Credit Opportunities Funds can give higher returns with limited volatility

Credit Opportunities Funds, also known as corporate bond funds, invest in corporate bonds with aim of giving higher returns to investors by capturing credit spreads of lower rated bonds. Credit Opportunities Funds employ accrual strategy (they hold bonds till their maturity) to limit interest rate risk.

In the last 3 years the Credit Opportunity Funds gave average annualized return of 10.4%. The median 3 year annualized return was 10.6%. The maximum return in this category was 11.2% while the minimum return was 9.25%. These returns (even the minimum) were higher than returns of traditional fixed income investments like Fixed Deposits and Government Small Savings Schemes. Even in the last 12 months, when interest rates and yields were in a downward trajectory, average return of Credit Opportunities Funds was 10.3% (median return was 10.4%). You can see returns of Credit Opportunity Fund relative to other debt fund categories over various investment tenures by using our Mutual Fund Category Returns tool.

In this blog post, we will discuss how credit opportunities funds work. We will discuss the risk factors and correct misconceptions about this category of mutual funds. By the end of this article, hopefully, Credit Opportunities Funds will make a compelling case for inclusion in your fixed income investment portfolio.

What are corporate bonds?

Before we discuss Credit Opportunities Fund, we should discuss corporate bonds because these securities form the underlying portfolios of Credit Opportunities Funds. Companies need funds to finance ongoing operations, capacity expansion, modernization and acquisitions. Companies raise funds either in the form of equity or debt. Debt is the more common form of financing, because equity finance has a direct impact on the existing shareholders (dilution of ownership).

The most common form of debt financing in India is bank loan. However, bank lending rates are still quite high in India (despite several rate cuts by the RBI). Bonds, also known as debentures, offer companies a more attractive (cheaper) alternative of raising debt capital.

Corporate Bonds or Non Convertible Debentures (NCDs) are securities issued by a company. When you are buying a corporate bond you are essentially lending money to the company. The company will return the principal to you on a specified maturity date. Also the company will pay you a specified rate of interest (in bond finance language, known as the coupon) on a regular basis. In India, coupon (interest) payments are generally made on semi-annual basis. There a few important concepts that, you should understand when investing in bonds.

- Par Value: Par value of the bond is the money that the issuer will pay you on maturity of the bond. You can think of par value as the principal of the loan given by you to the company. In India the par value of a corporate bond is usually

र1,000 - Price: You can buy a bond at par value or at a different price (higher or lower), depending on when you buy the bond. The price of a new issued bond is close to its par value.

- Coupon: Coupon is the interest rate paid by the bond issuer (company). The coupon rate is always a percentage of the par value.

- Current Yield: Current Yield is the annual return on investment from the bond. If coupon rate of a bond (par value

र1,000) is 9%, then the company will pay youर90 interest every year. If you bought the bond at par value (र1,000), the yield will be 9%. However, if you bought the bond atर900, then the yield will be 10% (र90 divided byर900) - Yield to Maturity (YTM): Yield to maturity (YTM) is an important concept in bond investing. It is the internal rate of returns of all the cash-flows in the bond, the current price of a bond, the coupon payments to be made till maturity and the maturity amount. YTM basically tells you, the total returns that you will get if you buy a bond at its current price. Higher the YTM, higher will be your returns if you hold the bond to maturity.

If you understand the basic concepts of bond finance, you can be a much more intelligent debt investor. If you are investing in short term or medium term accrual based debt mutual funds, the fund YTM is the most important number that you should look at, when making your investment decision, because the YTM is directly related to your future returns.

Corporate bonds give attractive yields

The current benchmark 10 year Government bond yield is around 6.8 – 7%. The current fixed deposit rates offered by most banks is in the range of 7.25 – 7.5%. After the recent rate cut announced by the RBI, we can expect FD rates go down further in the future. Corporate bonds offer higher yields compared to FDs because, unlike FDs, corporate bonds are not totally risk free investments.

However, if you have a good understanding of risk, the risk return trade-off of corporate bonds make them quite attractive investment propositions in this interest rate environment (we will discuss this in more detail later). Some AAA rated (highest safety) bonds in September offered around 9% or higher interest rates. Lower rated bonds can offer even higher yields. We had discussed earlier, how credit opportunities funds capture these higher yields and gave double digit returns to investors in past 1 to 3 years.

Risk Factors of Corporate Bonds and Credit Opportunities Funds

There are broadly two types of risks in fixed income.

- Interest Rate Risk: Bond prices go up when interest rate falls and go down when interest rate risks. However, if an investor holds a bond till its maturity, interest rate risk is irrelevant to the investor, because irrespective of the market price of the bond, the investor will continue to receive coupon (interest) payments and the face value of the bond at maturity. Credit Opportunities Funds hold bonds till their maturities. Hence interest rate risk is limited in these funds and they can give fairly stable returns.

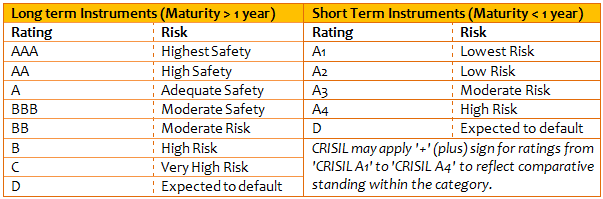

- Credit Risk: Credit risk arises if the bond issuer is not able to make interest or principal payments to the bondholders. If the bond issuer defaults on interest or principal payments, the price of the bond will fall. The credit rating assigned to a bond by rating agencies provides investors an objective evaluation of credit risk. Let us understand how credit rating scale works. The table below describes the credit rating scale used by CRISIL to rate fixed income securities.

Source: CRISIL

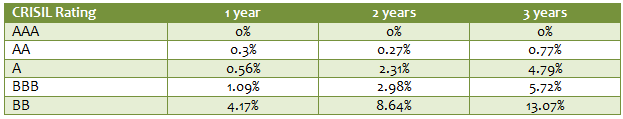

If you are analytically oriented, the table below will tell you, the average default rates of CRISIL rated securities from 1988 to 2015. We have not shown the default rates of lower rated bonds, because credit opportunities funds rarely invest in such bonds. In addition to investing in high quality bonds, good fund houses have setup robust risk management mechanisms to pro-actively monitor and manage credit risk.

Source: CRISIL 2015

You can see that the probability of default of AAA, AA, A and even BBB rated bonds is quite low. Last year, the impact of a default on debentures of an auto ancillaries company, on two mutual schemes of a particular fund house sparked off a lot of discussion in the media regarding credit opportunities funds. Many of those discussions missed a fundamental point about mutual fund investing, which we want our readers to understand.

When you are investing in a mutual fund, you are investing in a portfolio of securities. You should be concerned about the scheme risk / return profile and not be concerned about individual names in the scheme portfolio. You can get a sense of the overall portfolio credit risk of a credit opportunities fund from the credit quality of fund portfolio and average default rates for each rating class (shown in the table above).

For example, if a fund has 35% AAA, 35% AA and 30% A rated bonds in its portfolio, the weighted average probability of default is only 1.4% (35% X 0% + 30% X 0.77% + 30% X 4.79%). This is just a hypothetical example, to illustrate credit risk of a bond fund. As per Morningstar data, the category average “AAA” rated bond holdings of credit opportunities funds is 26% of the total portfolio. “AA” rated bonds account for 46% on an average, while “A” rated bonds account for 26%. If we weight the CRISIL’s three year default rates with category average ratings distribution, the default risk works to be 1.25% only. Investors should also understand that, while downgrade in credit rating causes bond prices to fall, an upgrade in credit rating causes bond prices to rise. If there are both downgrades and upgrades of bonds in the fund portfolio, then they can cancel out each other’s impact on the fund NAV.

Conclusion

We had discussed earlier that, the interest rate risk of credit opportunities funds are limited. We also saw that the average credit quality profile of these funds is quite good and weighted average portfolio default probability is very low. Since these funds can give 2 – 3% extra returns compared to risk free investments, their risk return trade-offs can be quite attractive. Investors should discuss with their financial advisors, if credit opportunities funds are suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- Why you need to have hybrid mutual funds in your portfolio: Different types of funds Part 2

- Why you need to have hybrid mutual funds in your portfolio: Misconceptions Part 1

- Which is the best time to invest in mutual funds

- Economic slowdown: Is it real and what should you do

- Importance of liquidity in investing: Mutual funds are ideal solutions

An Investor Education Initiative by ICICI Prudential Mutual Fund to help you make informed investment decisions.

Quick Links

Follow ICICI Pru MF

More About ICICI Pru MF

POST A QUERY