UTI Retirement Fund - Regular Plan

(Erstwhile UTI - Retirement Benefit Pension Fund)

Fund House: UTI Mutual Fund| Category: Retirement Fund |

| Launch Date: 26-12-1994 |

| Asset Class: Mixed Asset |

| Benchmark: CRISIL Short Term Debt Hybrid 60+40 Index |

| TER: 1.67% As on (31-12-2025) |

| Status: Open Ended Schemes |

| Minimum Investment: 500.0 |

| Minimum Topup: 500.0 |

| Total Assets: 4,788.52 Cr As on 31-12-2025(Source:AMFI) |

| Turn over: 34% | Exit Load: Period of Holding *: (A) Less than one year – 1% (B) Greater than or equal to one year – Nil *Units shall not be under lock-in period. |

50.0812

-0.18 (-0.3626%)

9.65%

Benchmark: 11.39%

PERFORMANCE

Fund Multiplier

Time it would have taken to make your money double (2x), quadruple (4x) and quintuple (5x)

Investment Objective

The investment objective of the scheme is primarily to generate a corpus to provide for pension in the form of periodical income / cash flow to the unit holders to the extent of redemption value of their holding after the age of 58 years by investing in a mix of securities comprising of debt & money market instruments and equity & equity related instruments. However, there is no assurance or guarantee that the investment objective of the Scheme would be achieved.

Current Asset Allocation (%)

Indicators

| Standard Deviation | 5.54 |

| Sharpe Ratio | 1.1 |

| Alpha | 1.82 |

| Beta | 0.82 |

| Yield to Maturity | 7.12 |

| Average Maturity | 10.72 |

PEER COMPARISON

Scheme Characteristics

Scheme having a lock-in for at least 5 years or till retirement age whichever is earlier.

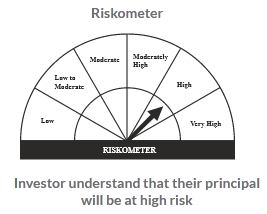

Riskometer

PORTFOLIO

Market Cap Distribution

Small Cap

6.34%

Others

62.15%

Large Cap

24.12%

Mid Cap

7.3%

Scheme Documents

There are no scheme documents available