Investors should not get deterred by macro noises and invest in a disciplined way

BFSI Industry Interview

Mr. Neelesh Surana has been re-designated as the CIO - Equity at Mirae Asset Global Investments (India) Pvt. Ltd. He joined Mirae Asset in 2008. In his capacity as CIO - Equity, Neelesh spearheads the equity research and investment function. He is responsible for the managing existing equity funds of Mirae Asset (India), as well as, providing research support for the global mandate. Prior to this, Neelesh served as the Head – Equity of the AMC. An engineering graduate with MBA in Finance, Neelesh has over 19 years of experience in equity research and portfolio management. Prior to Mirae, Neelesh was with ASK Investment Managers Ltd., as Senior Portfolio Manager responsible for managing domestic, and international portfolios.

In an interview with Advisorkhoj, Mr. Surana discussed the various local and global factors and his take on Indian equities. His advice to retail investors is not to get deterred by macro noises and invest in a disciplined way. He feels that investors should continue to built in a well-crafted asset allocation with balanced weight to equities.

Accept our heartiest congratulations for a very successful and stable performance of Mirae Asset India Opportunities Fund which completed 8 years of superb performance. What is your long term, 3 to 5 years, outlook for this fund vis-à-vis the Indian equity market?

Mirae Asset India Opportunities Fund has completed eight years. Since inception, i.e., over the last 8 years, it has delivered a return of return of 15% compared to the benchmark return of about 7%, thereby generating alpha of about 8% CAGR.

We have generated returns over the benchmark, by being in the right pockets as divergence across sectors and stocks within a sector has been significant over the last eight years. Disciplined approach to investing, with focus on “quality up to a reasonable price”, has helped us deliver as satisfactory track record.

Over the long term we would expect similar returns which will be driven by stock selection.

The performances of Mirae Asset India Opportunities Fund has been stellar and one of the best in its category. It has also become very popular amongst IFAs and Investors and has a robust SIP book. Are you proposing any changes in the scheme in keeping tune with the recent market trends? What broadly will be your style and strategy going forward considering the fact that the expectation from this scheme is quite high?

Broad strategy as enumerated above will remain same. We would continue to focus on stock selection to generate alpha. We strongly believe that stock selection is equally important within as sector due to factors like different earnings growth expectations, valuation, management, etc.

The market has rallied after the recent Budget. Apart from sticking to the fiscal deficit target, what other positives do you see in this Budget? What are some areas, if any, where you were disappointed?

Gvien the challenging economic backdrop, the budget has realistic assumptions, and the fiscal target was positive. Also, many initiatives do happened on a regular basis which does not get as much attention as if these were say part of budget. For e.g., we have seen measures related to reduction in interest rates on small savings, and timely changes in oil prices post the budget which is positive.

We find that the top 5 sectors for almost all the AMCS are now Banking and Financial, Construction, Technology, Services and automobiles. Are you going to follow the same sectoral allocation trends for your funds? If no, then what other sectors you are bullish on? If yes, do you still think more is expected from these sectors?

We are positive on the above mentioned sectors, except construction. We have avoided construction businesses owing to lack of free cash generation in many companies.

In addition to above sectors we are positive on consumer discretionary and Healthcare. Consumer spends will improve with recovery in economy and increase in wages arising from seventh pay commission.

Do you think that the Nifty had bottomed out at 6800 – 6900 levels and now stable at 7600+ levels? Or is there a risk of the market retesting those levels again and possibly going lower? What are the major risk factors for the Indian equity market this year?

We have constructive view on indices, and it is unlikely that recent lows will be retested. Overall, returns will be driven by extent of revival in earnings, which have been muted for the last two years.

For the benefit of our readers, please also give us your outlook on the stressed assets problem in the public sector banks?

Worst of incremental accretion to stress should be over – however, the recognition of past stress will be over the course of next financial year, i.e., up to March 2017. Recent improvement in commodity sector particularly steel, should help what was otherwise severe stress in the system.

Last month the US Federal Reserve issued a dovish statement. How long do you think the Fed will wait before raising rates again?

It is complex subject to do forecast as the same is data dependent. Fed has tempered its expectation of further rate hike, significantly as compared to January when markets were expecting four rate hikes this year.

We would go by the assumption that rates will be increased, albeit marginally and as long as rate increase is in line with market expectations, it should not make much of difference to Indian markets.

The Fed statement last month indicates concerns with the US GDP growth and also global risks. What impact will the US economic outlook and other global macro-economic factors have on the Indian economy and equity market?

Indian exports have been particularly weak in FY16, decline by about 13% in FY16. If we exclude petroleum products, the decline is still about 9%. The headwinds related to revival in Indian exports are low growth globally in manufacturing, and China’s dumping in such environment.

How much room does the RBI have for rate cuts in FY 2016 – 2017? What is the quantum of rate cuts that you expect in FY 2017?

We believe that there is likelihood of 25 bps rate cuts, subject to normal monsoon.

Commodity prices have shown some improvement in the last few weeks. Can we say that the bear market in some of the major commodities is over or is it way too early to say such a thing? How will commodity markets affect Indian equities in 2016?

At an aggregate level, Commodity markets have positive impact on Indian equities. It helps mitigate stress in these sectors both domestic market as well as globally. We have recently seen bit of restocking in steel – and related impact on beaten down stocks in the sector.

Separately, many consumer related businesses had expansion in gross margin owing to low commodity prices – we are internally, building in on assumption that some of these margins will be reduced going forward.

When do you expect to see a recovery in corporate earnings?

Earnings recovery should happened by H2-FY17. After two years of muted growth, we expect recovery in FY17, when the current disconnect in favourable macros is translated in volume growth both on the investment side, as well as consumer side.

Some experts proclaim that we are still in a new secular bull market run (even though the Indian stock market corrected by 18 – 20% from its last peak). While some are more guarded as they feel the recent run up is a hype rally only and soon settle to realistic levels. What is your take on the current market and what do you see as the key drivers for markets in the next three to five years?

India’s attractiveness on growth has increased, in a world which is starved for growth. The outlook for Indian economy continues to be strong due to a recovery that is firmly underway. Unlike most emerging markets, India has secular drivers to growth. The government is on the right track and is making good progress on most fronts. This is probably the best pace of reforms that India has experienced in a long time.

The correction of about 18% should be seen in context of 40% increase in indices in 12 month following the 2014 election victory, in a backdrop where earnings did not grow at an aggregate level.

Over the next 3-5 years, key drivers for markets will be revival in earnings, and improvement in incremental ROCI (return on invested capital). India Inc. profit as a percentage of GDP is currently at multi-year low and is expected to revert to normal.

At an overall level, growth will remain maintain attractiveness of India, in a world which is growth starved.

What is your advice for the retail Mutual Fund Investors? What they should do now and how to invest in the current volatile market situation?

Despite one of the most challenging periods (multitude of macros impacting global and domestic markets) over the last eight years, many funds have delivered returns of about 15%. Given the tax benefit in mutual fund, these returns are decent particularly considering challenging environment. In this context, we would advise investors not get deterred by macro noises and invest in a disciplined way. Investors should continue to built in a well-crafted asset allocation with balanced weight to equities.

Recent Interviews

-

Partner Connect by Advisorkhoj with Mr Ajay Sehgal from Allegiance Financial

Jan 13, 2026

-

In conversation with Mr Pratik Oswal Chief of Passive Business of Motilal Oswal MF

Jan 6, 2026

-

In conversation with Mr Nilesh Jethani Fund Manager Equity with Bank of India Mutual Fund

Jan 6, 2026

-

Partner Connect by Advisorkhoj with Mr Amit Kalra Glorious Path Pvt Ltd New Delhi

Dec 5, 2025

-

Partner Connect by Advisorkhoj with Mr Alok Dubey PrimeWealth Pune

Dec 1, 2025

Fund News

-

Groww Mutual Fund launches Groww Nifty PSE ETF FOF

Jan 23, 2026 by Advisorkhoj Team

-

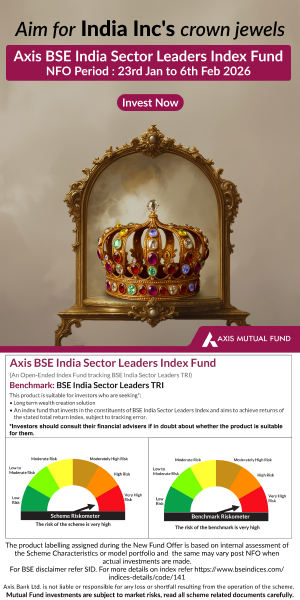

Axis Mutual Fund launches Axis BSE India Sector Leaders Index Fund

Jan 23, 2026 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty PSE ETF

Jan 22, 2026 by Advisorkhoj Team

-

Samco Mutual Fund launches Samco Mid Cap Fund

Jan 22, 2026 by Advisorkhoj Team

-

WhiteOak Capital Mutual Fund launches WhiteOak Capital Consumption Opportunities Fund

Jan 20, 2026 by Advisorkhoj Team