Importance of Gross Profit Margin in stock selection and investment

In this blog post we will discuss the importance of gross profit margin in fundamental analysis of stock valuation for investment. Before we delve into gross profit margin, let us discuss the importance of fundamental analysis in equity investing. Equity investing, in its most basic form, is essentially about buying stocks of a company or companies with the expectation that, the share price of the stock will go up from the price at which bought, so that, you make a profit when you sell. Though equity investment involves risk, it is different from buying a lottery ticket, because in lottery a number is picked at random and declared the winner; it is all about luck in lottery. In equity investing you will make a profit, if the market price of a stock is less than its fundamental or true value; luck has little role in long term equity investing.

The market price of a stock is often different from the fair value for variety of reasons including market risk sentiment, liquidity situation, macro factors, political factors etc. However, in the long run, the market recognizes the true value of a stock and the market price converges with the true value of the stock. Fundamental analysis is an analytical technique used for determining the true value or the fair value of a stock. In fundamental analysis, the analysts look at various economic factors that affect the revenues and margins of a company and forecast what these factors will be in the future.

Based on the forecast of these factors, employing a variety of methodologies, the analysts forecast the future price of the asset. However, any economic forecast involves a set of assumptions and risk factors. Investors should remember that, there is always uncertainty around how the assumptions and risk factors will play out in the future. Therefore, fundamental analysis is updated, from time to time when new information (e.g. quarterly earnings release, corporate announcements etc) is available. The most important component of fundamental analysis is studying the financial statements (income statement, balance sheet and cash flow statement) of companies to insight into the company’s future performance.

You may like to read Importance of free cash flows in equity investing

Gross Profit Margin

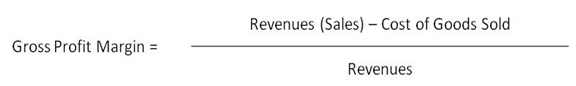

Gross Profit Margin (GPM) is one the most important profitability ratios of a company. GPM tells us how profitable is the core operations of a company. The formula for calculating GPM is as follows:-

You can see that the Gross Profit margin formula has two components, Revenue and Cost of Goods Sold. Readers who have an accounting background know very well about these two items, but for benefit of the readers who do not have an accounting background, we will explain in brief what these two items are.

Revenues

Revenue or the top-line is the income of a company during a specified period (quarter, year etc) for goods and services sold by the company to its customers. In its most basic form revenue is the money received from customers for goods and services. As per the accrual concept of accounting, revenue also includes the payments due (receivable) from customers for goods and services already delivered to the customer.

However, as per the accrual concept of accounting, advance made by customers for goods and services not yet delivered, is not considered revenue. Readers should note that, the revenue used in GPM calculation is the net revenue. Let us explain net revenue with the help of an example.

Suppose a company sells a product to a customer. The company records the money received from the customer as revenue in its accounting book. After sometime, the customer returns the product to the company and the company refunds money back to the customer, as per its return policy. The refunds will be subtracted from the gross revenues and reported as net revenue in the quarterly income statement of the company. Revenue in the GPM formula does not include one-time items like proceeds from sale of assets, legal settlements etc. Fundamental analysts try to ensure that, the revenue numbers that they work with represent the true income from the main operations of the company and make appropriate adjustments to the reported numbers, if required.

Cost of Goods Sold

Cost of Goods sold (COGS) is the expense directly related to the production of goods and services. For manufacturing companies, it includes raw materials cost, labour costs and portion of overhead costs allocated to production. Overhead costs include the salaries and benefits of management personnel. The costs of management personnel involved in production are included in COGS. Let us understand COGS with an example of a steel producer. The raw material and labour cost of making steel products (sheets, bars, rods, pipes etc) is included in COGS. Management personnel cost attributable to production is also part of COGS. However, cost of transporting the finished products from the factories to the distributors / dealers is not included in COGS. Cost of sales staff is not included in COGS. Advertisement cost is not included in COGS. Some corporate overhead costs, which cannot be allocated to production units, are not included in COGS. Interest payments for loans taken by the company to build manufacturing facilities are also not included in COGS.

The term Cost of Goods Sold has its origin in the manufacturing industry. However, the concept can be used in the service industry (a huge industry in our country) as well. In the service industry, instead of the term Cost of Goods Sold, Cost of Sales is usually used. Like COGS, Cost of Sales includes expenses directly attributable to the manufacturing the service product and delivering it to the customer.

For example, in a company that provides courier services, cost of the staff receiving the package for delivery, cost of the staff delivering the package to the customer, shipping costs (air, railway, truck etc) are considered to be Cost of Sales. Overhead costs like rent of offices, utility (electricity, telephone etc) expenses, cost of management staff not involved in customer service, advertising, marketing, promotions etc are not part of Cost of Sales.

Importance of Gross Profit Margin

Some investors confuse Gross Profit Margin (GPM) with another important profitability ratio operating margin. GPM refers to the profitability from the main operations (production of goods and services) of the company, whereas operating margin is the profitability of the company before payments made to creditors (in form of interest payments), the Government (in form of tax) and the money left for shareholders.

We will discuss the importance of operating margin in another post, but as discussed earlier, Gross Profit Margin (GPM) is one the most important profitability ratios of a company. We will understand the importance of GPM by discussing how fixed and variable costs impact the profitability of a business. Variable costs, as the name suggests, change with number of units produced. Fixed cost, on the other hand, remains unchanged, whether more or less units are produced. COGS is almost entirely variable cost. GPM is high if COGS as percentage of revenue is low and vice versa. When revenues or sales go up COGS will also go up, but fixed cost will remain unchanged.

Therefore if COGS as a percentage of revenue is low (high GPM), then when revenues grow, profits grow even faster; at the same time, if revenues fall, the profits decline even more rapidly. This is also known as Operating Leverage. Different businesses have different GPMs depending on the nature of business. Investors should not compare GPM of businesses across industries. However, you can and should compare GPM of companies in the same industry segment provided quality parameters of their products are comparable.

How can GPM be used in stock selection?

Most businesses follow boom and recession cycles. In the boom cycle, demand is high, whereas in recession, demand is low. In fact, bull and bear markets are closely related with business cycles. Towards the end of a bear market or beginning of a bull market or the middle phase of a bull market, companies with high GPM and operating leverage are attractive investment opportunities, because the profits and EPS of these companies are likely to grow faster in the future. Higher EPS will result in higher share-holder returns. However, at the peak of bull market or the beginning of bear market companies with high GPM are likely to suffer more, because the profits will fall faster, unless of course, the management are able to identify cost reduction opportunities and prevent operating margin erosion.

Conclusion

In this post, we discussed the importance of Gross Profit Margin in fundamental analysis. Depending on where we are in the market cycle, investors can use GPM, along with other factors, to select stocks for their portfolio. Over a sufficiently long investment horizon, however, companies with high GPMs can deliver strong shareholder returns provided other fundamental business parameters and market potential is also good.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Mirae Asset Global Investments is the leading independent asset management firm in Asia. With our unique culture of entrepreneurship, enthusiasm and innovation, we employ our expertise in emerging markets to provide exceptional investments opportunities for our clients.

Quick Links

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Fund Review - Mirae Asset Emerging Bluechip Fund : Best Midcap Mutual Fund in the last 6 years

- Fund Review - Mirae Asset India Opportunities Fund: One of the best SIP returns in last 8 years

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Our Articles

- Our Website

- Investor Centre

- Mirae Asset Knowledge Academy

- Knowledge Centre

- Investor Awarness Programs

Follow Mirae Assets MF

More About Mirae Assets MF

POST A QUERY