Templeton India Value Fund - IDCW

(Erstwhile Templeton India Growth Fund-Dividend Plan)

Fund House: Franklin Templeton Mutual Fund| Category: Equity: Value |

| Launch Date: 10-09-1996 |

| Asset Class: Equity |

| Benchmark: NIFTY 500 TRI |

| TER: 2.03% As on (31-12-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 5000.0 |

| Minimum Topup: 1000.0 |

| Total Assets: 2,326.48 Cr As on 31-12-2025(Source:AMFI) |

| Turn over: 31.66% | Exit Load: In respect of each purchase of Units - 1% if the Units are redeemed/switched-out within one year of allotment |

96.3231

1.97 (2.0487%)

15.49%

Benchmark: 12.35%

PERFORMANCE

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Investment Objective

The Investment Objective of the Scheme is to provide long-term capital growth to its Unitholders by following a value investment strategy.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 12.73 |

| Sharpe Ratio | 1.45 |

| Alpha | 9.11 |

| Beta | 0.9 |

| Yield to Maturity | - |

| Average Maturity | - |

PEER COMPARISON

| Scheme Name | Inception Date |

1 Year Return(%) |

2 Year Return(%) |

3 Year Return(%) |

5 Year Return(%) |

10 Year Return(%) |

|---|---|---|---|---|---|---|

| Templeton India Value Fund - IDCW | 10-09-1996 | 8.0 | 7.78 | 17.5 | 18.0 | 15.09 |

| DSP Value Fund - Regular Plan - Growth | 02-12-2020 | 17.35 | 15.01 | 20.8 | 17.39 | - |

| HSBC Value Fund - Regular Growth | 01-01-2013 | 13.98 | 12.43 | 23.08 | 20.58 | 17.18 |

| ICICI Prudential Value Fund (erstwhile Value Discovery Fund) - Growth | 05-08-2004 | 13.69 | 13.37 | 20.79 | 21.08 | 16.9 |

| HDFC Value Fund - Growth Plan | 01-02-1994 | 13.05 | 12.77 | 19.81 | 17.06 | 15.4 |

| Union Value Fund - Regular Plan - Growth Option | 28-11-2018 | 12.18 | 8.5 | 18.15 | 16.21 | - |

| Axis Value Fund - Regular Plan - Growth | 19-09-2021 | 11.61 | 13.38 | 22.83 | - | - |

| Groww Value Fund (formerly known as Indiabulls Value Fund) - Regular Plan - Growth Option | 08-09-2015 | 11.18 | 7.12 | 16.58 | 13.91 | 10.99 |

| ITI Value Fund - Regular Plan - Growth Option | 14-06-2021 | 10.37 | 6.73 | 18.57 | - | - |

| Aditya Birla Sun Life Value Fund - Growth Option | 05-03-2008 | 10.25 | 7.01 | 21.12 | 17.48 | 13.39 |

Scheme Characteristics

Scheme should follow a value investment strategy. Minimum investment in equity & equity related instruments - 65% of total assets.

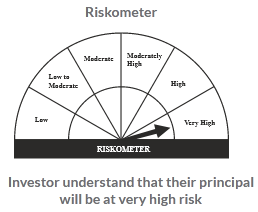

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

21.46%

Others

5.59%

Large Cap

63.11%

Mid Cap

9.82%

Scheme Documents

There are no scheme documents available