LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

Current market context

Though the market has bounced back from the March 2025 lows, volatility has returned in recent weeks due geo-political uncertainties, US tariffs / counter tariffs, EU sanctions on Russian oil, global economic slowdown etc. While India is projected to be the fastest growing economy in FY 2025-26, the global risk factors have been dragging the equity market down. From a long term perspective, India's favourable macro environment and resilient economic growth make Indian equities attractive for long term investors. LIC Mutual Fund has re-introduced four of their flagship schemes - LIC MF Focused Fund, LIC MF Value Fund, LIC MF Dividend Yield Fund and LIC MF Small Cap Fund, aligning them with current market dynamics. We covered LIC MF Focused Fund and LIC MF Value Fund earlier in this series. In this article, we will review LIC MF Dividend Yield Fund.

What is dividend yield?

Dividend yield is the annual dividend paid by the stock divided by the share price. Dividend yield is an important ratio in selecting stocks. Dividend yield = (Annual dividends ÷ Current share price). Suppose the share price of a company is Rs 100. The company declares a dividend of Rs 10. The dividend yield will be Rs 10 ÷ 100 = 10%. Dividend yield funds are equity mutual fund schemes that invest in relatively high dividend yield stocks.

Why dividend yield is important?

Key attributes of high dividend yield stocks are:-

- Tried and tested business model with an ability to generate healthy free cash-flows

- Relatively less prone to downside risk in falling market coupled with capital appreciation prospects in a reviving market

- Reflects optimum usage of free cash-flows, good operational health & sustainability of future earnings

- Consistent dividend payouts (income for investors) & growth or possibility of growth in dividend payouts

Dividend yield funds can add diversification and consistency to your portfolio

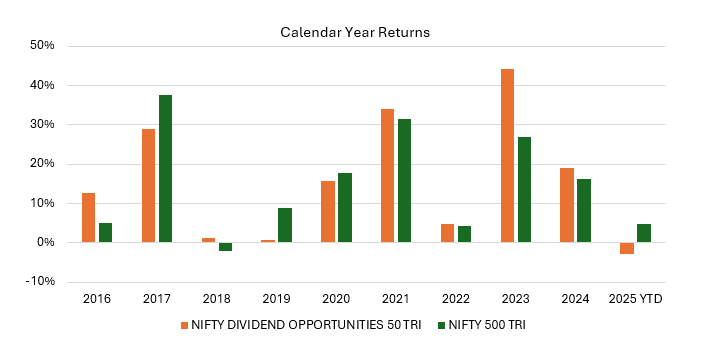

The chart below shows the calendar year returns of Nifty Dividend Opportunities 50 TRI (an index comprising of high dividend yield stocks) versus Nifty 500 TRI over the last 10 years. You can see the dividend opportunities index outperformed the broad market in the years when the market was volatile. You can also see that dividend opportunities index was also more consistent than the broad market index – outperforming the broad market index 6 times in the last 10 years.

Source: National Stock Exchange, Advisorkhoj Research, as on 22ndJuly 2025

Dividend yield funds can limit downside risks for investors

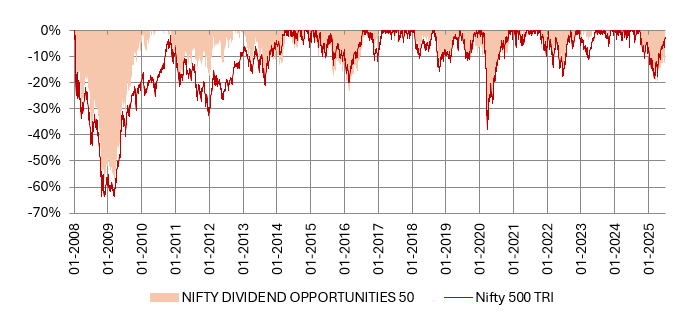

The chart below shows the drawdowns of Nifty Dividend Opportunities 50 TRI versus the broad market index, Nifty 500 TRI since 1st January 2008. You can see that the dividend opportunities index was able to limit downside risks for investors.

Source: National Stock Exchange, Advisorkhoj Research. Period: 1st January 2008 to 22nd July 2025

LIC MF Dividend Yield Fund - Outperformed peers across different market conditions

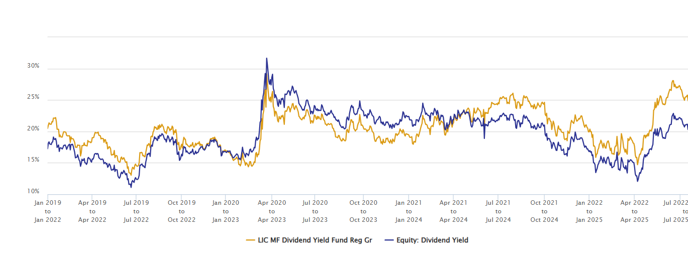

The chart below shows the 3 year rolling returns of LIC MF Dividend Yield Fund versus the dividend yields fund category average since the inception of the scheme. You can see that barring a brief period, LIC MF Dividend Yield Fund consistently outperformed the category average.

Source: Advisorkhoj Research, as on 22nd July 2025

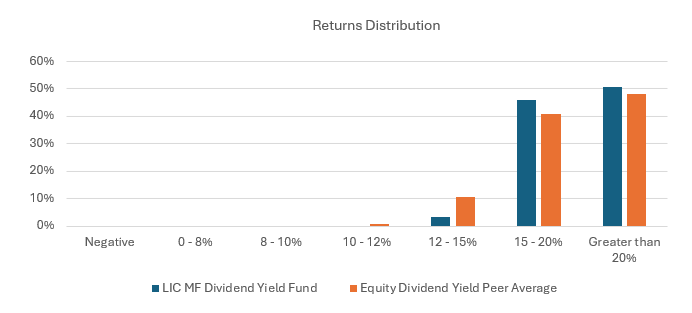

The chart below shows the 3 year rolling returns distribution of LIC MF Dividend Yield Fund versus the category average since the inception of the scheme. You can see that LIC MF Dividend Yield Fund gave 15%+ 3 year CAGR returns in 97% of the instances (observations) – higher than the category average.

Source: Advisorkhoj Research, as on 22nd July 2025

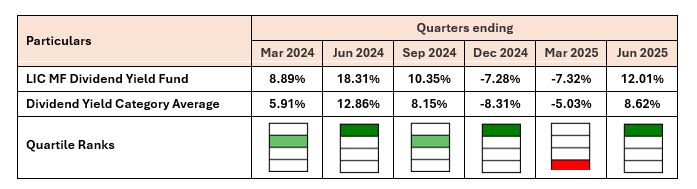

Consistently a top quartile performer

The fund has ranked in the upper quartiles on a fairly consistent basis in the last 18 months. The fund was in the top 2 quartiles in 5 out of the last 6 quarters, including 3 quarters in the top quartile.

Source: Advisorkhoj Research, as on 30th June 2025

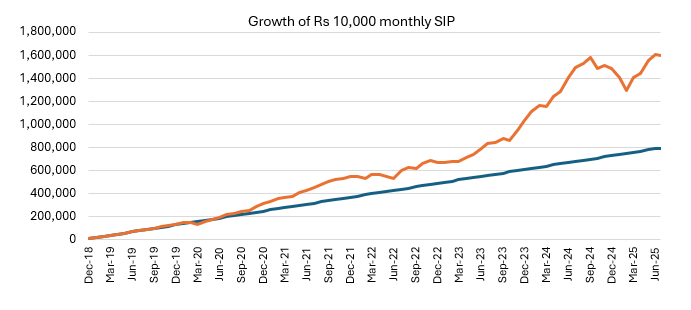

Impressive wealth creation track record

The chart below shows the growth of Rs 10,000 monthly SIP since the inception of the scheme. You can see that with a cumulative investment of Rs 7.9 lakhs, you could have accumulated a corpus of Rs 15.9 lakhs as on 22nd July 2025.

Source: Advisorkhoj Research, as on 22nd July 2025

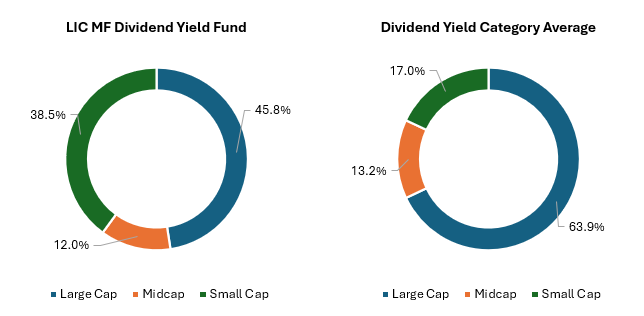

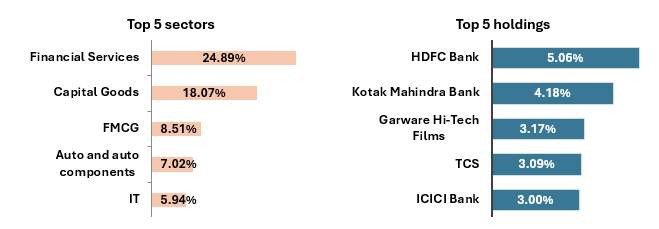

Portfolio positioning

The chart below shows the market capitalization allocations of LIC MF Dividend Yield Fund versus the dividend yield fund category average. You can see that the fund has significantly higher allocations to small cap stocks compared to the category average. The small cap allocation of the fund can help it outperform in market recovery and bull market phases.

Source: Advisorkhoj Research, as on 30th June 2025

Who should invest in LIC MF Dividend Yield Fund?

- The scheme is suitable for new or existing investors looking for potential long term wealth creation wanting to have exposure to relatively strong businesses. The scheme is suited for new investors because volatility will be relatively low.

- The scheme is also suitable for long term investors aiming to build wealth to meet their long term financial goals with a potentially better risk return trade off.

- Since the volatility of the fund can be expected to be on the lower side, the fund may also be suitable for investors who want regular tax efficient cash-flows from their investments through Systematic Withdrawal Plan (SWP) over long investment horizons.

- Investors should have minimum 3 - 5 years plus investment tenure for this scheme.

Investors should consult with their financial advisors or mutual fund distributors if LIC MF Dividend Yield Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Multicap Fund: One of the most consistent multicap funds

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY