For early starters power of compounding can be magical

Interest is calculated on the initial principal and also on the accumulated interest of previous periods of an investment. Compound interest can be thought of as “interest on interest,” and will make an investment grow at a faster rate than simple interest, which is interest calculated only on the principal amount. The rate at which compound interest accrues depends on the frequency of compounding; the higher the number of compounding periods, the greater the compound interest. Thus, the amount of interest accrued on 10,000 INR compounded at 10% annually will be lower than that of 10,000 INR compounded at 10% semi-annually over the same time period. The interest if compounded 10% quarterly will ensure higher returns.

The only way to generate money is to save more than you spend. The rich are not rich because they have high income but they inculcated the habit of savings. If savings is the way to get wealthy then time is the factor that will exponentially increase the savings. You might think how small amounts could possibly make a large difference. It does and that is the power of compounding. The concept of compounding is the foundation of the time value of money. Time value of money is one of the foundations of modern finance. It states that value of money changes depending on when it is received. 1,000 INR is worth more today than it will be in the next ten years. This occurs because you will be able to buy lesser good and services in future with the same 1,000 INR due to an increasing inflation. The 1,000 INR that you hold today has the potential to generate returns and dividends. If you keep losing such small amounts of money today you are losing potential interests and dividends which may not hold the same value ten years down the line. For example if you invest 1000 INR five years later your investment will not be able to accumulate the compounding interest for these five years. But if you invest today and leave the investment to earn compounded interest for ten years the returns will be higher. The simple connection of time value of money and compound interest is: the longer you leave your money invested, the more returns it will be able to generate. Start early, invest for long periods of time and watch yourself become rich.

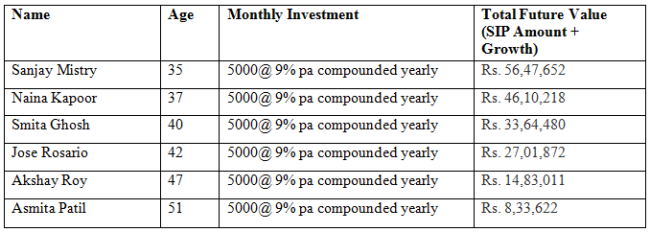

An example of time value of money and compounding can be found in this table below. In the above table hypothetical investors have been created to show how compounding is done in real time. The investors who are of varied age invest the same amount in debt funds which could generate returns upto 9% annually compounded. All the investors are going to keep investing till they are 60. We will see how the time factors affect the returns.

The investor investing for the longest time is Sanjay Mistry. He is investing for a period of 25 years. Hence, his investment is able to generate a return of Rs.56,47,652 due to the long period of compounding. Asmita Patil who is investing the same amount is investing it only for nine years. Hence, the future value of her investment is only Rs.8,33,622. The differences in the returns are because of the difference in the time invested even though the compounding rates remains the same. Hence, the true value of compounding can be extracted when the time value of money is considered.

If you are still thinking if this is the right time to invest or not, stop thinking and start acting because your money needs to start accumulating “interest on interest”. Due to compound interest even small sum of money invested over a fixed period time and in a disciplined manner can create a snowball of money. So do not underestimate the power of Rs.1000 that you may have in your wallet right now. It maybe just enough to fund the foreign holiday you were planning five years down the line. The magic of compounding may not seem very effective in the beginning but wait a little to see the results. Time is money and money is time but I think you already know that. The longer you leave the money to multiply the sweeter will be the results. Start saving and start investing and watch the magic of compounding.

RECOMMENDED READS

LATEST ARTICLES

- Why you need to have hybrid mutual funds in your portfolio: Different types of funds Part 2

- Why you need to have hybrid mutual funds in your portfolio: Misconceptions Part 1

- Which is the best time to invest in mutual funds

- Economic slowdown: Is it real and what should you do

- Importance of liquidity in investing: Mutual funds are ideal solutions

An Investor Education Initiative by ICICI Prudential Mutual Fund to help you make informed investment decisions.

Quick Links

Follow ICICI Pru MF

More About ICICI Pru MF

POST A QUERY