LIC MF Flexi Cap Fund: A suitable long term investment in current valuation scenario

Current market scenario

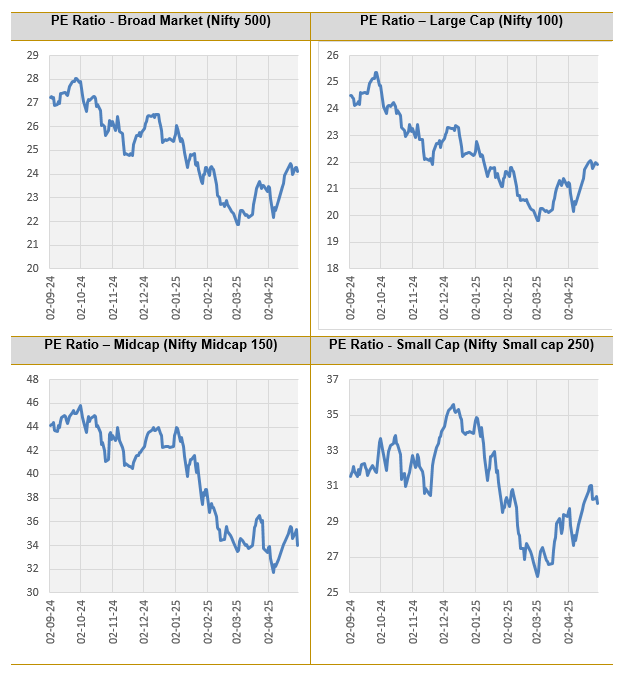

There is uncertainty in the market after the terrorist attack in Kashmir. The market had recovered from March lows after the Trump Administration announced a 90 day pause on retaliatory tariffs earlier this month. The deep correction has led to valuations moderating across all market cap segments (see the graphic below). Current levels may provide attractive investment opportunities in a flexicap strategy.

Source: NSE, Advisorkhoj research as on 30th April 2025

Why flexicap funds?

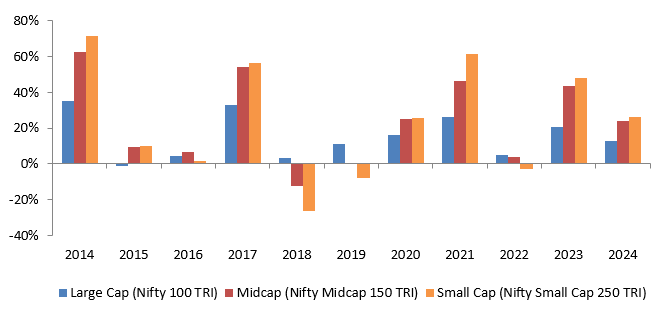

Different market cap segments have different risk / return characteristics. Midcap and small cap stocks can be more volatile than large caps, but they can give superior returns over long investment horizons. Different market cap segments underperform / outperform each in different market conditions (see the chart below). The fund managers of these schemes can invest any percentage of their assets in any market cap segment according to their market outlook. These schemes have wealth creation potential in the long term while balancing downside risks in the short term.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st December 2024

Why invest in Flexicap now?

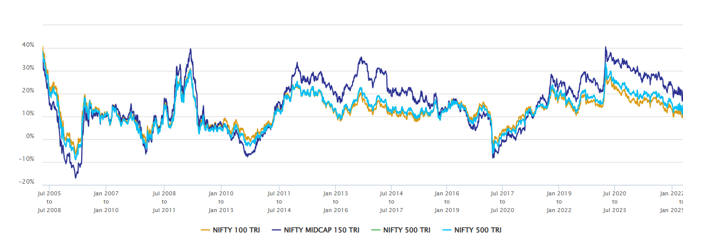

Though the market is off the lows, there are uncertainties in the short term to medium term. In the short term, the terrorist attack in Kashmir is a major risk factor since the tension between India and Pakistan can quickly escalate. In the medium there is considerable uncertainty about the direction of US Trade Policies and its fallout on the global economy. In this situation a flexicap strategy can be useful since the fund manager would have flexibility to manage allocations across market cap segments depending on his / her outlook. The chart below shows the 3 year rolling returns of different market cap indices (e.g. large cap, midcap, small cap) versus the broad market index, Nifty 500 over the last 20 years. You can see that Nifty 500 was able to provide relative stability in volatile market phases and also outperform large caps.

Source: National Stock Exchange, Advisorkhoj Research, as on 30th April 2025

Flexicap funds are also tax efficient. If an individual investor rebalanced between different investments (large, mid or small cap) then such rebalancing would attract tax liabilities for the investor. Flexicap funds are tax efficient in the sense that any rebalancing or change in market cap allocations of the fund does not attract any tax liabilities in the hands of the investor.

LIC MF Flexi Cap Fund

The LIC MF Flexi Cap fund managers Mr Nikhil Rungta and Mr. Jaiprakash Toshniwal apply a mix of investment strategies in order to earn consistent returns. Let us look at these in detail.

- Investment Style: Blend of Growth, Value, Turnaround, Tactical opportunities.

- Market Cap allocation: Dynamic driven by pricing anomalies and macros across the market cap spectrum. The fund managers have maintained relatively lower exposure to large cap as compared to the benchmark. The portfolio consists of 50-55 stocks and is biased towards sector rotation.

- Portfolio turnover / churn: The portfolio has high churn due to tactical changes as per the changing environment.

- Business Quality: Medium to High Quality business due to Value/ Turnaround / Tactical plays.

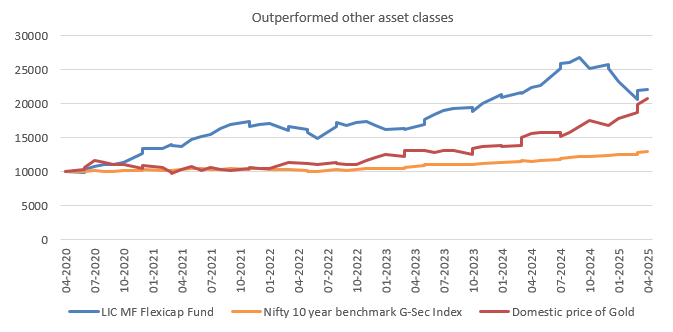

LIC MF Flexi Cap Fund – Outperformed other asset classes

Source: Advisorkhoj Research, as on 30th April 2025

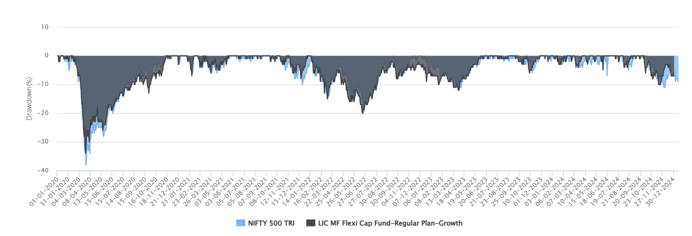

Limited downside risks in market corrections

The chart below shows the drawdowns of LIC MF Flexi Cap Fund versus the market benchmark over the last 5 years. We had several volatile phases market corrections during this period e.g. COVID-19, Taper Tantrum 2.0, Russia Ukraine War, FII sell-off, INR Depreciation etc. You can see that the fund was able to limit downside risks for investors in volatile market conditions.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st December 2024

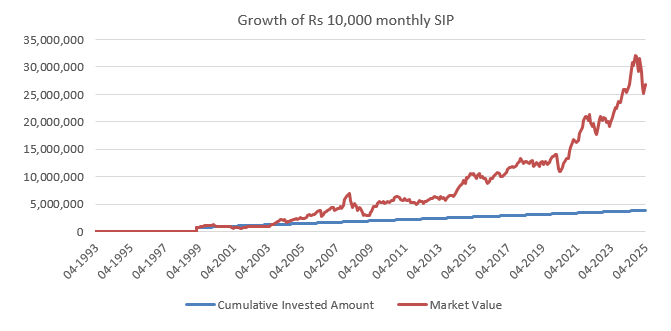

Wealth creation track record

The chart below shows the growth of Rs 10,000 monthly SIP in LIC MF Flexi Cap Fund since the inception of the fund. With a cumulative investment of Rs 38.5 lakhs, you could have accumulated a corpus of Rs 2.67 crores (as on 30th April 2025)

Source: Advisorkhoj Research, as on 30th April 2025

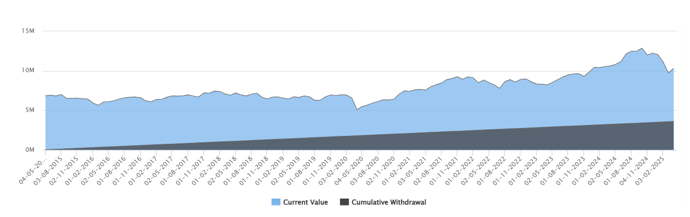

Strong SWP track record

The chart below shows the results of Rs 30,000 monthly SWP from a lump sum investment of Rs 50 lakhs in LIC MF Flexi Cap Fund over the last 10 years. We have assumed that the investment was made 12 months prior to the SWP start date to avoid short term capital gains and exit load. You can see that, despite making a withdrawal of Rs 36 lakhs from your initial investment of Rs 50 lakhs, the market value of your balance units in LIC MF Flexi Cap Fund would have grown to Rs 1.02 crores. This shows that for moderate withdrawal rates, SWP from LIC MF Flexi Cap Fund can generate regular cash flows, as well as capital appreciation.

Source: Advisorkhoj Research, as on 30th April 2025

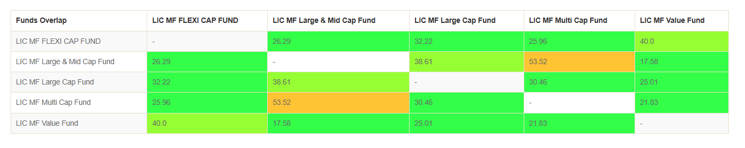

Low overlap with other LIC MF equity funds

The table below shows the portfolio overlap of LIC MF Flexi Cap Fund with other LIC MF diversified equity funds. You can see that the flexicap fund has low overlap with other funds. You can build a well-diversified portfolio of the equity funds using LIC MF Flexi Cap Fund and other LIC MF diversified equity funds.

Source: Advisorkhoj Research, as on 31st March 2025

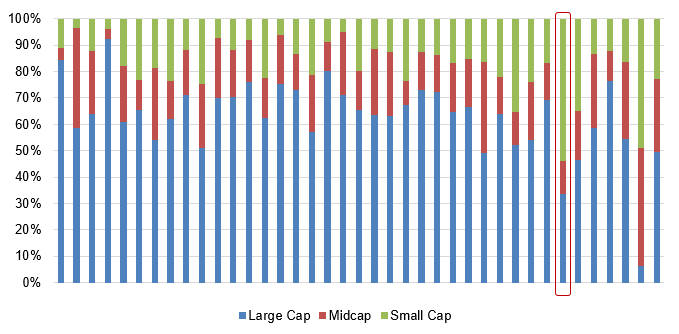

How market cap allocations differ from peers?

The chart below shows the market cap allocations of all the flexicap funds that have minimum 3-year track records and have minimum Rs 500 crores of AUM. You can see that LIC MF Flexi Cap Fund has significantly higher small cap allocations relative to peers. Since small caps have experienced the biggest drawdown in the last 4 months, LIC MF Flexi Cap is well positioned to do well in the market recovery phase.

Source: Advisorkhoj Research, as on 31st March 2025

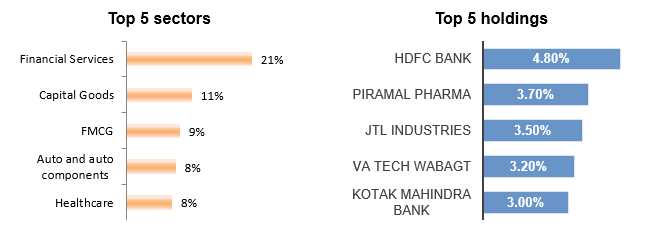

Current portfolio positioning

Source: LIC MF, Advisorkhoj Research, as on 31st March 2025

Why invest in LIC MF Flexi Cap Fund?

- The fund manager follows a prudent and pragmatic investment strategy to take advantage of opportunities across market cap segments and industry sectors.

- The fund managers have a judicious approach towards stock selection based on near term risk factors especially high interest rates, slowdown in consumption expenditure and global economic slowdown. The fund manager avoids sectors that may be more vulnerable to the near-term risk factors in the present geopolitical scenario.

- The fund manager has maintained relatively lower exposure to large cap as compared to the benchmark index and peers. The portfolio consists of 50-55 stocks and is biased towards sector rotation.

- The portfolio has high churn due to tactical changes as per the changing environment. The fund manager focusses on Medium to High Quality business.

- The investment strategy of the scheme and turnaround in performance gives us the confidence that the scheme can create alphas for investors over sufficiently long investment horizons.

Who should invest in LIC MF Flexi Cap Fund?

- Investors looking for capital appreciation over long investment tenures.

- Investors with high-risk appetites.

- Investors with minimum 5-year investment tenures.

- Depending on your investment needs, you can invest either in lumpsum or SIP.

- If you are worried about short term volatility, you can invest in LIC MF Flexi Cap Fund through a 3 – 6-month STP from LIC MF Liquid Fund.

Speak to a mutual fund distributor or your financial advisor to understand how LIC MF Flexi Cap fund may help you achieve your financial goals.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Multicap Fund: One of the most consistent multicap funds

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY