Importance of Up Market and Down Market capture ratios in mutual funds

In January, the Nifty rose nearly 600 points (nearly 6% rally) and in the first 7 days of February, it fell nearly 500 points. The ferocity of the correction seen over the past few days may have spooked some new investors, but for long time investors, such rallies and corrections are part of equity investing. Equity is the most volatile of all asset classes, but also has the potential to give superior returns compared to other asset classes. Financial advisors ask investors to ignore volatility and remain invested in equity for a long period of time to create wealth but there is no denying that, volatility does have an effect on investor sentiments.

If you had Rs 1 crore of investments in stocks or mutual funds, just in the last few days, you could have lost 5% (or Rs 5 lakhs). One can argue that this loss is notional and you can recover the loss in a few weeks or months. But what if a correction lasts longer than a few months? What if the market falls by 30% around the time when you need the money? Bear markets are inevitable in equity investing. If you are investing in equity, then you will be affected by bear market or corrections, but the question is, how much will the bear market affect you? Are there mutual funds where the fund managers are able to protect downsides?

Absolute Returns versus Relative Returns

There can be two investment mindsets – absolute returns mindset and relative returns mindset. If you have the absolute returns mindset, you do not care what the market is doing; you are only interested in the returns you get over the tenure, irrespective of how the market behaved during this period. If you have a relative returns mindset, you look at market returns over a period and if you are investing in actively managed mutual funds, you hope to get superior returns compared to the market. There are no absolute returns funds in India most equity mutual funds do not use short selling, futures, options, leverage etc which absolute returns funds in the west do. Therefore, in our context, when you are evaluating a mutual fund’s performance, you have to look at relative returns versus benchmark or category.

When a mutual fund gives fantastic returns in bull markets, investors are obviously very happy. A fund may outperform in a bull market simply by taking more risks; in investment parlance we call this beta. But the same fund is likely to underperform in a bear market. In our view, investors should not look at the absolute returns of a fund over the past few years and should concern themselves more with risk adjusted performance.

Risk adjusted Performance

The most common measure of risk in most mutual fund research websites is a metric called standard deviation. Standard deviation is a measure dispersion of monthly returns of a mutual fund scheme over a certain period, e.g. 1 year, 3 years, 5 years etc. I have seen that, average retail investors usually find it difficult to grasp the concept of standard deviation. You can compare the standard deviation of a fund with the average standard deviation of all funds in a category, to get a sense whether the fund is taking more or less risk relative to the others. You can also compare the standard deviation of a fund with that of the market benchmark to get a sense of the risk.

However, one problem with a standard deviation as a measure of risk is that, it does not distinguish between good and bad volatility. If the NAVs of a mutual fund scheme rise very rapidly in up markets, the standard deviation will be high, but this should not be a cause of concern because this is good volatility. On the other hand, standard deviation will be high, if the NAVs of a scheme fall rapidly, but this is bad volatility and should concern the investors.

The abstruseness of standard deviation as a measure of risk for retail investors and its inability to distinguish between good and bad volatility limits its utility for the average investor. In our view market capture ratios, Up Market Capture ratio and Down Market Capture ratio, are simpler to understand and is a more effective measure of risk adjusted returns of a fund. In Advisorkhoj blog, we refer to these ratios from time to time. We have also built a tool in our Mutual Fund Research Section. You can find the tool in the Advanced Tools section in the menu on the left hand side of our Mutual Fund Research Section.

Market Capture Ratios

Investors expect their mutual funds to outperform the market both during rallies and corrections. If a fund NAV rises only as much as its market benchmark during up markets, then the fund manager has not added any value. Similarly if the fund NAV falls as much as the benchmark during down markets, again the fund manager would not have added any value. Fund managers who outperform the benchmark in up market or down market or both create value for investors. This value on an aggregate basis, over the investment tenure, is known as alpha. Purists please note that, this is not the theoretical definition of alpha (please see our post, How to select the best mutual fund: The importance of Alpha, for the theoretically correct definition of alpha), but this definition is good enough from a practical standpoint.

Up Market Capture Ratio is the ratio of a fund returns to the benchmark returns during the periods the market (benchmark) was rising. So if the market (benchmark) rose by 10% during a month and the fund NAV rose by 11%, then up-market capture ratio will be 110%.In Advisorkhoj Market Capture Ratio tool, we calculate the average up-market capture ratio for all the periods the market was up.Market Ratio of more than 100% is good because it shows that, the fund manager was able to capture the market upside and deliver even more. However, investors should be interested in knowing how the fund manager was able to beat the market. Did he / she beat the market by taking more risks, e.g. investing in high beta stocks or through careful stock selection, without increasing the risk? This is where investors need to look at Down Market Capture.

Down Market Capture Ratio is the ratio of a fund returns to the benchmark returns during the periods the market (benchmark) was falling. So if the market (benchmark) fell by 10% during a month and the fund NAV fell by 8%, then down-market capture ratio will be 80%. In Advisorkhoj Market Capture Ratio tool, we calculate the average down-market capture ratio for all the periods the market was down. Down Market Ratio of less than 100% is good because it shows that, the fund manager was able to limit downside risks for the investors. Down market capture ratio is important both from a risk and return perspective. A fund with low down market capture ratio falls less, recovers faster and therefore, can give superior returns in the future, if the up market capture ratio is also high.

You can see Up Market and Down Market Capture Ratios of any equity mutual fund scheme in Advisorkhoj by going to our tool, Market Capture Ratio. You need to select the fund category, fund and the period over which you want to see these ratios. Please note that in our tool Market Capture Ratio, the benchmark used in the fund benchmark as stated in fund scheme information document or factsheet.

Readers may argue that, use of a common benchmark for all schemes in a category enables comparison of market capture ratios of multiple schemes, but unfortunately, we do not have a common benchmark for all schemes in a category. Despite the merits of a common benchmark, force fitting a common benchmark to calculate market capture ratios may lead to erroneous conclusions because the fund manager’s benchmark might be different. In the future, if the regulator / industry work towards harmonization of benchmarks, Advisorkhoj will definitely incorporate it in our tool.

Periods chosen for Market Capture Ratios

In the mutual fund research community, there is a lot of debate on what is a good period for capturing up-markets and down markets; should we look at a daily, weekly, monthly, quarterly or annual returns? Advisorkhoj view on this is informed both by analytical and practical considerations. Monthly returns over historical periods indicate many periods of up or down market but quarterly returns have indicated fewer periods of either. Therefore, capture ratios based on quarterly returns may be biased towards up-markets. From a practical standpoint, Indian market is quite volatile in nature and our experience tells us that, investors can wait for a few days or weeks to get a better price. Therefore, in Advisorkhoj research, we use monthly returns for Up-Market and Down-Market capture ratios.

Does High Up-Market Capture RatioimplieshighDown-Market Capture Ratio?

Often high Up-Market Capture Ratio implies high Down-Market Capture Ratio, but that is not always the case – top performing funds have high Up-Market Capture Ratio and at the same time, have low Down-Market Capture Ratio. Funds are often able to deliver high Up-Market capture through high beta strategies, but good funds are able to deliver superior risk adjusted returns (high up-market capture and low down-market capture) through their stock picking strategy. Historical evidence shows that such funds are able to outperform over a long investment time-frame. The reason is very simple, funds which outperform in bull markets, but do not fall as much in bear markets are able to recover much faster. This enables these funds to give more consistent returns. Consistent performers, as discussed before in our blog, are able to give superior long term returns irrespective of prevailing market conditions.

Good Market Capture Ratios are indicative of strong alphas

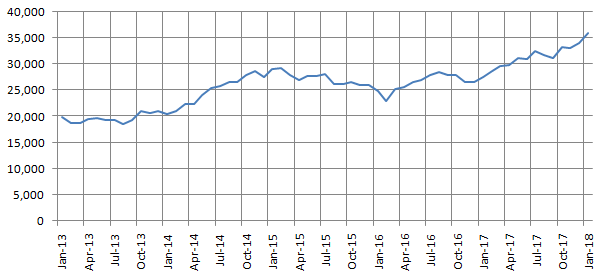

The chart below shows the monthly closing Sensex price from January 31, 2013 to January 31, 2018.

Source: Bombay Stock Exchange

You can see that the Sensex rose from sub 20,000 to 35,000+ during this period. During this period there were 35 up months (months in which the Sensex rose) and 25 down months (months in which the Sensex fell). The 25 down months may come as a surprise to some investors, but this is the reality of our stock market. During the up months the average monthly return was 3.6%, while in the down months the average monthly return was -2.5%. A mutual fund scheme whose up-market capture ratio was 110% w.r.t Sensex (i.e. the fund beat the Sensex by 10% during the up months) and whose down market capture was 100% (i.e. the fund fell in line with the Sensex in the down months) would have delivered an alpha of 2.5% (2.5% CAGR outperformance versus Sensex over the 5 year period). However, if the down market capture ratio of the fund was 90% (instead of 100%), the fund could have delivered an alpha of 3.7%. On Rs 10 lakh investment an alpha of 3.7% would generate additional profit of Rs 3.2 lakhs over and above Sensex returns during the 5 year period.

Conclusion

In this blog post, we discussed the importance of up-market and down-market capture ratios. We encourage investors to use our tool, Market Capture Ratio. As discussed in this post, ideally you should look for funds which have up-market capture ratio of more 100% and down market capture ratio of less than 100%. Are there funds, which have such good capture ratios? Not many, but if you research funds which have done well on a consistent basis over the past 3 to 5 years, you will be able to find a few.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Mirae Asset Global Investments is the leading independent asset management firm in Asia. With our unique culture of entrepreneurship, enthusiasm and innovation, we employ our expertise in emerging markets to provide exceptional investments opportunities for our clients.

Quick Links

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Fund Review - Mirae Asset Emerging Bluechip Fund : Best Midcap Mutual Fund in the last 6 years

- Fund Review - Mirae Asset India Opportunities Fund: One of the best SIP returns in last 8 years

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Our Articles

- Our Website

- Investor Centre

- Mirae Asset Knowledge Academy

- Knowledge Centre

- Investor Awarness Programs

Follow Mirae Assets MF

More About Mirae Assets MF

POST A QUERY