DSP Natural Resources And New Energy Fund - Regular - Growth

Fund House: DSP Mutual Fund| Category: Equity: Thematic-Energy |

| Launch Date: 25-04-2008 |

| Asset Class: Equity |

| Benchmark: BSE Oil & Gas TRI(35.00), MSCI World Energy 10/40 Net TRI(35.00), BSE Metal TRI(30.00) |

| TER: 2.05% As on (31-12-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 100.0 |

| Minimum Topup: 100.0 |

| Total Assets: 1,572.72 Cr As on 31-12-2025(Source:AMFI) |

| Turn over: 33% | Exit Load: Nil |

101.672

-0.22 (-0.2203%)

13.95%

Benchmark: 12.29%

PERFORMANCE

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Investment Objective

The primary investment objective of the Scheme is to seek to generate capital appreciation and provide long term growth opportunities by investing in equity and equity related securities of companies domiciled in India whose pre-dominant economic activity is in the: (a) discovery, development, production, or distribution of natural resources, viz., energy, mining etc.; (b) alternative energy and energy technology sectors, with emphasis given to renewable energy, automotive and on-site power generation, energy storage and enabling energy technologies. The Scheme will also invest a certain portion of its corpus in the equity and equity related securities of companies domiciled overseas, which are principally engaged in the discovery, development, production or distribution of natural resources and alternative energy and/or the units/shares of BlackRock Global Funds – Sustainable Energy Fund, BlackRock Global Funds – World Energy Fund and similar other overseas mutual fund schemes. There is no assurance that the investment objective of the Scheme will be achieved.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 15.22 |

| Sharpe Ratio | 0.94 |

| Alpha | 4.36 |

| Beta | 0.92 |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| DSP Natural Resources And New Energy Fund - Regular - Growth | 25-04-2008 | 19.68 | 17.63 | 19.63 | 22.03 | 19.3 |

| Tata Resources & Energy Fund-Regular Plan-Growth | 28-12-2015 | 7.49 | 10.71 | 15.4 | 17.27 | 16.42 |

| ICICI PRUDENTIAL ENERGY OPPORTUNITIES FUND - Growth | 22-07-2024 | 6.14 | - | - | - | - |

| SBI Energy Opportunities Fund - Regular Plan - Growth | 05-02-2024 | 3.15 | - | - | - | - |

Scheme Characteristics

Minimum investment in equity & equity related instruments of a particular sector/ particular theme - 80% of total assets.

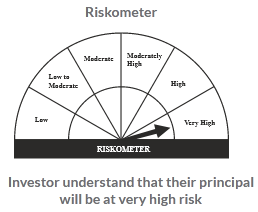

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

7.0%

Others

16.94%

Others

0.95%

Large Cap

46.73%

Mid Cap

28.38%

Scheme Documents

There are no scheme documents available