Starting Small but Steadily in Mutual Funds

Investments are not for the rich. They are to make you rich. To be able to start this journey you start small towards building a substantial corpus. As kids we all had the habit of investing of in piggy banks. The money was put away to fulfill short term goals like birthday present for your best friend or just to save. The amount may have been very small but at the end of the year you will be surprised the amount you have. If this amount accumulated, without the power of compounding, in a piggy bank can surprise you then imagine the effect the effect of compounding on the same amount.

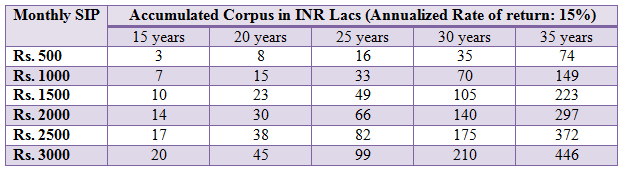

It is human tendency to underestimate the power of small and overestimate the power of big. An investment can be started with an amount as small as Rs. 500. A sum of Rs. 500 if invested in equity funds for 25 years, the rate of return could be as high as 15% - 18% annualized. The total amount invested in the SIP would be Rs. 1.50 Lacs (Rs.500 x 300 months) and the total growth of this corpus throughout the years will be INR 14.92 lacs at 15% compounded annual return. Your total future value, which is the money invested and the total growth will be Rs. 16.42 lacs. If the compounded annual return is 18%, then your total future value will be Rs. 29.12 lacs. All you did was invest Rs. 500 every month. This is the magic of compounding which is applicable to all SIPs and Mutual Funds irrespective of the size of the investment. These small investments have the power to turn into substantial money as already showed in the example. The table below shows the accumulated corpus over different investment periods, for different monthly SIP payments at 15% annualized return.

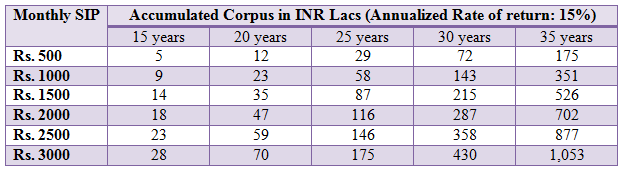

Now let us see the accumulated corpus over different investment periods, for different monthly SIP payments at 18% annualized return.

One of the biggest advantages of investing small amounts in diversified equity funds is that, it reduces your risk by diversifying the unsystematic risk. However, you should avoid investing very small amounts in a large number of funds, because it can lead to over-diversification. While investing in equities gives you high returns, you should remember that it exposes you to risks. If you want good returns, but are not willing to take the risk associated with diversified equity funds, you can invest in Balanced Funds to lower the risk. Start small if this is the first time you are about to invest. Also, if this is the first time you are shifting from a fixed deposit to mutual funds then it is alright to have your inhibitions. Start investing small amounts and slowly when you start to gain confidence increase the amount and diversify your portfolio.

People who have just started earning or youngsters who have money in their hands but also have the tendency to spend it all are always advised to start small. Starting small will not make the investment a burden that does not allow you splurge on your money. Instead it will make you feel less guilty when you buy an expensive phone on EMI because you will know that you are at least saving that little amount. Money, apart from being the susceptible to the magic of compounding can also perform a magic of its own. It can be in your wallet today and vanish tomorrow. It happens to a lot of us, especially when you promised yourself you will save that stipulate amount this month. To avoid such magic start small so only the favourable kind of magic is performed.

Starting early also allows you to plan for the future. There is nothing shameful about thinking about your retirement and have concrete plans when you are starting your career. The plans may change over the years but you will have a steady corpus going at an early age. Starting early may even give you the luxury of retiring early because you simply don’t need to work further to gather more. Starting early and small can only benefit you. So what are you waiting for? Start and start now!

RECOMMENDED READS

LATEST ARTICLES

- Why you need to have hybrid mutual funds in your portfolio: Different types of funds Part 2

- Why you need to have hybrid mutual funds in your portfolio: Misconceptions Part 1

- Which is the best time to invest in mutual funds

- Economic slowdown: Is it real and what should you do

- Importance of liquidity in investing: Mutual funds are ideal solutions

An Investor Education Initiative by ICICI Prudential Mutual Fund to help you make informed investment decisions.

Quick Links

Follow ICICI Pru MF

More About ICICI Pru MF

POST A QUERY