LIC MF Midcap Fund: A promising fund for long term investors

Market context

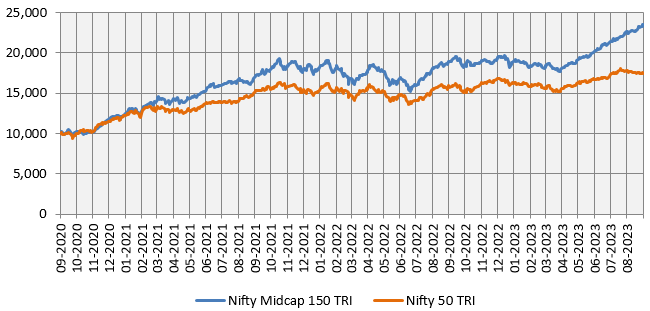

Midcaps have outperformed large caps over the last 3 years (see the chart below). In the last 3 years ending 31st August 2023, Nifty Midcap 150 TRI gave nearly 33% CAGR returns while the Nifty 50 TRI gave 20% CAGR returns (source: NSE, Advisorkhoj Research, as on 31st August 2023). As a result, there is a lot of investor interest in midcaps. In FY 2023 – 24, midcap equity mutual funds have received net inflows of nearly Rs 8,900 crores so far (source: AMFI, April to August 2023).

Source: National Stock Exchange, Advisorkhoj Research, as on 31st August 2023

What are midcap funds?

SEBI classifies 101st to 250th listed companies by market capitalization as midcap companies or midcap stocks. Midcap funds are equity mutual fund schemes which invest at least 65% of their assets under management (AUM) in midcap stocks. Midcaps have long track record of wealth creation in our country. In the last 15 years, Nifty Midcap 150 TRI has given CAGR returns of over 16%. As a result, midcap has always been one of the most popular equity mutual fund categories among retail investors. Some midcap funds have vintage of nearly 30 years.

Why midcap funds tend to outperform large cap funds?

- Midcap stocks have smaller revenue base compared to large caps. As a result, midcap companies have the ability to grow revenues and earnings much faster than large caps. Performance of these mid cap stocks may compensate for their higher volatility compared to large caps in the long run. You should always have longer investment tenures for midcap funds.

- Since midcap stocks tend to be relatively under-researched compared to large caps, the price discovery in this market cap segment is not as efficient as large caps. As a result, fund managers of midcap schemes have greater opportunities of identifying stocks which are trading at discounts to their fair or intrinsic valuations. These stocks can generate considerable alphas.

- Also, stocks which are midcap today have the potential of becoming large caps in the future. When a stock moves from midcap to large cap segment, valuation rerating takes place. This can result in considerable capital appreciation for investors. As per AMFI’s semi-annual reclassification of stocks in large cap, midcap and small cap segments, 8 midcap stocks became large cap in the last 6 months from January 2023 to June 2023 (source: AMFI, July 2023)

- The universe of midcap stocks (150 stocks) is 50% larger than large cap (total 100 stocks) stocks. Midcap stocks may have presence in industry sectors where large caps have no presence. Mid cap companies offer potential of growth in long run because of its presence in new areas/segments which are growing at faster pace. And these stocks have ability to acquire market share due to its advanced/new technologies, better products /services etc.

- The widening pool of entrepreneurial talent in India is best tapped in small and mid-sized companies which appear to be on the edge of growth phase. These companies are more flexible and have better ability to respond to market opportunities than their large cap peers.

About LIC MF AMC

LIC Mutual Fund is a Public Sector Undertaking (PSU) Sponsored asset management company (AMC) with stakeholders LIC of India, LIC Housing Finance Ltd, GIC Housing Finance Ltd and Union Bank of India. The AMC was established in 1989; one of the first AMCs to be established when the Government wanted to bring in more players in mutual fund industry after more than 2 decades of monopoly of Unit Trust of India. LIC MF offer a complete basket of products covering ETF, Debt, Equity, Hybrid, Passive and Solution oriented themes. LIC has built a brand which is synonymous to trust. LIC Mutual Fund, under the aegis of LIC of India, strives to achieve similar level in the Mutual Fund Industry.

About LIC MF Midcap Fund

LIC MF Midcap Fund was launched in February 2017. The scheme has Rs 206 crores of AUM as on 31st August 2023. The Total Expense Ratio (TER) of the scheme is 2.5% for the regular plan. LIC MF Midcap Fund has given 11.5% return since inception. Karan Doshi is the fund manager of the scheme since 31st July 2023. The scheme’s benchmark is Nifty Midcap 150 TRI.

Wealth Creation through SIP in LIC MF Midcap Fund

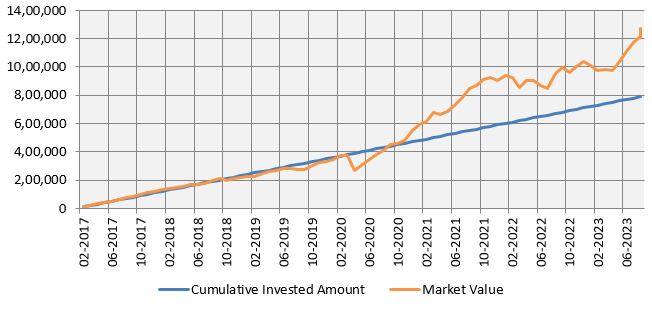

The chart below shows the growth of Rs 10,000 monthly SIP investment in LIC MF Midcap Fund since the inception of the scheme. With a cumulative investment of Rs 7.9 lakhs, you could have accumulated a corpus Rs 12.7 lakhs by investing through SIP in this scheme (as on 31st August 2023). The annualized SIP returns (XIRR) of the scheme are nearly 14%. The SIP performance of the scheme demonstrates the wealth creation track record of LIC MF Midcap Fund.

Source: National Stock Exchange, Advisorkhoj Research, as on 31st August 2023

Investment strategy of LIC MF Midcap Fund

- The investment strategy of the Scheme involves constructing a well-diversified portfolio of companies predominantly from the midcap universe.

- The fund managers will adopt a combination of top-down and bottom-up approaches for portfolio construction.

- The investment philosophy focuses on growth at reasonable prices (GARP) by evaluating companies across fundamental parameters like competitive position, earnings growth, management quality, promoter track record, future plans, valuation corporate governance, sustainable cash flows etc.

- The investment framework focuses on Business sustainability and Governance & Management quality.

- Companies are evaluated for Competitive advantage, Capital efficiency and Scalability. LIC MF focuses on quality stocks.

Why invest in LIC MF Midcap Fund in the current market scenario?

- After an underperformance in 2022, midcaps have bounced back strongly in 2023. The Nifty Midcap 150 TRI has given 31.12% return in 2023 YTD (as on 31st August 2023).

- Though the midcap rally has pushed up valuations with Nifty Midcap 150 TRI trading at 25 X EPS (source: NSE, as on 31st August 2023), it is considerably lower than its valuations in October 2021 when the index was trading at 35 X EPS.

- Earnings growth for Nifty Midcap 150 TRI in Q1 FY 2024 was strong at 15% on YOY basis (source: NSE, as on 30th June 2023) and is expected to accelerate with clear signs of economic recovery. Midcap companies tend to show stronger earnings growth vis-a-vis large cap companies, when there is an economic recovery after a prolonged period of business sluggishness.

- Historical data shows that midcap funds have outperformed large cap funds over long investment tenures.

- At the same time, midcap stocks are less volatile than small caps and experience smaller drawdowns in deep correction. A diversified portfolio comprising of large caps, midcaps and small caps, will provide balance to your portfolio along with the potential of wealth creation over long investment horizons.

- Inflation has cooled considerably and interest rates in India seem to have peaked with the RBI holding repo rates in the last few MPC meetings. With reasonable forward valuations (PE, PB etc), improving consumption growth, midcaps are positioned strongly from a long-term perspective when we reach the end of this interest rate cycle.

- LIC MF Midcap Fund had underperformed in the past few years relative to its peers, but in line with the turnaround in performance of other LIC MF schemes in the last few months / quarters, we expect a turnaround in LIC MF Midcap Fund.

- The investment strategy with its focus on GARP and quality is sound and has the potential to deliver good performance in current market conditions over sufficiently long investment horizon.

Who should invest in LIC MF Midcap Fund?

- Investors looking for capital appreciation over long investment tenures.

- Investors with high-risk appetites.

- Investors with minimum 5-year investment tenures.

- We think that SIP is the best mode of investment in midcap funds over long investment horizons.

- However, investors can also take advantage of deep corrections to tactically invest in lump sum.

- You can also invest in this fund through 6 – 12 months STP from LIC MF Liquid or Ultra Short Duration Fund.

Investors should consult with their financial advisors or mutual fund distributors if LIC MF Midcap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY