How rise in yields impact Equity Markets

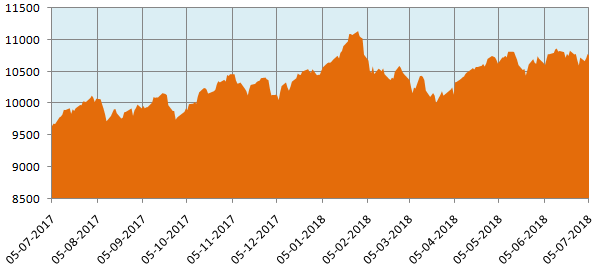

India’s GDP grew at 6.7% in FY18, down from 7.1% in FY17, the slowdown being attributed to the lingering effects of demonetization and the GST roll-out last year. The temporary slowdown due to these two major reforms was largely expected and our economy remains fundamentally strong - GDP growth has been increased continuously every quarter in 2017-18 with growth of 7.7 per cent in Q4. India retained its number 1 ranking as the fastest growing major economy, outperforming China. Let us now see how the stock market performed in the last one year – the chart shows the Nifty movement in the last 12 months.

Data Source: National Stock Exchange

You can see that the Nifty had an upward trend till the end of CY 2017, but in 2018 the market turned volatile and has largely traded sideways for the last 2 – 3 months. Some of our readers may be slightly perplexed by the behavior of the market because the macros of our economy are quite strong. In order to understand the behavior of equity markets, investors should not look at equity in isolation – you should try to understand the behavior of the stock market in relation to other asset classes and markets. What are these other asset markets? They are the bond market, currency market and commodities market.

From the beginning of this calendar year, I have mentioned a number of times in my blog that most important factor determining of performance of equity (stocks and mutual funds) in FY19 will be US Treasury Bond yields - interest rate is the most important determining factor in bond yields. US bond yields (interest rates) have a direct impact on Indian bond yields. Bond yields have played the biggest role in stock market performance in 2018. Other asset markets like the currency market (INR/USD exchange rate) and commodities market (crude prices) have also played important roles – but they are all inter-connected with bond yields. In this blog post, we will discuss how rising bond yields impact equity markets.

Bond yields and stock market

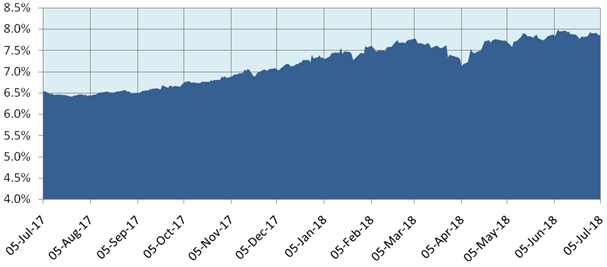

The chart below shows the movement of 10 year India Government Bond yield over the last 12 months.

Source: Investing.com

Notice how the 10 year yield has crept up from 6.5% to nearly 8% in the last 12 months. Let us discuss how bond yields impact stock market. There is a belief among many investors that rising yields are bad for equity market and falling yields are good – this is incorrect. Misconceptions can lead to wrong investment decisions and that is why, it is important to clear misconceptions. Revisit the two charts, Nifty and 10 year G-Sec, we showed above. You will see that the 10 yield was constantly rising from July 2017 to January 2018 and beyond. If rising yields are bad for equity, then why did Nifty also rise during this period?

The relationship between bond yields and stock market is more complex, constantly evolving based on economic conditions and investment cycles. A lot of mathematical research has been done and many economic theories have been discussed on this topic. These theories are quite complex and often confusing for the average investor. The retail investor is our most important stakeholder in Advisorkhoj. Our endeavor in Advisorkhoj is to explain investment concepts in a simple, easy to understand way, so that investors can get a sense of what is happening, what to expect and take investment decisions based on that.

You do not need a degree in finance or economics to understand the basic relationship between bond yields and equities. You simply need to be, what you are – an investor. Some investors (e.g. institutional investors) may have more knowledge than you, but all investors, retail, high net-worth (HNI) and institutional (foreign or domestic) make investment decisions based on one consideration – risk / return trade-off. Equity is a risky asset class, while bonds have low risk. If bond yields are low, then risk / return trade-off is in favor of equity.

Relationship between bond yields and equity when yields are falling

Think about it, you are getting 6% interest rate on FDs and you expect to get 12 – 15% returns from equity mutual funds, you are likely to be more inclined to invest in equity mutual funds over a 3 year plus tenor, even if it means taking more risks. Even if equity underperforms for a year, you are still likely to get higher post tax returns from mutual funds. As interest rate / bond yields fall, equity is the more attractive asset class, from the perspective of risk return trade-off. The more yields fall the more investors shift their asset allocation from bonds to equity. Asset prices depend on demand and supply. As more money flows into equity market, stock prices rise and investors get higher returns.

Another reason, why falling yields are good for equity is that borrowing costs for companies go down and they deliver higher profits (EPS), pay more dividends and see share price appreciation. Companies also take advantage to fund capex at low cost, for capacity expansion and business growth – this leads to higher profits in the future and higher returns for shareholders / equity investors. Therefore, falling yields are generally good for equity.

What happens when yields start rising?

When yields start to rise, bonds become more attractive in a relative sense. However, as an investor, you will make decisions based on risk / return trade-off. As long as gap between expected equity return and bond yield is sufficiently big, there is no reason for you to shift your asset allocation to bonds. Though the 10 year G-Sec yield rose by 100 basis points from July 2017 to January 2018, the Nifty also rose more than 15% in the same period. You will continue to invest in equity as long as risk / return expectations are favorable. Therefore, rise in interest rate / bond yield is not necessarily bad for equities.

Would you like to read – what is the importance of equity in asset allocation

Let us now understand the relationship between interest rate and bond yield from a macro-economic perspective. Why do central banks like Fed, RBI etc increase interest rates? Controlling inflation is the most important objective of central banks. If inflation is caused by economic growth and higher per capita income, then it is good for equity because it tells investors that the economy is healthy. This kind of inflation is known as demand side inflation. Even if interest rate rises and borrowing costs of companies increase, companies have the pricing power to pass on the higher costs to the customers, thereby protecting or even growing profits(EPS). Therefore, if bond yields rise due to demand side inflation, it is actually good for equity.

Inflexion point for yields and equity

However, as bond yields continue to rise, when investors start to wonder, whether it makes more sense to switch to safe asset class like Government bonds instead of remaining with risky asset class. As yields rise, an inflexion point is reached, when risk free yields are so high that investors shift their asset allocation to bonds because risk-return trade off looks more favorable for bonds. Investors sell stocks, which causes stock prices to fall and buy bonds, causing bond prices to rise. It is all about demand and supply -as demand for bonds increase investors are ready to pay more for risk free Government bonds. The earnings for bond investors, holding the bonds till maturity will be the fixed interest (coupon) paid by the bond, but as bond prices increase, the bond yields fall; yield is the ratio of how much the bond investor is earning and how much the investor pays for the bond. So when bond yields reach the inflexion point both stock prices and bond yields fall together.

But fall in stock prices causes risk aversion among investors. As long term equity investors and hopefully you are one, you should remain invested in equity mutual funds because the situation will eventually reverse, as we will explain shortly. But as stock prices fall,risk-averse investors will shift to bonds to protect their capital. This causes stock prices to fall further along with fall in bond yields. Eventually, a point will be reached when stock prices look attractive and bond yields are not attractive. Investors will then again shift their asset allocation to equity and the investment cycle will begin all over again. This is why, despite the volatility in stock prices, as long term equity investors you should remain invested in stocks.

Some readers may be curious to know, what is the inflexion point at which rising bond yields and equity price trend reverses? Studies in the US have shown that the yield of the 10 year US Treasury Bond above 3% is the average inflexion point – current 10 year US Treasury Bond yield is 2.85%; so in the US, they are not far from the inflexion point. But India is different from the US because there are other factors, which affect the relationship between bond yields and equity.

You should also read: Federal Funds Rate and Stock Market

Bond yields, Foreign Exchange rate and Equity Market

Changes in interest rate differential between two countries affect their exchange rates. Our equity market is dominated by Foreign Institutional Investors. FIIs want dollar (USD) returns. In the last 1 year the INR/USD exchange rate fell from INR 64.4/USD to almost INR 70/USD – nearly 10% decline. As US Treasury Bonds (which is the safest asset class for global investors) yields rose and the INR depreciated versus USD, Indian equity versus US Treasury bond risk / return trade-off looked less favorable for FIIs. Though FIIs are not major players in the Indian Government Bond market, FII flows into / from equity market do have an impact on our bond yields indirectly through the foreign exchange rate.

India is a net importer – our biggest import item is oil. Depreciating currency makes oil imports more expensive and causes inflation. Rise in crude prices in dollar terms (crude prices have increased 50% from $50/barrel tonearly $75/barrel). This has an impact on our CPI inflation and is of concern to RBI. The RBI hiked repo rates for the first time in four years – further rate hikes this year cannot be ruled out. We discussed earlier that interest rate is the most important factor in determining bond yields. Therefore, further rise in bond yields from the current level of 8% is entirely within the realm of possibilities and in our opinion, quite likely.

You may like to read: Margin of safety: Importance in equity investing

Outlook and conclusion

In the last 15 years, 9 to 9.3% was the peak yield level for the 10 year bond. While in that sense, we are not very far away from peak, there is room for yields to rise further. Further rise in yields will have an impact on the stock market in the near term – whether the market will remain sideways, see increase in volatility or see a correction, falls in the speculative realm because there are so many factors. After a fairly long period of low bond yields and terrific equity returns, we are now in a rising yield and sideways / volatile equity market regime. Investor expectations in the near term have already been tempered by the market volatility this year and investors have showed resilience in the face of volatility. This is a sign of maturity in investors. As discussed in this blog post, bond yields are cyclical and at one point of time will reverse its direction. As long term equity investors, you should not be bothered too much by yield changes – the purpose of this post is to give you a sense of what to expect in the future. You should remain focused on your goals and remain disciplined in your financial plans. In fact, investing through SIP / STP in volatile market will enhance your returns over a sufficiently long investment horizon. Disciplined investors are always rewarded in the long term.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Mirae Asset Global Investments is the leading independent asset management firm in Asia. With our unique culture of entrepreneurship, enthusiasm and innovation, we employ our expertise in emerging markets to provide exceptional investments opportunities for our clients.

Quick Links

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Fund Review - Mirae Asset Emerging Bluechip Fund : Best Midcap Mutual Fund in the last 6 years

- Fund Review - Mirae Asset India Opportunities Fund: One of the best SIP returns in last 8 years

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Our Articles

- Our Website

- Investor Centre

- Mirae Asset Knowledge Academy

- Knowledge Centre

- Investor Awarness Programs

Follow Mirae Assets MF

More About Mirae Assets MF

POST A QUERY