Kotak Pioneer Fund- Regular Plan- Reinvestment of Income Distribution cum capital withdrawal option

Fund House: Kotak Mahindra Mutual Fund| Category: Equity: Thematic-Innovation |

| Launch Date: 31-10-2019 |

| Asset Class: Equity |

| Benchmark: NIFTY 500 TRI(85.00), MSCI ACWI Information Technology TRI(15.00) |

| TER: 1.84% As on (31-12-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 100.0 |

| Minimum Topup: 100.0 |

| Total Assets: 3,341.75 Cr As on 31-12-2025(Source:AMFI) |

| Turn over: 37.85% | Exit Load: For redemption / switch out within 90 days from the date of allotment: 0.5% If units are redeemed or switched out on or after 90 days from the date of allotment -Nil |

30.524

-0.09 (-0.2785%)

19.53%

Benchmark: 12.35%

PERFORMANCE

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Investment Objective

The investment objective of the scheme is to generate capital appreciation from a diversified portfolio of equity, equity related instruments and units of global mutual funds which invests into such companies that utilize new forms of production, technology, distribution or processes which are likely to challenge existing markets or value networks, or displace established market leaders, or bring in novel products and/or business models. However, there is no assurance that the objective of the scheme will be achieved.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 12.71 |

| Sharpe Ratio | 0.98 |

| Alpha | 2.52 |

| Beta | 0.81 |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| Kotak Pioneer Fund- Regular Plan- Reinvestment of Income Distribution cum capital withdrawal option | 31-10-2019 | 5.82 | 12.67 | 20.49 | 16.49 | - |

| Bandhan Innovation Fund - Regular Plan - Growth | 30-04-2024 | 11.11 | - | - | - | - |

| ICICI Prudential Innovation Fund - Growth | 05-04-2023 | 8.02 | 13.88 | - | - | - |

| Baroda BNP Paribas Innovation Fund Regular plan - Growth Option | 05-03-2024 | 7.35 | - | - | - | - |

| Nippon India Innovation Fund-Regular Plan-Growth Option | 29-08-2023 | 6.0 | 9.37 | - | - | - |

| Kotak Pioneer Fund- Regular Plan- Growth Option | 31-10-2019 | 5.83 | 12.67 | 20.48 | 16.48 | - |

| Axis Innovation Fund - Regular Plan - Growth Option | 05-12-2020 | 3.37 | 11.26 | 16.55 | 11.85 | - |

| Union Innovation & Opportunities Fund - Regular Plan - Growth Option | 06-09-2023 | 3.04 | 12.21 | - | - | - |

| Tata India Innovation Fund- Regular Growth | 01-11-2024 | 2.04 | - | - | - | - |

| SBI Innovative Opportunities Fund - Regular Plan - Growth | 05-08-2024 | -0.47 | - | - | - | - |

Scheme Characteristics

Minimum investment in equity & equity related instruments of a particular sector/ particular theme - 80% of total assets.

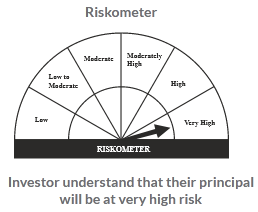

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

18.43%

Others

20.6%

Large Cap

35.72%

Mid Cap

25.25%

Scheme Documents

There are no scheme documents available