Invesco India Large & Mid Cap Fund - IDCW (Payout / Reinvestment)

(Erstwhile Invesco India Growth Fund - Dividend)

Fund House: Invesco Mutual Fund| Category: Equity: Large and Mid Cap |

| Launch Date: 09-08-2007 |

| Asset Class: Equity |

| Benchmark: NIFTY Large Midcap 250 TRI |

| TER: 1.75% As on (31-12-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 100.0 |

| Minimum Topup: 100.0 |

| Total Assets: 9,344.28 Cr As on 31-12-2025(Source:AMFI) |

| Turn over: 89% | Exit Load: If upto 10% of Units allotted are redeemed / switched-out within 1 year from the date of allotment - Nil.For any redemption / switchout in excess of 10% of units allotted within one year from the date of allotment - 1% 1f units are redeemed orswitched-out after 1 year from thedate of allotment - Nil |

43.93

1.47 (3.3462%)

11.9%

Benchmark: 15.85%

PERFORMANCE

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Investment Objective

The scheme aims to generate long-term capital growth by investing predominantly in equity and equity related securities following a bottom-up approach in selecting stocks depending on their market-cap and sector.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 12.64 |

| Sharpe Ratio | 1.11 |

| Alpha | 3.64 |

| Beta | 0.9 |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

Scheme Characteristics

Minimum investment in equity & equity related instruments of large cap companies - 35% of total assets. Minimum investment in equity & equity related instruments of mid cap stocks - 35% of total assets.

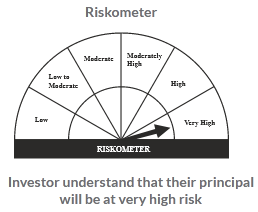

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

20.05%

Others

2.25%

Large Cap

37.95%

Mid Cap

39.75%

Scheme Documents

There are no scheme documents available