LIC MF Multi Cap Fund: A promising diversified equity fund

LIC MF Multi Cap Fund has just completed a year. The fund has made an excellent start delivering around 17% CAGR returns since launch (as on 31st October 2023). The fund was able to outperform its benchmark index and create alphas for investors. Though 1 year is a relatively short period for evaluating a fund’s performance, the investment strategy of the fund and its performance suggests strong future potential.

What are Multi Cap funds?

Multi Cap is an equity investment strategy, where your investment is diversified across different market capitalization segments e.g. large cap, midcap and small caps. As per SEBI’s mandate, Multi Cap funds are required to invest at least 25% of their assets in large cap stocks, at least 25% in midcap stocks and at least 25% in small cap stocks. This means that at any point of time, Multi Cap fund has a minimum 50% exposure to small and midcap cap stocks.

What are the benefits of Multi Cap funds?

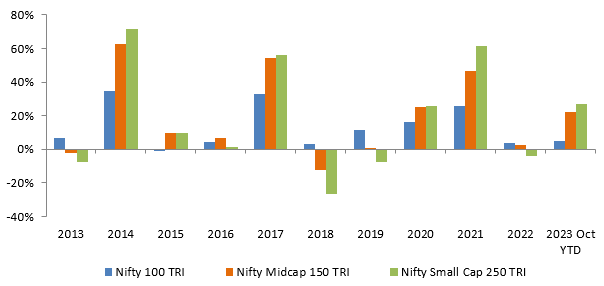

- Within the equity asset class, winners rotate across different market cap segments. In other words, different segments of the market outperform each other in different market cycles (see the chart below). Large cap stocks usually outperform small / midcaps in bear markets. Small / midcaps usually outperform large caps in early to mid-stages bull markets. A Multi Cap strategy has the potential to generate superior long term returns while balancing risks in the short term (please see the chart below).

Source: National Stock Exchange, Advisorkhoj Research, as on 31st October. Large cap is represented by Nifty 100 TRI, Midcap is represented by Nifty Midcap 150 TRI and Small cap is represented by Nifty Small cap 250 TRI

- Small / midcaps provide you exposure to larger number of industry sectors compared to large caps. There are many industry sectors with high demand driven growth potential where large caps do not have any presence. Mid and small caps can also benefit from the new China plus 1 strategy, shift from unorganized to organized sectors, increasing digitalization etc.

- Multi Cap strategy provides you exposure to a much larger universe of stocks compared to market cap specific investment strategy. While the large cap segment is restricted to 100 stocks, the mid cap is restricted to 150 stocks. A Multi Cap strategy will provide you exposure to a far bigger universe of stock (500+ stocks) i.e. many more investment opportunities.

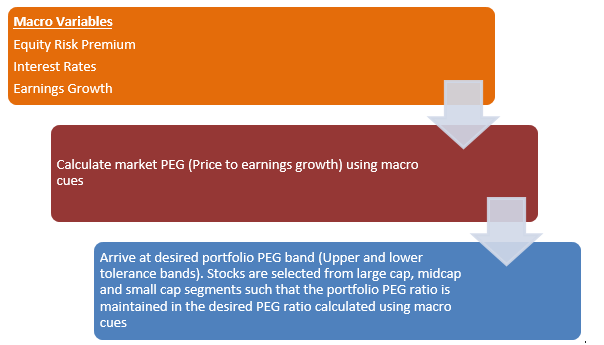

LIC MF’s Macro Based Valuation Check (MVC) Framework

The key differentiation of LIC MF Multi Cap Fund is how it adjusts the valuation in line with changing macro variables, to maintain a strict Valuation Discipline using its in-house framework of MVC (Macro Based Valuation Check).

MVC framework is essential guardrail to avoid traps of overvaluation or bubbles without sacrificing the ability to participate in growth opportunities.

Multi Cap Strategy of the fund

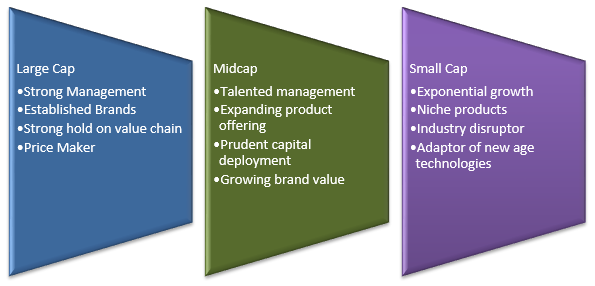

Stock selection

The fund manager follows a blended approach using qualitative and quantitative analysis:-

- Qualitative: Emphasis is put on the company’s products, services, management, competitors, etc. The fund manager evaluates impact of prevailing and evolving macro on above factors on the sector and company

- Quantitative: The fund manager concentrates on the income statements, balance sheets, and cash flows, and analyses the relationship between price and intrinsic value

The qualitative approach helps in understanding the business dynamics and assigning the better multiple and quantitative approach helps in forecasting financials. Combination of these two approaches helps in determining optimal valuations.

Portfolio construction

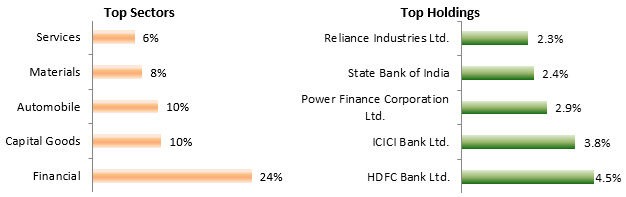

The portfolio seems to be well diversified and balanced across market segments with large caps comprising 33% of the portfolio, while midcaps and small caps comprising 28% and 32% respectively.

Source: Advisorkhoj Research, as on 30th September 2023

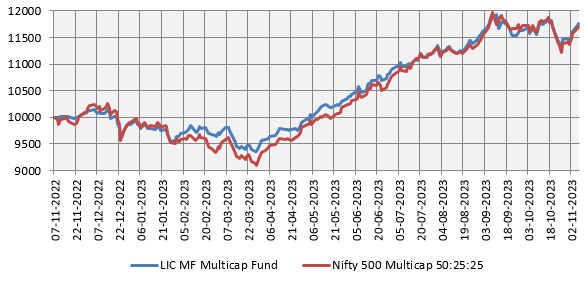

Performance of LIC MF Multi Cap Fund in the last 1 year

The chart below shows the growth of Rs 10,000 investment in LIC MF Multi Cap Fund over the last 1 year ending 7th November 2023. The fund was able to beat the benchmark index by a small margin and create alphas for investors.

Source: Advisorkhoj Research

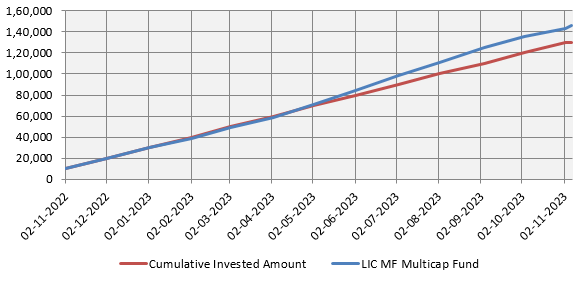

SIP performance of LIC MF Multi Cap Fund since inception

The chart below shows the growth of Rs 10,000 monthly SIP in LIC MF Multi Cap Fund since the scheme’s inception. The SIP XIRR since inception as on 7th November 2023 is 25.36%.

Source: Advisorkhoj Research

Why invest in LIC MF Multi Cap Fund?

- Disciplined diversification across market capitalization segments

- Multi-level checks for prudent market cap allocation

- Opportunity to invest in Industry leaders across market capitalization segments

Who should invest LIC MF Multi Cap Fund?

- Investors looking for capital appreciation over long investment horizon.

- Investors with very risk appetites.

- Investors with minimum 5 years investment tenures.

- You can invest in SIP or lump sum. You can also invest through 6 – 12 month STP from LIC MF Liquid Fund or LIC MF Ultra Short Duration Funds.

- Investors should consult their financial advisors or mutual fund distributors if LIC MF Multi Cap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY