Protect your life and Create wealth

In the journey towards financial freedom, there are two important aspect, creation of wealth while you are alive & protecting your family financially after you are gone.

LIC Mutual Fund offers a product which does both, this is called LIC MF ULIS. LIC MF Unit Linked Insurance Scheme (ULIS) combines the investment features with insurance and provide best of both worlds to the investors.

About LIC MF ULIS

The investment objective of the scheme is to generates long term capital appreciation and offer Tax benefits u/s 80C of the Income Tax Act as well as additional benefits of a life cover and free accident insurance cover.

The scheme not only offers Tax rebate on investment u/s 80C of Income Tax Act but also provide life insurance cover and a free accidental insurance cover.

Benefits

The LIC MF ULIS provides insurance cover of up to Rs. 15 lakh. Investors in the age group between 12 to 55 years of Age Nearer to Birthday (NBD)can subscribe to this scheme. It offers flexibility by way of different term periods (5, 10 and 15) and payment modes (single, monthly, quarterly, half yearly and yearly).

The flexibility does not end there as one can start the scheme with Rs. 1000 monthly Systematic Investment Plan (SIP) or Rs. 3000 quarterly SIP. For a one-time payment and yearly premium, the minimum investment amount is Rs. 10,000. The scheme even offers a free accident cover of up to Rs. 1 lakh.

This unique policy gives the dual benefits of capital appreciation together with the safety of insurance. It gives income tax benefits under section 80C.

Portfolio snapshot

The scheme pre-dominantly invests in equities and equity related instruments with a prudent mix of fixed income securities including securitised debt, asset backed securities, corporate debentures, bonds, money market instruments and with the aim of maximising long-term capital appreciation.

The fund manager invests in companies with a strong competitive position with good business and quality management. The focus is on fundamentally driven investment with scope for future growth.

The fund is broad-based as it has exposure to a wide variety of companies and sectors. In the month of June 2018, the fund had allocation in 41 companies and over the past one year, it was exposed to 58 companies. The top five sectors in June 2018 were Banks, Software, Auto, Finance and Chemicals, which together accounted for around 39% of the portfolio net assets. Except Banks (16.49%), no other sector has exposure in double digits, which underlines the fund’s commitment to diversification.

Equity exposure of the fund stands at almost 70% in June 2018, followed by 7% in debt and 23% in others. Portfolio turnover ratio is on the lower side ranging between 35 to 41 in the past one year, which shows the fund manager stands by his convictions and does not budge from the fund’s core commitments.

The fund generated 10.4% from April 2017 to March 2018, beating its benchmark CRISIL Hybrid 35+65 - Aggressive Index, which gave returns of 9.9%.

Take away

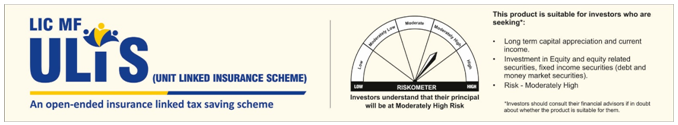

Investors looking for capital appreciation together with the advantage of insurance can consider this scheme. Since majority exposure is in equity, the scheme comes under moderately high risk. The scheme has given decent results in the long-term periods of 5-, 10- and 15-years, so it is wise to stay invested for the longer periods.

Riskometer

Disclaimer: The views expressed herein are based on internal data, publicly available information and other sources believed to be reliable. Any calculations made are approximations, meant as guidelines only, which you must confirm before relying on them. The information contained in this document is for general purposes only. The document is given in summary form and does not purport to be complete. The document does not have regard to specific investment objectives, financial situation and the particular needs of any specific person who may receive this document. The information / data herein alone are not sufficient and should not be used for the development or implementation of an investment strategy. The statements contained herein are based on our current views and involve known and unknown risk and uncertainties that could cause actual results, performance or event to differ materially from those expressed or implied in such statements. Past performance may or may not be sustained in the future. LIC Mutual Fund Asset Management Ltd. / LIC Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investment made in the scheme(s). Neither LIC Mutual Fund Asset Management Ltd. and LIC Mutual Fund (the Fund) nor any person connected with them, accepts any liability arising from the use of this document. The recipients(s) before acting on any information herein should make his/her/their own investigation and seek appropriate professional advice and shall alone be fully responsible / liable for any decision taken on the basis of information contained herein.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

- LIC MF Money Market Fund: Good investment option for parking your idle funds

- LIC MF Small Cap Fund: A promising small cap fund for long term investors

- LIC MF Dividend Yield Fund: A suitable diversified equity in current market dynamics

- LIC MF Value Fund: A good fund for volatile markets

- LIC MF Focused Fund: Potential of creating alphas over long investment horizons

LIC Mutual Fund was established on 20th April 1989 by LIC of India. Being an associate company of India's premier and most trusted brand, LIC Mutual Fund is one of the well known players in the asset management sphere. With a systematic investment discipline coupled with a high standard of financial ethics and corporate governance, LIC Mutual Fund is emerging as a preferred Investment Manager amongst the investor fraternity.

Investor Centre

Follow LIC MF

More About LIC MF

POST A QUERY