Motilal Oswal Financial Services Fund NFO: Investment for Long Term Capital Appreciation

The Motilal Oswal AMC has launched the Motilal Oswal Financial Services Fund NFO on 27th January 2026. The NFO will close on 10th February 2026. In this article we will review the fund in light of the growth and transformation of India's Banking and Financial Services (BFSI) sector, and its contribution to the growth of Indian economy.

The Banking and Financial services sector is the one of the main drivers of a nation's economy. India is projected to become the world's third-largest economy by 2030, with a GDP of $7.3 trillion (estimated) and the BFSI sector will be pivotal in the India growth story. The financial assets to GDP ratio of some of the major economies is 4 - 5X. If India is to become a $30 Trillion economy by 2047, then its financial assets should multiply 20X in the next two decades.

Banking and financial services sector in India: No more limited to banks

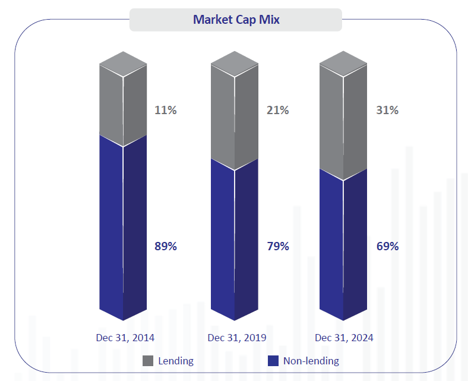

- Many investors associate financial services primarily with banks. Although banks are a very important part of financial services, the financial services sector is much broader than purely the banking sector. As of 2025, the share of banks in BFSI's market cap have come down from 85% in 2005 to just 57% in 2025 (source: MOFSL, April 2025). This reflects the rising contribution of NBFCs, fintech, AMCs, and insurers as major value drivers in the sector. This transformation has been powered by digitization, fintech innovation, rising retail participation, and the growing demand for diverse financial services.

- Financial services extend beyond lending activities

Source: AMFI

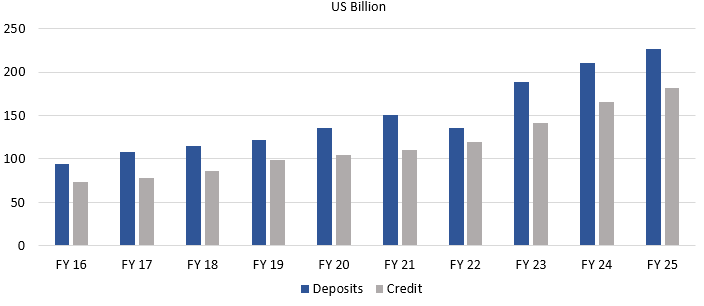

- Bank deposits and credit have been growing at 10 - 11%.

Source: RBI

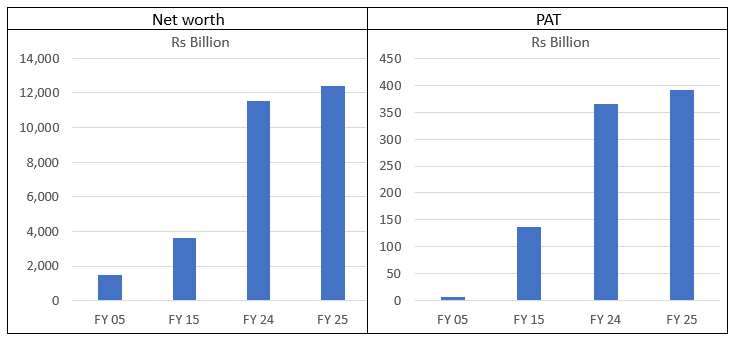

- NBFCs are emerging as key players in MSME lending, recording a PAT growth of 32% CAGR from FY 05 to FY 25. The fundamentals of NBFCs have improved with improvement in net interest margin and reduction in NPAs. Net worth of NBFCs has grown around 15% CAGR from FY 10 to FY 25.

Source: MOFSL, RBI

- The insurance sector market cap has surged to Rs 10.6 trillion, aided by increased financialization of savings and rising retail participation. Assets under management of life insurance industry has grown around 10X from FY 07 to FY 24. Meanwhile, the general insurance industry grew around 10X in the last 18 years. India is projected to become the 6th largest insurance market in 2032, surpassing Italy, Canada, South Korea, and Germany (Source: IRDAI, MOFSL, Swiss Re Sigma World Insurance Report)

- Country wise, India has the 4th largest Capital Market by market capitalization after the US, China and Japan. India is above the global average in terms of market capitalization penetration, touching a 1.3x multiple, outperforming other emerging market equities due to its promising growth (Source: NSE Report on Indian Capital Markets)

- The Government has also taken several steps to reform and strengthen the banking sector. Initiatives such as the Pradhan Mantri Jan Dhan Yojana (PMJDY) aimed at providing financial inclusion to all Indians has brought nearly 57 crore Indians under the banking system.

- The Government has made a major thrust for digitization of payments as well through the Jan Dhan, Aadhaar and Mobile (JAM) trinity. UPI has revolutionized digital payments in India. Unified Payments Interface (UPI) recorded 19.6 billion transactions in the month of September 2025, valued at around Rs 25 lakh crores (Source: NPCI).

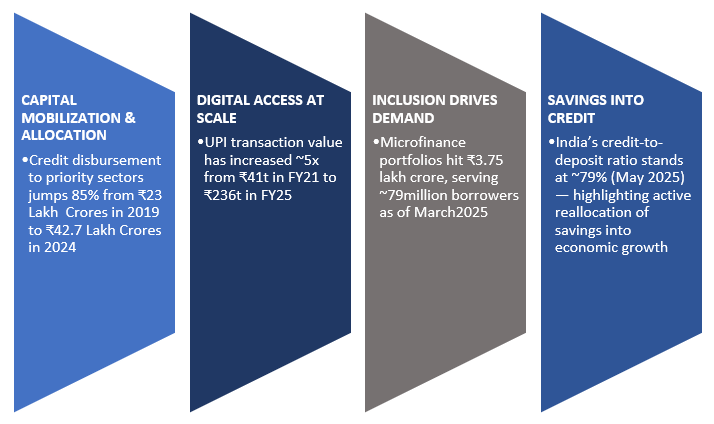

Role of banking and financial services in powering Indian economy

The BFSI sector in India has experienced substantial growth, with a market cap increase of over 50 times in 20 years.

Source: Motilal Oswal, PIB, CareEdge

Why should you invest in the Financial Sector?

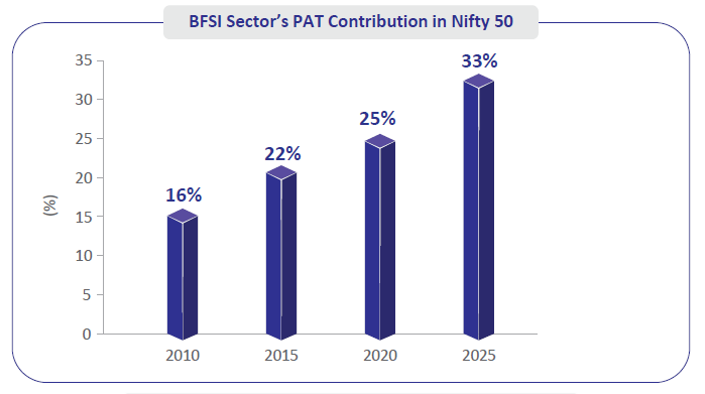

- The Banking and Financial sector's contribution in Nifty 50 grew from 16% in 2010 to 33% in 2025 signifying a momentum that is conducive to long term growth

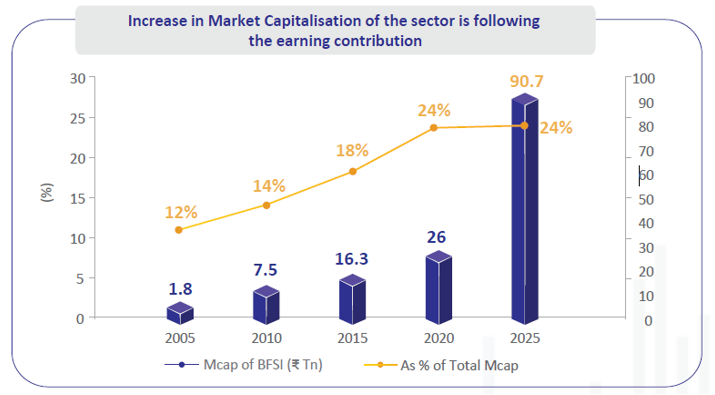

- The contribution of the Banking and financial Sector as a percentage of total market capitalization in India has undergone phenomenal increase since 2005.

Source: Bajaj Finserv, MOAMC, Data as on Dec'25

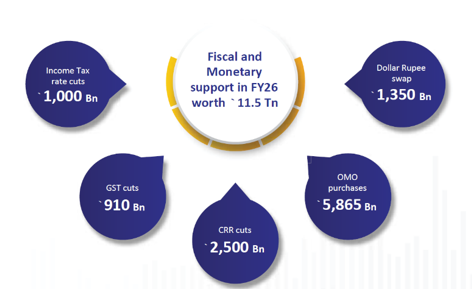

- Government and RBI measures are expected to drive credit growth

Source: Ambit Capital research Data as on Dec'25.

- Long runway for growth

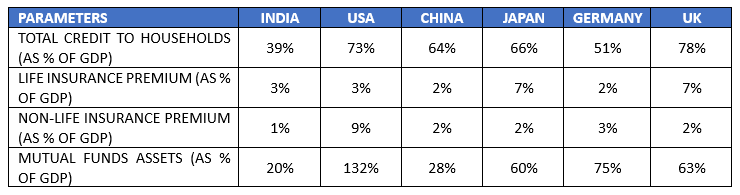

Significant growth in financial services sector is needed for India to catch up with the developed markets, in terms of the sector's penetration.

Source: IRDAI, AMFI, World Bank Data as on CY 2024

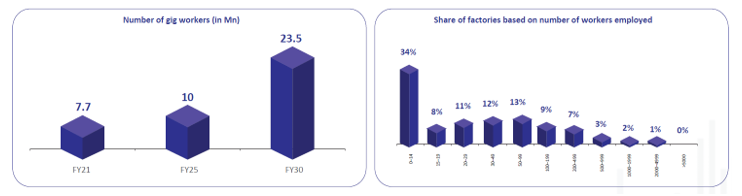

- India's informal economy employs ~2/3rd of the ~420 million workforce, underscoring its central role in income generation and economic stability. The informal sector spans ~80 million enterprises and employs ~129 million workers, making small businesses critical to employment-led growth. This translates to substantial scope for further formalisation.

Source: Niti Ayog, Ambit Capital research, MoSPI, Annual Survey of Industries, Ambit Capital research. Note- Data as on FY24 and covers factories registered under the Factories Act.

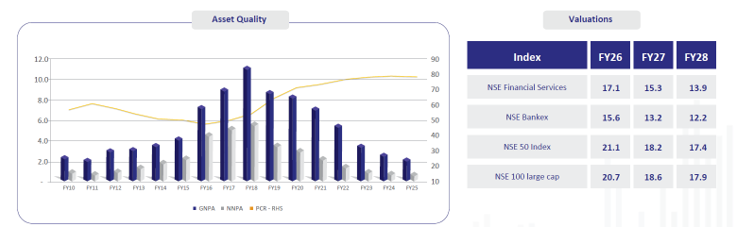

- Reasonable valuations with benign asset quality

Source: Bloomberg, BBNPP *DATA not available for nifty financial services.

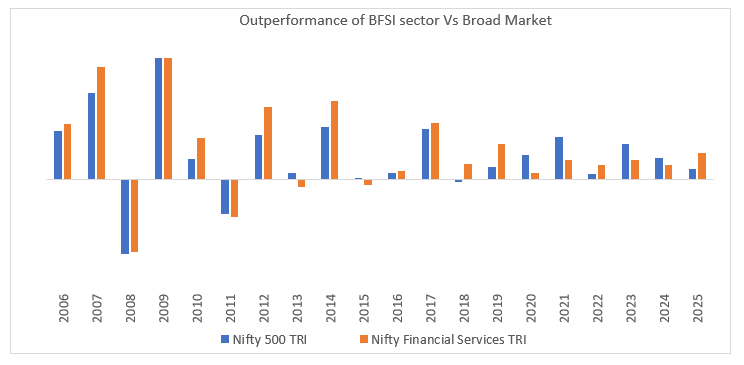

- BFSI Sector has outperformed broad markets in 13 out of 20 Years. In the recent past, after improvement in balance sheet of most of the Financial Services Sector players, the outperformance is significant. (Data as on CY 30th Nov 2025)

Source: Advisorkhoj Research. Data shows the CAGR (%) for each calendar year ending 31st December. For the CYTD 2025 the data is as on Nov 30th 2025

Investment strategy of the Motilal Oswal Financial Services Fund

The primary objective of the Scheme is to generate long-term capital appreciation by investing in equity or equity related instruments across market capitalization of companies deriving majority of their income from financial Services businesses thereby tapping into digital finance, financial inclusion, and sectoral growth, driven by UPI, digital lending, Jan Dhan, and rising traction across NBFCs, mutual funds, and insurance.

The proprietary QGLP Hi- Quality, Hi-Growth investment framework employs 65% representation of stocks from the house theme, 25% Flexibility to invest outside house theme and 10% reserved for risk mitigation. The QGLP strategy emphasizes investments in companies with a high quality of business and management, strong earnings growth potential, sustainable longevity, and attractive price valuations.

Source: MOSL product ppt

Portfolio Construction Process

- Hi Conviction Portfolio of up to 20-25 Stocks

- Balance-Sheet - First vs Story-First Investing - In Other Sectors Proft & Loss/Growth Stories Dominate where as in BFSI - Asset, Liability, Capital, and Risk Dominates

- Cycle based Investment

- Early Credit Upcycle - Overweight Lenders (NBFC, Small Finance Banks, PSU Banks)

- Mid Cycle - Private Banks, Insurers

- Late Cycle - Asset Light Plays (Fee Based income players like AMC, Exchanges)

- Lending Vs Non-Lending- Barbell Strategy - Managing Growth and Risk

- Sector Sizing- Limits on sector deviations relative to benchmark

- Subsector Rotation Within BFSI

Risk Management Framework for Sustainability

- Stock weightage and stock sizing: Minimum and maximum exposure limits set

- Profit taking and stop loss framework. Proprietary framework for measuring triggers

- Stringent Liquidity Framework. Ensuring efficient management for ability to take necessary action

- Diversification Strategy: Portfolio size capped up to 20-25 stocks

- Sector Sizing: Limits on sector deviations relative to benchmark

Who should invest in Motilal Oswal Financial Services Fund NFO?

- Investors who are looking for long-term capital appreciation through thematic investments.

- Investors who are aiming to capitalise on the growth potential within banking, financial services, and related sectors.

- Investors with an investment horizon of minimum 5 years.

- Investors who have a high-risk appetite.

Investors should consult their financial advisors or mutual fund distributors, if Motilal Oswal Financial Services Fund NFO will be suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

- Motilal Oswal Midcap Fund: 7 point 4X in 10 years

- Look beyond Nifty 50: Explore the Benefits of Investing in the Nifty 500 Index

- Why index funds make a good investment choice

- Motilal Oswal Consumption Fund: Potential for long term growth from consumption story

- Motilal Oswal Large and Midcap Fund: Best Performing Large and Midcap Fund

LATEST ARTICLES

- Motilal Oswal Digital India Fund: Investment in the future of the Digital Innovations

- Motilal Oswal Large and Midcap Fund: A clear winner in Large and Midcap Funds

- Motilal Oswal Small Cap Fund: Strong performance in difficult market conditions

- Motilal Oswal Consumption Fund: Potential for long term growth from consumption story

- Motilal Oswal Special Opportunities Fund: Provides exposure to special opportunities

Motilal Oswal Asset Management Company Ltd. (MOAMC) is a public limited company incorporated under the Companies Act, 1956 on November 14, 2008, having its Registered Office at 10th Floor, Motilal Oswal Tower, Rahimtullah Sayani Road, Opposite Parel ST Depot, Prabhadevi, Mumbai - 400025. Motilal Oswal Asset Management Company Ltd. has been appointed as the Investment Manager to Motilal Oswal Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated May 21, 2009, executed between Motilal Oswal Trustee Company Ltd. and Motilal Oswal Asset Management Company Ltd.

Investor Centre

Follow Motilal Oswal MF

More About Motilal Oswal MF

POST A QUERY