Mahindra Manulife Liquid Fund - Regular Plan - Growth

Fund House: Mahindra Manulife Mutual Fund| Category: Debt: Liquid |

| Launch Date: 04-07-2016 |

| Asset Class: Fixed Income |

| Benchmark: CRISIL Liquid Debt A-I Index |

| TER: 0.26% As on (31-12-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 1000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 1,189.95 Cr As on 31-12-2025(Source:AMFI) |

| Turn over: - | Exit Load: Exit Load: Effective October 20, 2019, following graded exit load will be applicable if redeemed/switched-out within the number of days specified from the date of investments at their respective percentage: Day1 - 0.0070%; Day2 - 0.0065%; Day3 - 0.0060%; Day4 - 0.0055%; Day5 - 0.0050%; Day6 - 0.0045%; Day7 onwards - Nil. |

1756.7097

0.61 (0.035%)

6.05%

Benchmark: 5.51%

PERFORMANCE

Returns Type:

of :

Start :

End :

Period:

This Scheme

-

vs

BSE Liquid Rate Index

-

Gold

-

PPF

-

Returns Type:

of :

Period:

Start :

Period:

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Time Taken To Multiply

2x

4x

5x

10x

FUND

0 Years 0 Months

0 Years 0 Months

0 Years 0 Months

0 Years 0 Months

FD

11 years 10 Months

GOLD

8 years 9 Months

NIFTY

5 years 5 Months

Investment Objective

The Scheme seeks to deliver reasonable market related returns with lower risk and higher liquidity through a portfolio of money market and debt instruments. However, there is no assurance that the investment objective of the Scheme will be realized and the Scheme does not assure or guarantee any returns.

Current Asset Allocation (%)

Indicators

| Standard Deviation | - |

| Sharpe Ratio | - |

| Alpha | - |

| Beta | - |

| Yield to Maturity | 6.05 |

| Average Maturity | 0.14 |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| Mahindra Manulife Liquid Fund - Regular Plan - Growth | 04-07-2016 | 6.33 | 6.83 | 6.92 | 5.84 | - |

| Aditya Birla Sun Life Liquid Fund- Discipline Advantage Plan | 22-06-2009 | 6.82 | 7.18 | 7.24 | 5.99 | 6.26 |

| BANK OF INDIA Liquid Fund- Regular Plan- Growth | 16-07-2008 | 6.42 | 6.9 | 6.98 | 5.88 | 6.12 |

| Axis Liquid Fund - Regular Plan - Growth Option | 05-10-2009 | 6.4 | 6.87 | 6.96 | 5.86 | 6.15 |

| Groww Liquid Fund (formerly known as Indiabulls Liquid Fund) - Regular Plan - Growth Option | 25-10-2011 | 6.4 | 6.85 | 6.85 | 5.68 | 6.03 |

| Union Liquid Fund - Growth Option | 15-06-2011 | 6.39 | 6.84 | 6.94 | 5.84 | 5.69 |

| PGIM India Liquid Fund - Growth | 05-09-2007 | 6.39 | 6.82 | 6.91 | 5.82 | 6.13 |

| Canara Robeco Liquid Fund - Regular Plan - Growth Option | 05-07-2008 | 6.38 | 6.84 | 6.93 | 5.83 | 6.01 |

| Edelweiss Liquid Fund - Regular Plan - Growth Option | 20-09-2007 | 6.38 | 6.85 | 6.88 | 5.75 | 5.99 |

| Edelweiss Liquid Fund - Retail Plan - Growth Option | 21-09-2007 | 6.38 | 6.85 | 6.88 | 5.75 | 5.98 |

Scheme Characteristics

Investment in Debt and money market securities with maturity of upto 91 days only.

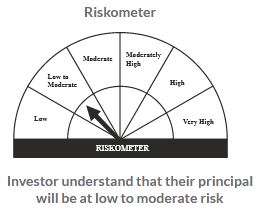

Riskometer

PORTFOLIO

Market Cap Distribution

Others

100.0%

Scheme Documents

There are no scheme documents available