4 Early Life Mistakes which Investors should avoid at any cost

Youth – a golden period of our life, a period which is free from responsibilities (for the most part anyways), a period which makes us take risks, a period of carefree joy and a period which teaches us life’s lessons. Yes, mistakes we commit in youth teach us lessons we understand when we age and become mature. A famous proverb says – if only youth had the knowledge and old age the strength!

Yes, many mistakes would have been avoided if we had the required knowledge in our youth especially when it came to taking care of our finances. Being carefree and reckless, building up a financial portfolio usually takes a back-seat because the newly attained financial freedom calls for celebrations. The trendy gadgets, that high-end tablet, a new bike or a car, etc. divert our finances from savings to splurging. Well, no one is to blame. Who can resist the temptation of such material comforts when the joy of owning them overwhelms the young mind? Read Your Plan – Your Investments

On a serious note, the bottom line is that taking control of one’s finances and the development of a financial portfolio is usually ignored in the early ages of our life when we become financially free. Other than providing insights into life, our elders also render advice when it comes to taking care of our finances when we are young. Theoretically, we all know how to secure a good future but in practice how many of us apply the knowledge? As Robert Kiyosaki, author of Rich Dad Poor Dad, rightly commented in his book – ‘Most people never get wealthy simply because they are not trained to recognize the opportunities right in front of them’.

He was not wrong because, we tend to suffer from this problem and as a result commit financial mistakes, especially when young, which must be avoided. If you are still scratching your head, trying to figure out what such mistakes could be, here is a list of 4 such common errors most youngsters commit when it comes to finance:

Procrastination

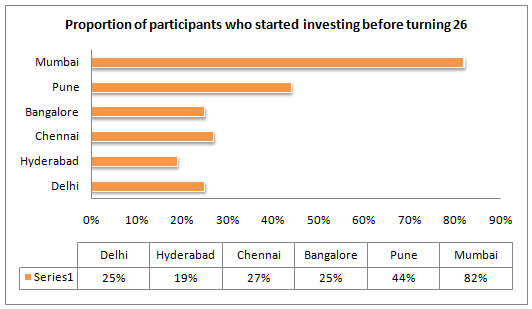

Delaying things is a very common practice which is seen in almost all aspects of our lives. As a famous proverb goes, ‘Procrastination is the grave in which opportunity is buried.’ We tend to delay doing things and investments are no exception. A survey conducted by Ameriprise on 700 Indians in six of the major cities of the country yielded the following result which bolsters my statement.

When asked how many of the individuals started saving before they attained 26 years of age, here’s what the answer was:

Though participants in Mumbai were quite aware, the other metropolitans showed a dismal figure and it was actually not very surprising. Inculcating the habit of savings, investing and building up a financial portfolio is usually given a miss earlier in life. Even those who do develop the habit don’t follow it religiously and have a haphazard saving pattern.

The Power of Compounding (try this Power of Compounding Calculator), which yields great returns and is also the applied principle in almost all investment instruments, depends largely on the time factor. Longer the duration of investment, larger would be the accumulated fund. If numbers are your thing, here is how it works:

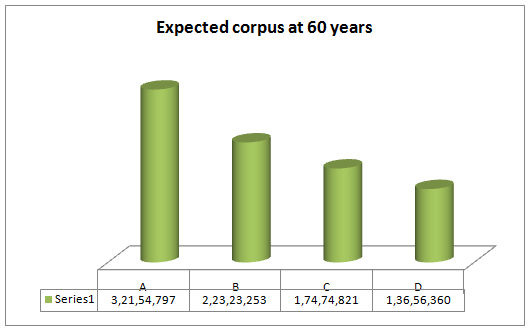

Say, four individuals – A, B, C and D, aged 25 years each, are asked invest Rs. 5000 per month till they reach 60 years of age. They are given the choice of timing their investments. A starts his investments immediately while B delays it by 3 years. C delays his investments by 5 years while D starts investing after 7 years. Their respective corpus at age 60 would be:

A slight delay of 3 years caused B to lose about 10 million, whew! This is the power of compounding I was talking about and the later you start investing, the smaller your corpus would be.

You may also like to read How Compound Interest Works

Favoritism

Early in our adulthood when we become financially free, we tend to take more risks. Free from any major responsibilities, most of us favor equity investments because of the thrill of risk inherent in them. On the contrary, some of us are more conservative and tend to invest only in debt securities, bonds or fixed deposits, to protect our returns, however small. Playing favorites when it comes to investments is a bad practice. Wise men say – Don’t put all your eggs in one basket and they are right. Having a lopsided portfolio would make your investments risky. While favoring debt would mar the return potential, heavy equity exposure would make you prone to market volatility.

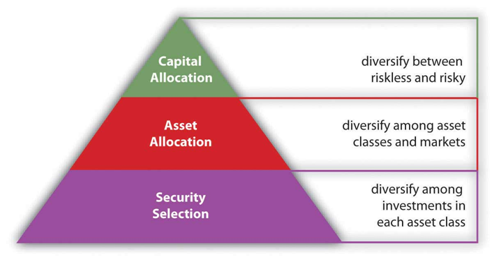

Diversification is the key to wealth. If you want to retire rich, diversify your investments among the investment avenues available to reap the benefits of diversified returns. Diversification is a three step process which first starts with -

- Capital Allocation which earmarks the amount to be invested in risky funds, moderately risky funds and non-risky funds. Know How to achieve financial goals through right asset allocation

- The second is Asset Allocation which tries to maximize the returns generated from the earmarked quantum of risk. This step identifies the assets to be chosen for the different funds classified in the earlier step as per their risk profile. You may check your Risk Profile here

- The third and the last step is Security Selection which includes selecting the securities for each asset class chosen in Step (b) above.

You may like to read Top 4 Investment Faux Pas

The pyramid helps depict the diversification levels at a quick glance:

No Financial Planning

Building up a financial portfolio is very essential when it comes to managing investments across various assets. However, when we are young, we are in the learning stages when we grasp the meaning of financial independence. As such financial literacy is very low which results in a lack of financial planning. As such individuals don’t have any objective-aligned financial strategy which results in haphazard investments and lack of disciplined investments. Some common traits found in young investors include:

- No perception of financial objectives

- Performance chasing investments

- Undisciplined investments

- No long-term perspective in investments

- No financial strategy

I can make the list as long as I want and I am sure you, as readers you are agreeing with the stated points and are even suggesting some yourself, but, to cut the story short, the gist of the matter are that there is no financial planning in early life. Thus, a goal-based investment strategy, if not adopted will never yields the expected returns. A goal-aligned investment is the only approach for a financially free life which, sadly, is a very common oversight in early stage investments.

Overspending

Yes, early life seems like a party when we want to have it all. We spend carelessly and save little because we feel that we have our entire lives ahead of us for savings. Is it prudent? As explained earlier, the power of compounding works wonders and investments started earlier, no matter how small, yield the best returns. So don’t blame your earnings to be meager which prevents savings. Blame it on those parties and gadgets that you indulged in which ate away your earnings leaving nothing for investment. We suggest you to read Starting Small but Steadily in Mutual Funds

Another very common found practice is availing different types of loans. That flashy car or having own home motivates many individuals. Even if owning a house is given a miss (because of the huge financial costs involved) most of us give in to the temptation of owning a car. I agree that having a car has become a necessity in today’s age, but indulging in debt for it is not justified.

When we begin our careers, most of us are already burdened with student loans which require paying off and adding more debt burden to our income is foolish. Investors should first pay off their education loans, build up a financial portfolio, start investing for a couple of years and then go about availing a loan for buying a car or for other purposes. ‘Don’t bite more than you can chew’, is a common expression and it holds true in this scenario as well. Don’t overspend, or indulge in loans until you have a sufficient income level. Instead, start saving and see the power of compounding work its miracles. Read For early starters power of compounding can be magical

There are other mistakes committed earlier in life which spell disaster and should be avoided but for now, the above four are the most important ones. They say, ‘take care of the pennies and the pounds will take care of themselves.’ Start avoiding the above-mentioned mistakes in the first place and the other mistakes would be easily identified. So, when financial freedom sets in welcome financial literacy too and follow the basic guidelines of investing which are:

- Make a financial plan based on the life goals you have and the finances required for meeting such goals

- Build up a financial portfolio and diversify your investments

- Follow a goal-aligned investment strategy

- Lastly, maintain a disciplined approach to investments and avoid the temptation of dipping into your investments randomly.

Becoming wealthy is not luck; it is intelligent and disciplined investments. Keep in mind the mistakes that occur when we are young, avoid them and have a financially stress-free future.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Why you need to have hybrid mutual funds in your portfolio: Different types of funds Part 2

- Why you need to have hybrid mutual funds in your portfolio: Misconceptions Part 1

- Which is the best time to invest in mutual funds

- Economic slowdown: Is it real and what should you do

- Importance of liquidity in investing: Mutual funds are ideal solutions

An Investor Education Initiative by ICICI Prudential Mutual Fund to help you make informed investment decisions.

Quick Links

Follow ICICI Pru MF

More About ICICI Pru MF

POST A QUERY