SBI Retirement Benefit Fund - Conservative Plan - Regular Plan - Growth

Fund House: SBI Mutual Fund| Category: Retirement Fund |

| Launch Date: 05-02-2021 |

| Asset Class: Mixed Asset |

| Benchmark: CRISIL Hybrid 85+15 Conservative Index |

| TER: 1.38% As on (31-12-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 5000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 174.34 Cr As on 31-12-2025(Source:AMFI) |

| Turn over: - |

14.2287

-0.08 (-0.5398%)

7.31%

Benchmark: 9.73%

PERFORMANCE

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Investment Objective

The investment objective of the scheme is to provide a comprehensive retirement saving solution that serves the variable needs of the investors through long term diversified investments in major asset classes. However there can be no assurance that the investment objective of the Scheme will be realized.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 3.42 |

| Sharpe Ratio | 0.73 |

| Alpha | -0.36 |

| Beta | 0.77 |

| Yield to Maturity | 7.3 |

| Average Maturity | 18.32 |

PEER COMPARISON

Scheme Characteristics

Invests in at least three asset classes with a minimum allocation of at least 10% each in all three asset classes.

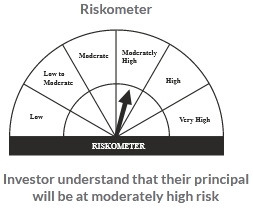

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

3.26%

Others

80.85%

Large Cap

11.97%

Mid Cap

3.92%

Scheme Documents

There are no scheme documents available