumption funds were launched in the last 5 years, Canara Robeco Consumer Trends Fund is one of the very few thematic consumption funds, that has a vintage of 15+ years. Canara Robeco Consumer Trends Fund is one the best performing thematic funds in the last 5 years. In this article, we will review Canara Robeco Consumer Trends Fund.

Canara Robeco Consumer Trends Fund has outperformed the broad market

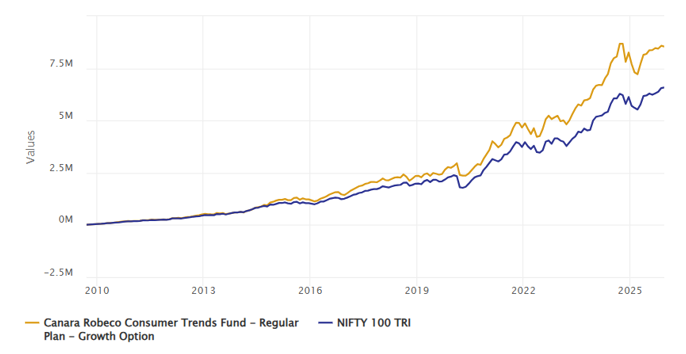

The chart below shows the growth of Rs 10,000 investment in Canara Robeco Consumer Trends Fund versus the large cap index, Nifty 100 TRI since the inception of the scheme. You can see that the investment value would have multiplied 11X since inception, outperforming the large cap index.

Source: Advisorkhoj Research, National Stock Exchange, as on 20th November 2025

Superior rolling returns compared to peers

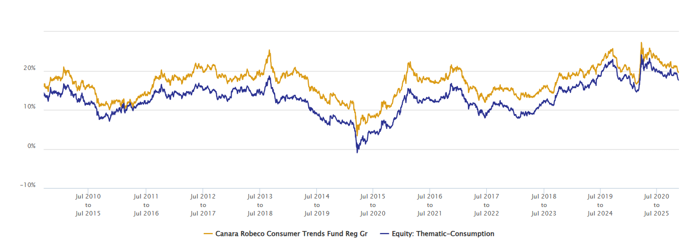

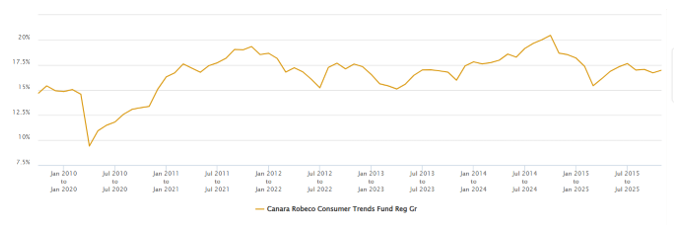

The chart below shows the 5 year rolling returns of Canara Robeco Consumer Trends Fund versus the Thematic Consumption Funds category average since the inception of the fund. You can see that during this period Canara Robeco Consumer Trends Fund consistently outperformed the category average for 5 year investment tenures across all market conditions e.g., rising market, falling market, range bound market etc.

Source: Advisorkhoj Research, as on 20th November 2025

The table below shows the rolling returns statistics of Canara Robeco Consumer Trends Fund versus the thematic consumption funds category average over different investment tenures since the inception of the fund. You can see that the fund outperformed the category average in all the parameters (statistics) over different investment tenures.

Source: Advisorkhoj Research, as on 20th November 2025

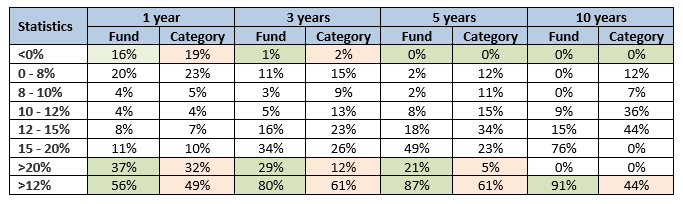

The table below shows the returns distribution of Canara Robeco Consumer Trends Fund versus the thematic consumption funds category average over different investment tenures since the inception of the fund. You can see that the fund provided superior risk / return trade-off compared to category average.

Source: Advisorkhoj Research, as on 20th November 2025

Downside risk limitation

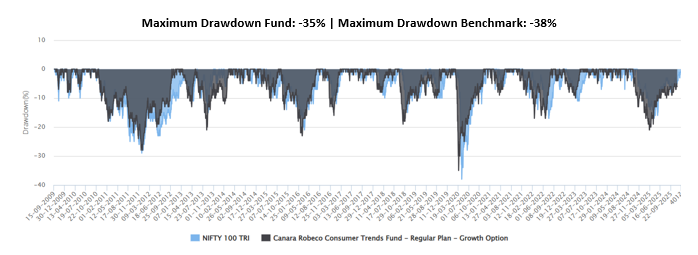

The chart below shows the drawdowns of the fund versus the large cap index, Nifty 100 TRI. You can see that the fund was able to limit downside risks for investors.

Source: Advisorkhoj Research, as on 20th November 2025

High consistency in quartile ranking

Canara Robeco Consumer Trends Fund was in the Top 2 quartiles, 7 times in the last 10 years. In 2025 the fund is back again in the top quartile.

Source: Advisorkhoj Research, as on 20th November 2025

Wealth creation through SIP

There is a perception among investors that thematic funds need market timing and therefore suitable for lump sum investments. However, a broad theme like consumption, which is diversified across several sectors, can be suitable for long term investment through SIP. The chart below shows the growth of Rs 10,000 monthly SIP in Canara Robeco Consumer Trends Fund since the inception of the scheme. With a cumulative investment of Rs 19.5 lakhs, you could have accumulated a corpus of Rs 85 lakhs, outperforming the broad market index.

Source: Advisorkhoj Research, as on 20th November 2025

The chart below showing rolling 10 year SIP returns of Canara Robeco Consumer Trends fund since the inception of the fund. You can see that the fund almost always delivered double digit returns over 10 year SIP tenures.

Source: Advisorkhoj Research, as on 20th November 2025

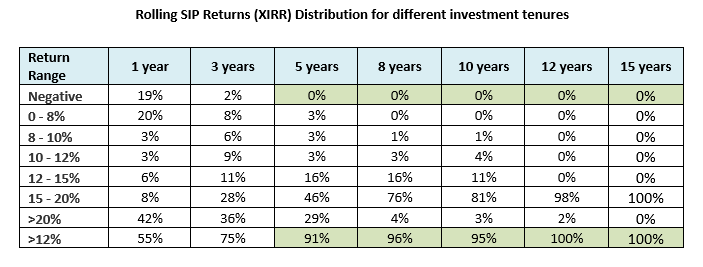

The fund never gave negative SIP returns over 5 years or longer SIP tenures. Furthermore, the fund have 12%+ CAGR returns in over 90% of the instances for 5+ year SIP tenures.

Source: Advisorkhoj Research, as on 20th November 2025

Superior risk adjusted returns

The Up Market Capture Ratio of Canara Robeco Consumer Trends Fund versus the large cap index (Nifty 100 TRI) was 99% which implies that if the index went up by 1% in a month, then the scheme's Net Asset Value (NAV) went up by 0.99%. The Down Market Capture Ratio of the fund was only 85% which implies that if the index went down by 1% in a month, then the scheme's Net Asset Value (NAV) went down by 0.85% only. The market capture ratios of Canara Robeco Consumer Trends Fund are a clear indication of the potential of the fund to give superior risk adjusted returns of the fund.

Higher large and midcap allocations versus peers

Source: Canara Robeco MF, Advisorkhoj Research as on 31st October 2025

Canara Robeco Consumption Fund – Investment Strategy

- The fund identifies themes like changing consumption pattern emerging out of rising middle class and increase in per capita income potential

- Fund follows a 'Growth' style of investing

- Market cap agnostic with focus on management quality

- Focus is on selective categories such as 1) discretionary consumption - supported by aspirational spending and rising disposable income and 2) the retail financers (banks and NBFCs) benefiting from the low credit penetration in the retail segment

- The fund participates in categories supported by regulatory or demand-backed tailwinds

- For stock selection, the fund manager spots the changing dynamics in an industry, identify winners early and then stay invested with superior executors to earn compounding returns

- Canara Robeco, as an AMC, focuses on the fundamentals of the business, the quality of management, sensitivity to economic factors and the financial strength of the company

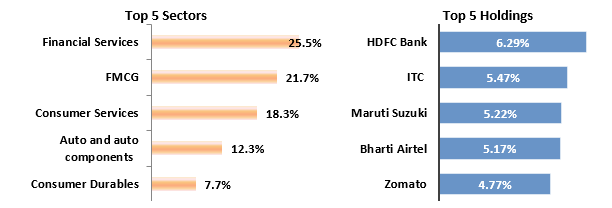

Current portfolio positioning

Source: Canara Robeco MF, Advisorkhoj Research as on 31st October 2025

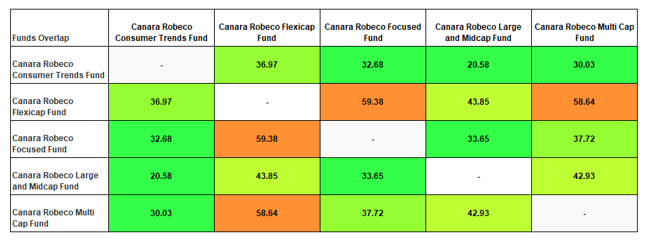

Low Overlap with Canara Robeco Diversified Equity Funds

The graphic below shows the portfolio overlaps of different Canara Robeco equity funds (including Canara Robeco Consumer Trends Fund. You can see that the fund has low overlap with Canara Robeco diversified equity schemes. In other words, you can include this fund in your portfolio along with other Canara Robeco equity funds.

Source: Advisorkhoj Research, as on 31st October 2025

Who can invest in Canara Robeco Consumer Trends Fund?

- Suitable for investors looking for tactical satellite allocations to their overall equity portfolio

- Investors who want capital appreciation over sufficiently long investment tenure

- Investors with investment horizons of at least 5 years or longer

- Investors with very high risk appetite

- You can invest in lump sum or SIP depending on your financial situation and investment needs

- Investors should consult with their financial advisors or mutual fund distributors if Canara Robeco Consumer Trends Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Canara Robeco Midcap Fund: Strong potential for outperformance

- Canara Robeco Multicap Fund:Strong all round outperformance

- Canara Robeco Large Cap Fund: A consistent wealth creator

- Canara Robeco Large and Midcap Fund: Two decades of wealth creation

- Canara Robeco Flexicap Fund: Good fund for volatile markets

Canara Bank, with over a century of experience, and Robeco, offering global investment expertise, combine to bring collective knowledge. Together, they deliver strong, sustained performance to secure your financial future.

Investor Centre

Follow Canara Robeco MF

About Canara Robeco MF

POST A QUERY