Add shine of gold and silver to your portfolio

Gold and silver has been considered auspicious commodities since time immemorial. In Indian culture gold is a symbol of purity, fortune and wealth. With the festive and wedding season approaching, gold and silver will be on shopping list of many households. Apart from its cultural significance, the precious metals have immense importance as financial assets. In this article, we will discuss the role precious metals can play in your investment portfolio and how to invest in these commodities.

Gold as hedge against inflation

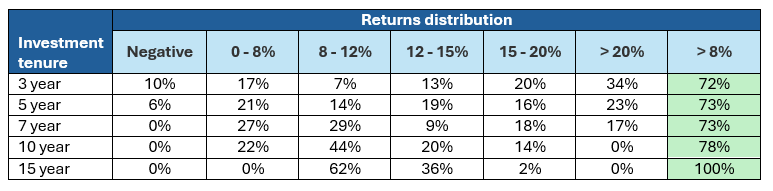

While the purchasing power of currency declines over time due to inflation, gold retains its purchasing power and therefore can function as a hedge against inflation. The table below shows the rolling returns distribution of gold over the last 22 years for different investment tenures. You can see that over long investment tenures, gold has given 8%+ CAGR returns in nearly 75% to 100% of instances – inflation beating returns.

Source: Advisorkhoj Research, MCX, November 2003 to September 2025. Disclaimer: The above table is for investor education only and should not be construed as investment recommendations. Past performance may or may not be sustained in the future.

Gold offers stability

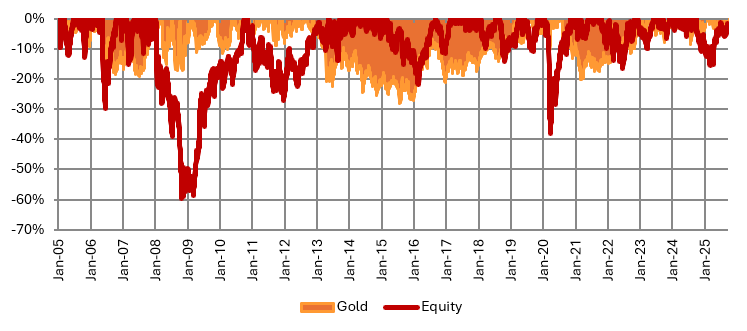

While gold can be volatile, it is less volatile than equity. The chart below shows the drawdowns of equity (represented by Nifty 50 TRI) and gold over the last 20 years. You can see equity experienced much deeper drawdowns compared to gold.

Source: Advisorkhoj Research, MCX, 1st September 2005 to 19th September 2025. Equity is represented by Nifty 50 TRI and Gold is represented by MCX Spot Prices. Disclaimer: The above table is for investor education only and should not be construed as investment recommendations. Past performance may or may not be sustained in the future.

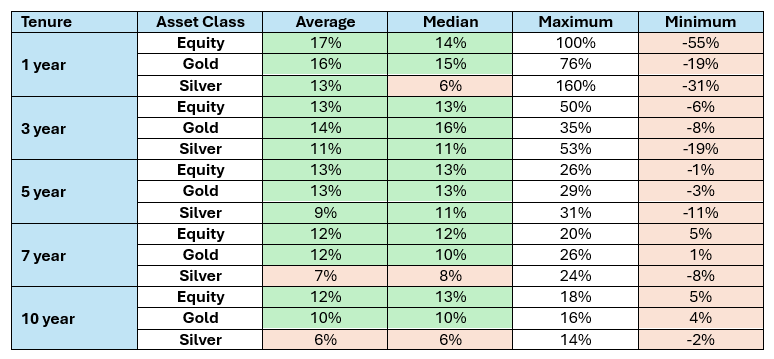

Gold and Silver can generate reasonable returns in the long term

The table below shows the rolling returns of different asset classes for different investment tenures over the last 20 years. You can see that the average and median returns of equity and precious metals (e.g., gold, silver) are similar.

Source: Advisorkhoj Research, MCX, 1st September 2005 to 19th September 2025. Equity is represented by Nifty 50 TRI. Gold and Silver are represented by MCX Spot Prices. Disclaimer: The above table is for investor education only and should not be construed as investment recommendations. Past performance may or may not be sustained in the future.

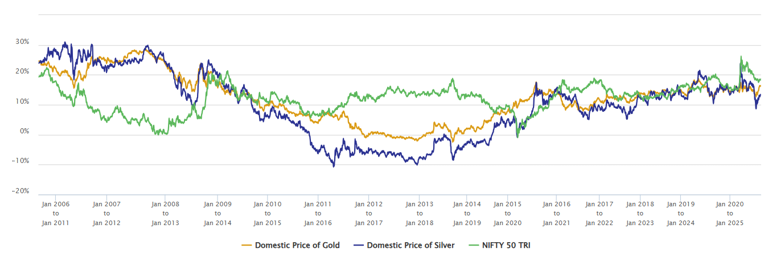

Asset allocation in precious metals can make your portfolio more resilient

Gold and silver have traditionally been considered as safe haven assets; investors turn to gold and silver in times of economic uncertainty. The chart below shows the 5 year rolling returns of gold (represented by MCX gold spot prices), silver (represented by MCX silver spot prices) and equity (represented by Nifty 50 TRI). You can see that precious metal returns have an inverse relationship with equity returns. Precious metals are usually counter-cyclical to equity – they outperform when equity underperforms and vice versa. Adding gold and silver to your asset allocation can bring stability to your investment portfolio.

Source: Advisorkhoj Research, MCX, 1st September 2005 to 19th September 2025. Equity is represented by Nifty 50 TRI. Gold and Silver are represented by MCX Spot Prices. Disclaimer: The above table is for investor education only and should not be construed as investment recommendations. Past performance may or may not be sustained in the future.

How to invest in precious metals?

Buying gold and silver jewellery is the traditional way of investing in precious metals. Most investors continue to invest in gold / silver in the physical form. Investing in gold / silver in the physical form especially jewellery has several drawbacks. Firstly, physical gold or silver in jewellery form, involves making charges. The making charges incurred by the investor has no economic return because if you sell the jewellery or exchange it for some other jewellery, you will only get the value of the weight of gold or silver. Secondly, gold or silver in jewellery form usually has impurities, which will get deducted from the weight of the metal if you sell the jewellery or exchange it for some other jewellery. Thirdly, you have to incur storage costs (e.g., bank locker charges) if you are investing in physical gold or silver.

Investing in gold or silver as financial asset

Gold and silver exchange traded funds (ETFs) or gold / silver Fund of Funds (FOFs) are the most efficient instruments for investing in precious metals. Exchange traded funds are passive schemes which track the prices of commodities. Gold Exchange Traded Funds or Gold ETF or Gold exchange traded fund track the price of pure Gold. They are backed by 99.5% pure physical gold bars (source: AMFI, Knowledge Centre, Gold ETFs). Silver exchange traded fund or Silver ETFs track the price of pure silver. Silver ETFs have to be backed by physical Silver of 30 kg bars with fineness of 999 parts per thousand (or 99.9% purity) conforming to London Bullion Market Association (LBMA) Good Delivery Standards (source: SEBI circular on Norms for Silver Exchange Traded Funds (Silver ETFs) and Gold Exchange Traded Funds (Gold ETFs) dated November 24, 2021). You need to have demat and trading accounts to invest in Gold or Silver ETFs. If you do not have demat account, then you can invest in gold or silver FOFs, which are mutual fund schemes that invest in gold or silver ETFs

Why invest in gold and silver ETFs or FOFs?

- Cost efficiency: There are making charges, impurities or storage charges in ETFs, making them much more cost effective than physical gold.

- Lower capital outlay: Investing in gold or silver in jewellery may require considerable capital outlay, especially if you are investing in gold. On the other hand, you can buy just one or more units of gold or silver ETFs. In case of FOFs, the minimum investment amount is just Rs 100. With gold / silver ETFs and FOFs, you can start accumulating gold and silver over a long period of time.

- High liquidity: You can sell your gold or silver ETF units any time during market hours in the stock exchange at prevailing market prices through your trading account. If you have gold or silver FOFs, you can redeem units of the FOFs with the asset management company (AMC) at prevailing Net Asset Values* (NAVs).

*Exit Load may apply. Read the scheme information document to understand the exit load structure or consult with your mutual fund distributor if you need any help. - High security: There is no risk of impurities or theft. Gold and silver ETFs are backed by physical metals of highest purity standards as mandated by SEBI.

- Highly convenient: You can buy or sell / redeem, gold and silver ETFs / FOFs from the comfort of your home through a click of a few buttons on your PC or mobile application. You can invest in gold / silver FOFs from your regular savings through Systematic Investment Plan (SIP)

Investors should consult their financial advisors or mutual fund distributors on how they can add gold and / or silver to their investment portfolios.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

The information being provided under this section 'Investor Education' is for the sole purpose of creating awareness about Mutual Funds and for their understanding, in general. The views being expressed only constitute opinions and therefore cannot be considered as guidelines, recommendations or as a professional guide for the readers. Before making any investments, the readers are advised to seek independent professional advice, verify the contents in order to arrive at an informed investment decision.

Mutual Fund investments are subject to market risks, read all scheme related documents carefully.

Quick Links

Follow Nippon India MF

More About Nippon India MF

POST A QUERY