Baroda BNP Paribas Business Cycle Fund - Regular Plan - IDCW Option

Fund House: Baroda BNP Paribas Mutual Fund| Category: Equity: Thematic-Business-Cycle |

| Launch Date: 15-09-2021 |

| Asset Class: |

| Benchmark: BSE 500 TRI |

| TER: 2.38% As on (31-12-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 5000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 584.52 Cr As on 31-12-2025(Source:AMFI) |

| Turn over: 67% | Exit Load: Redemption / switch out of units upto 10% of the units allotted before 1 Year from the date of allotment - NIL, If units are redeemed over and above the 10% limit, before 1 Year from the date of allotment - 1% of the applicable Net Asset Value (NAV), For redemption / switch out of units after 1 Year from the date of allotment - NIL. |

14.4149

0.35 (2.4121%)

10.79%

Benchmark: 12.35%

PERFORMANCE

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Investment Objective

The investment objective of the Scheme is to generate long term capital appreciation for investors by investing predominantly in equity and equity related securities with a focus on riding business cycles through dynamic allocation between various sectors and stocks at different stages of business cycles in the economy. However, there can be no assurance that the investment objectives of the Scheme will be realized. The Scheme does not guarantee/indicate any returns.

Current Asset Allocation (%)

Indicators

| Standard Deviation | |

| Sharpe Ratio | |

| Alpha | |

| Beta | |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| Baroda BNP Paribas Business Cycle Fund - Regular Plan - IDCW Option | 15-09-2021 | 5.55 | 6.9 | 15.88 | - | - |

| ICICI Prudential Business Cycle Fund Growth | 05-01-2021 | 13.34 | 13.05 | 21.73 | 19.17 | - |

| Mahindra Manulife Business Cycle Fund- Regular Plan - Growth | 11-09-2023 | 12.63 | 11.19 | - | - | - |

| DSP Business Cycle Fund - Regular - Growth | 17-12-2024 | 10.92 | - | - | - | - |

| Union Business Cycle Fund - Regular Plan - Growth Option | 05-03-2024 | 8.94 | - | - | - | - |

| Axis Business Cycles Fund - Regular Plan - Growth | 05-02-2023 | 8.48 | 9.35 | - | - | - |

| Bandhan Business Cycle Fund - Regular Plan - Growth | 01-09-2024 | 8.4 | - | - | - | - |

| Kotak Business Cycle Fund-Regular Plan-Growth | 05-09-2022 | 8.12 | 14.18 | 17.59 | - | - |

| Edelweiss Business Cycle Fund - Regular Plan - Growth | 30-07-2024 | 7.16 | - | - | - | - |

| Baroda BNP Paribas Business Cycle Fund - Regular Plan - Growth | 15-09-2021 | 6.39 | 7.32 | 16.19 | - | - |

Scheme Characteristics

Minimum investment in equity & equity related instruments of a particular sector/ particular theme - 80% of total assets.

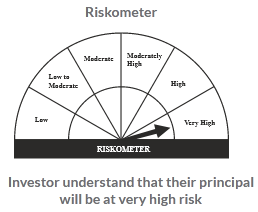

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

12.75%

Others

2.98%

Large Cap

62.35%

Mid Cap

21.92%

Scheme Documents

There are no scheme documents available