What is Sensex ETF

Most investors will be familiar with the term Sensex. Sensex is one of the leading indicators of the stock market in India. The term Sensex is blend of two words Sensitive and Index. The Sensex comprises of the Top 30 companies from different industry sectors are listed on the Bombay Stock Exchange (BSE). These stocks are the most actively traded stocks and is widely recognized as the barometer of the Indian stock market and a benchmark for measuring the performance of the market.

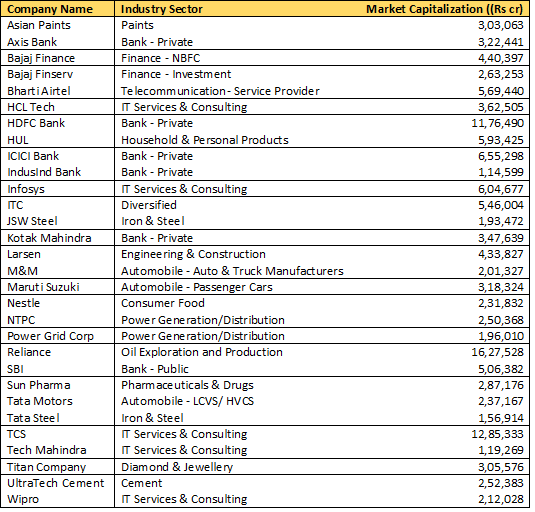

What stocks constitute the Sensex?

The constituents of the BSE Sensex are subject to periodic changes based on factors such as free float, market capitalization, liquidity, and other criteria.

Source: Moneycontrol, as on 29th November 2023

What is the importance of Sensex in the stock market?

The BSE Sensex holds significant importance in the Indian stock market for several reasons:

- Market Indicator: The Sensex serves as a key indicator of the performance and sentiment of the Indian stock market. Investors use it to gauge the overall direction of the market.

- Benchmark for Performance: The Sensex can be used as a benchmark for evaluating the performance of portfolios. Investors often compare their investment returns against the performance of the Sensex to determine how well their investments have fared relative to the broad market. Actively managed funds should be able to beat Sensex returns over long investment horizons.

- Economic Barometer: Sensex movements are often interpreted as indicators of investors’ confidence in India’s economic growth. Companies that comprise the Sensex are market leaders in their respective industry segments and play an important role in India’s industrial growth Sensex stocks usually have substantial institutional ownership, including foreign institutional investors (FIIs).

- Investor Sentiment: As mentioned earlier, Sensex reflects the collective sentiment and confidence of investors in the Indian stock market. However, in globally interconnected economies and financial markets, global risk sentiments also have impact on Sensex movements.

- Global Recognition: The Sensex has gained recognition globally as a key index in emerging markets. Global investors use the Sensex as one of the leading emerging market stock indices.

What is Sensex ETF?

Sensex ETFs invest in a basket of securities which replicate the BSE Sensex Index. Sensex ETFs are among the most popular and most actively traded ETFs in the stock market. After the Government allowed Employee Provident Fund (EPF) to invest in equities, a large part of EPF investments in equities goes to Sensex ETFs.

Here's a quick rundown of how ETFs work-

- Exchange Traded Funds (ETFs) are passive schemes which track market indices. ETFs invest in a basket of securities which replicate the benchmark index. Unlike actively managed mutual fund schemes, ETFs do not aim to beat the index, they merely track the index as closely as possible.

- You can buy a share in that basket in form of units of ETFs in the same way you would buy shares of a company in a stock exchange.

- You need to have demat and trading accounts to invest in ETFs

- Like a stock, buyers and sellers trade the ETF on an exchange throughout the day at prevailing market prices.

You must also read what are the benefits of investing in ETF

What are the benefits of Sensex ETF?

Investing in a Sensex Exchange-Traded Fund (ETF) can offer several benefits to investors. A Sensex ETF aims to replicate the performance of the BSE Sensex, providing exposure to a diversified portfolio of stocks that represent various sectors of the Indian economy. Here are some potential benefits of investing in a Sensex ETF:

- Market Performance: Investing in a Sensex ETF allows investors to participate in the overall performance of the Indian stock market, since the Sensex has a big impact in performance of the broad market.

- Diversification: A Sensex ETF provides instant diversification across multiple sectors of the Indian stock market. By holding shares of the 30 constituent companies of the BSE Sensex, investors gain exposure to a broad cross-section of the Indian economy.

- No unsystematic risks: Actively managed funds have unsystematic risks because these funds are overweight / underweight on certain stocks / sectors relative to the benchmark index. There is no unsystematic risk in ETFs.

- Low-Cost Investing: ETFs are known for their relatively low expense ratios compared to actively managed mutual funds. Investing in a Sensex ETF can be a cost-effective way for investors to gain exposure to the Indian equity market.

- Liquidity: Nifty 50 ETFs are among the most actively traded ETFs in India (see Advisorkhoj ETF Corner). Since trading volumes of these ETFs are high, they are more liquid than thinly traded ETFs.

- Convenience: Sensex ETFs can be bought and sold on the stock exchange like individual stocks. This ease of trading allows investors to react quickly to market conditions or adjust their portfolios as needed.

Who should invest in Sensex ETFs?

- Investors looking for capital appreciation over long investment horizon.

- You should have high to very high-risk appetites.

- You should have minimum 5-year investment tenures.

- You should have demat and trading accounts for investing in Sensex ETFs.

Suggested reading – what you need to know before you start investing in ETFs

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

Mirae Asset Global Investments is the leading independent asset management firm in Asia. With our unique culture of entrepreneurship, enthusiasm and innovation, we employ our expertise in emerging markets to provide exceptional investments opportunities for our clients.

Quick Links

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Fund Review - Mirae Asset Emerging Bluechip Fund : Best Midcap Mutual Fund in the last 6 years

- Fund Review - Mirae Asset India Opportunities Fund: One of the best SIP returns in last 8 years

- Fund Manager Interview - Mr. Neelesh Surana - Chief Investment Officer

- Our Articles

- Our Website

- Investor Centre

- Mirae Asset Knowledge Academy

- Knowledge Centre

- Investor Awarness Programs

Follow Mirae Assets MF

More About Mirae Assets MF

POST A QUERY