Bandhan BSE Healthcare Index Fund Regular Plan - Growth

Fund House: Bandhan Mutual Fund| Category: Index Fund |

| Launch Date: 06-09-2024 |

| Asset Class: |

| Benchmark: BSE Healthcare TRI |

| TER: 1.02% As on (31-12-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 1000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 17.19 Cr As on 31-12-2025(Source:AMFI) |

| Turn over: - | Exit Load: • 0.25% - if redeemed on or before 15 days from the allotment date. • Nil – if redeemed after 15 days from the allotment date |

9.4197

-0 (-0.0032%)

-3.99%

Benchmark: 14.39%

PERFORMANCE

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Investment Objective

The investment objective of the Scheme is to replicate the BSE Healthcare Index by investing in the underlying securities in the same proportion, subject to tracking error. The BSE Healthcare Index will track the performance of companiesthat are part of BSE AllCap belonging to the Healthcare sector.

Current Asset Allocation (%)

Indicators

| Standard Deviation | - |

| Sharpe Ratio | - |

| Alpha | - |

| Beta | - |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

Scheme Characteristics

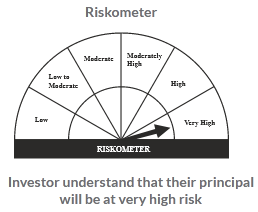

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

26.85%

Others

0.0%

Large Cap

45.46%

Mid Cap

27.69%

Scheme Documents

There are no scheme documents available